Email of the day on the prospects for Europe and cross holdings between auto manufacturers:

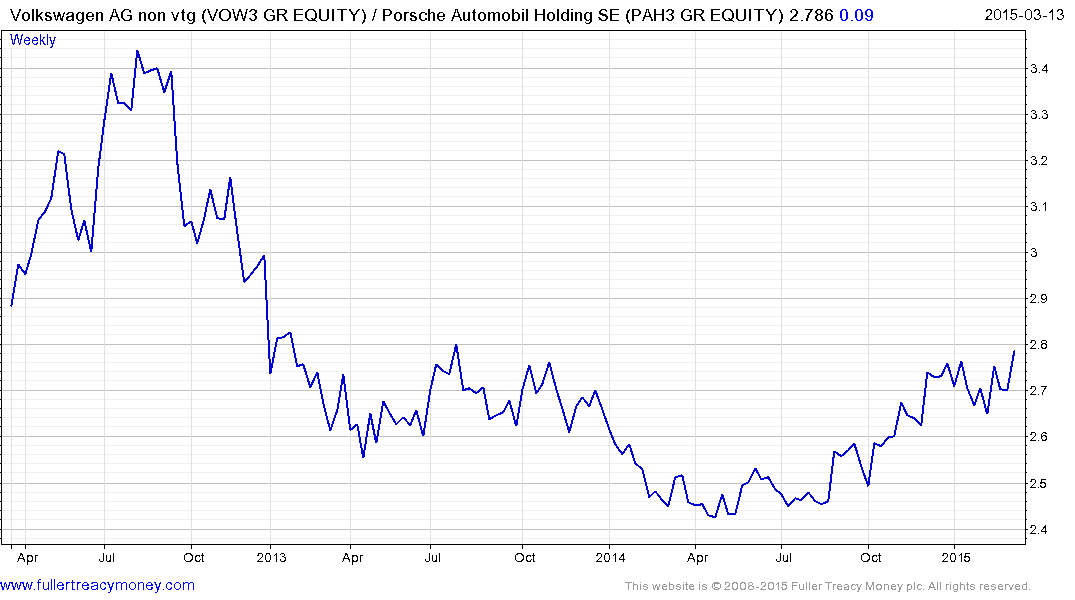

I would like to ask your opinion on two specific items. First on Porsche: they own 51 pct. of Volkswagen with a value of almost 58 billion euros whereas their value is only almost 27 billion euros if and when I make the right calculations. Where do I go wrong? Meaning why is the value only 88 euros on the stock market? I am long Porsche and very glad with their performance.

Further I would like your opinion on options on Dutch autonomies. On the shares listed on the AEX you can buy calls options till Dec 2018. I don't think any other exchange have options till 2018 I have been increasing my long call position also expecting a secular bull market and the QE gives a once in a lifetime opportunity in my opinion. The options still look very attractive to me. Would appreciate your opinion? Best regards and thank you both for your excellent views and service

Thank you for some interesting questions, which David and I discussed this morning and congratulations on your investment success. A number of European companies have their origins in the prowess of an individual or family. Christian Dior (€33 billion) for example remains much smaller than LVMH (€88.6 billion) but owns 40% of the company, almost 60% of the voting rights while Bernard Arnault is its largest shareholder as well as CEO of both companies.

.png)

Frederic Porsche contributed to the early success of Daimler, Volkswagen and Porsche. The mechanics of Porsche and Volkswagen’s relationship are complicated but since the former sold its car business to the latter in 2012, it is now a holding company whose primary asset is a massive position in Volkswagen stock. There is no prospect of Porsche selling its Volkswagen position, so it is open to question why the market would value it other than as a passive income producing asset. Rather than look for revaluation, the two shares are likely to perform more or less in line although Volkswagen has been outperforming this year.

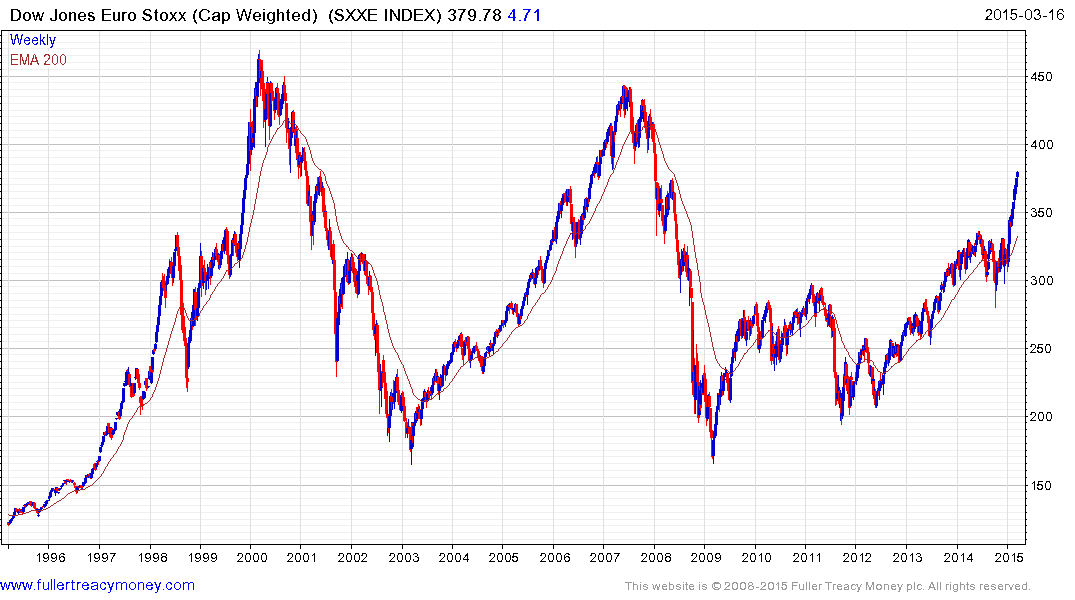

The outlook for Eurozone exporters, not least Dutch listed companies, remains positive as the ECB ramps up its QE program. If we look at the experience of the USA and Japan with their QE programs, the outlook for asset price inflation when the central bank is flooding the market with liquidity is very bullish.

Just as with Japan in late 2012, the Euro STOXX is rallying strongly as the Euro falls. The Index is developing a short-term overbought condition but a clear downward dynamic would be required to check momentum beyond a brief pause. Over the medium-term the potential for European shares to play catch up is looking more likely than not. The Index is still trading well below its 2007 peak despite the recent strong rally. If other major indices that have benefitted from QE are any guide we can expect to see new all-time highs at some point over the next few years.

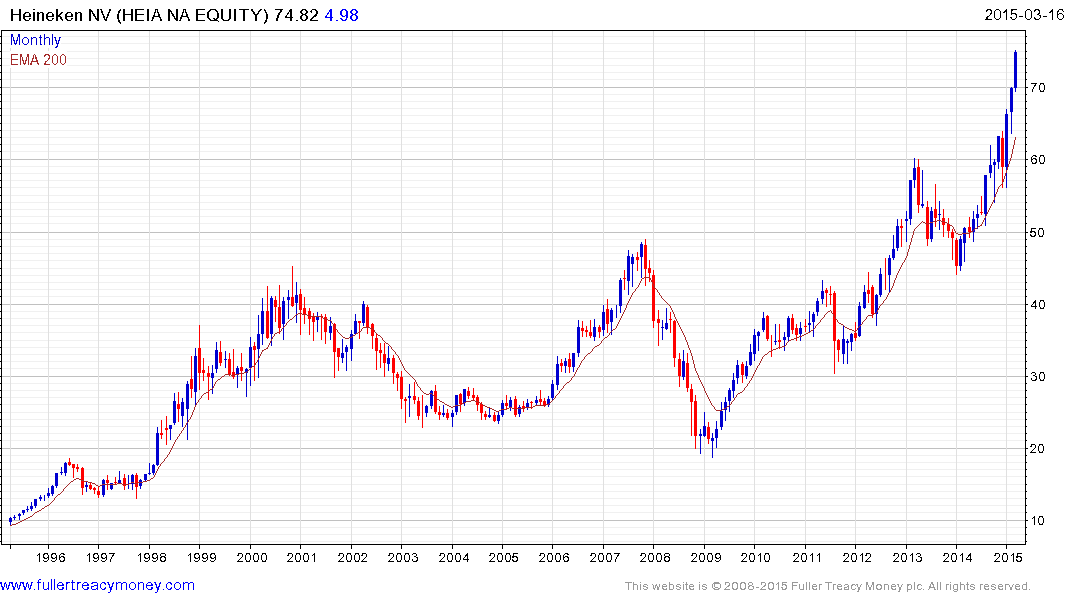

A number of Dutch Autonomies such as Heineken have been outperforming for a while.

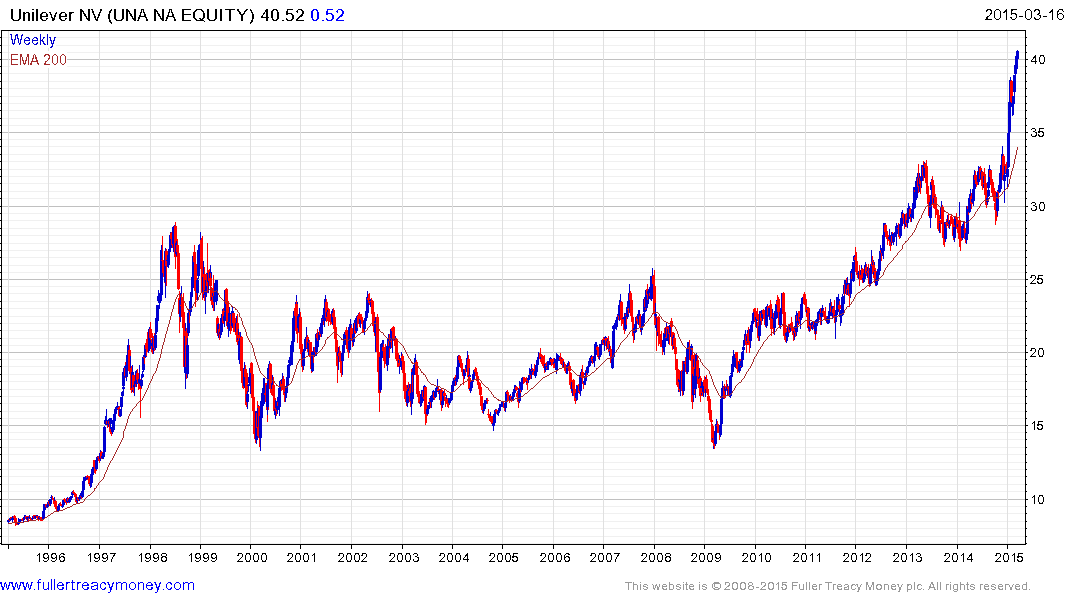

Unilever reasserted it bull market following an 18-month hiatus at least in part as a reaction to the devaluation of the Euro.

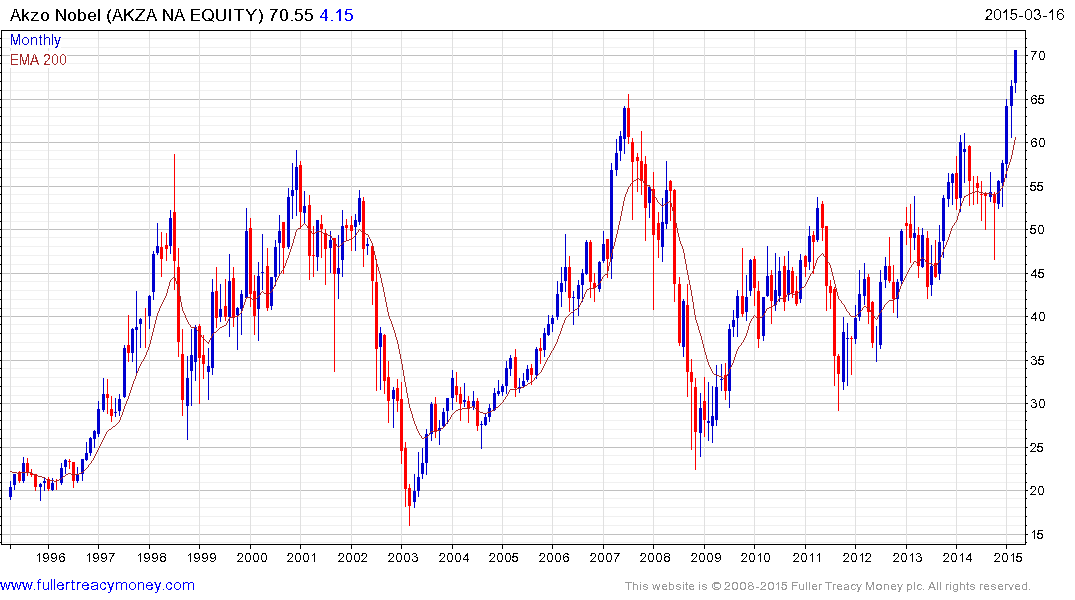

Akzo Nobel broke out of a long-term range in the last month.

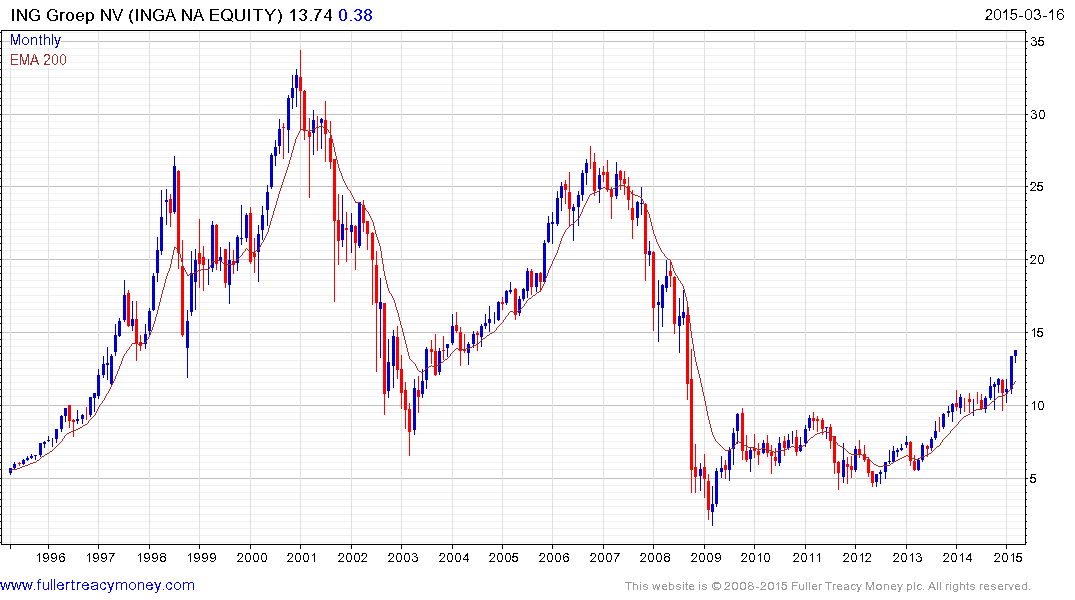

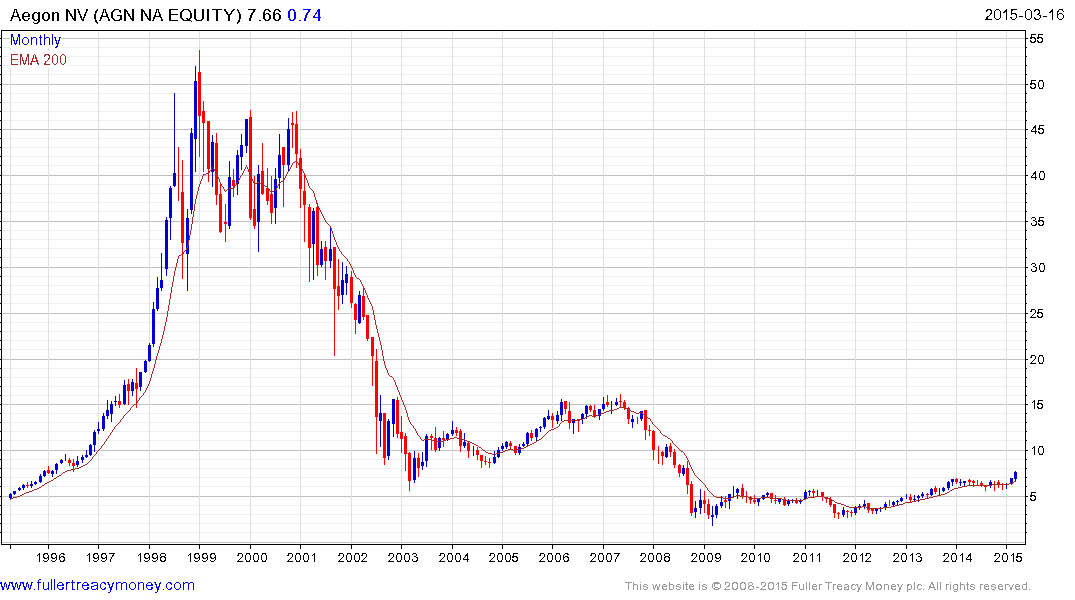

Major Dutch insurance companies such as ING and Aegon have recently returned to form and share commonalty with the wider Eurozone insurance sector.

Back to top