Email of the day on the S&P 500

Thanks for another very informative comment of the day. do you expect the SP500 to test the lows of 2020? I would very much like to hear your views on this. Thanks in advance. Best rgds.

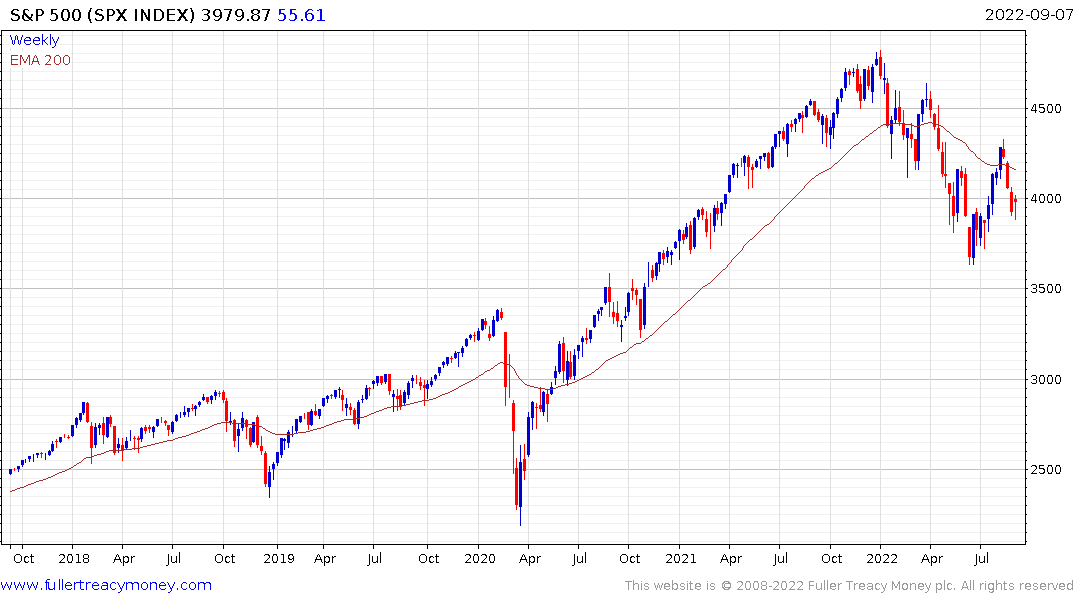

Thank you for this topical question. As a repeat delegate at the Chart Seminar, you will remember that targets are more a reflection of personal bias than an accurate predictor of where prices are likely to trade. Since I am short the Nasdaq-100 I am keenly aware of the influence that has on my personal psychology and that is likely to affect how I view downside potential. Let’s look at the chart facts.

The S&P500 is short-term oversold so we may see some steadier action over coming days. Medium-term there is a clear sequence of ranges one below the last. That’s a consistent downtrend and a successful break of a mid-point danger line stop would be required to check the downward bias. That level is currently around 4400.

If the trend is to remain consistent on the downside, the next breakdown would take the Index to a low of around 3000. That would fully unwind the post pandemic panic surge.

Let’s look at the bullish side. Maybe the Index is attempting to put in a higher reaction low. If that’s the case, it will continue to find support above the July nadir and push back up into the overhead trading range; pushing above the 200-day MA in the process.

My fear at present is the correlation between stocks and bonds has been reasserted and bond prices are steadying from a deep oversold condition. That’s creating the illusion of renewed demand dominance.

Inflation is still uncomfortably high and there is no real sign of the kind of stress in the economy that would deter the Federal Reserve from tightening. That implies, further efforts to siphon liquidity out of the market. The 55% peak to trough decline required for the S&P500 to retest the 2020 low seems like a worst-case scenario to me.