Email of the day on the outlook for bonds

This Interesting webcast by bond manager Jeff Gundlach from Doubline explains investors may be ignoring what the bond market, and now the commodity market, may be really telling us. DoubleLine sees the value in bonds and FTM sees the value in equities.

Thank you for this question which represents an important one for just about every investor. I contacted another subscriber who was at the conference Mr Gundlach spoke at and her biggest takeaway was that if the oil price stabilises near $40 Gundlach isn’t ruling out 1% on Treasury yields.

As you say we have strongly favoured equities since the 2008 lows while Doubline is a bond house that has been strongly in favour of Treasuries and other bonds. In an environment where the Fed is printing and purchasing bonds there is room for us both to be right because QE contributes to asset price inflation.

I agree with him that there will be some very interesting opportunities in the energy sector as prices decline and there will be some very attractive yields available on corporate bonds the more prices decline.

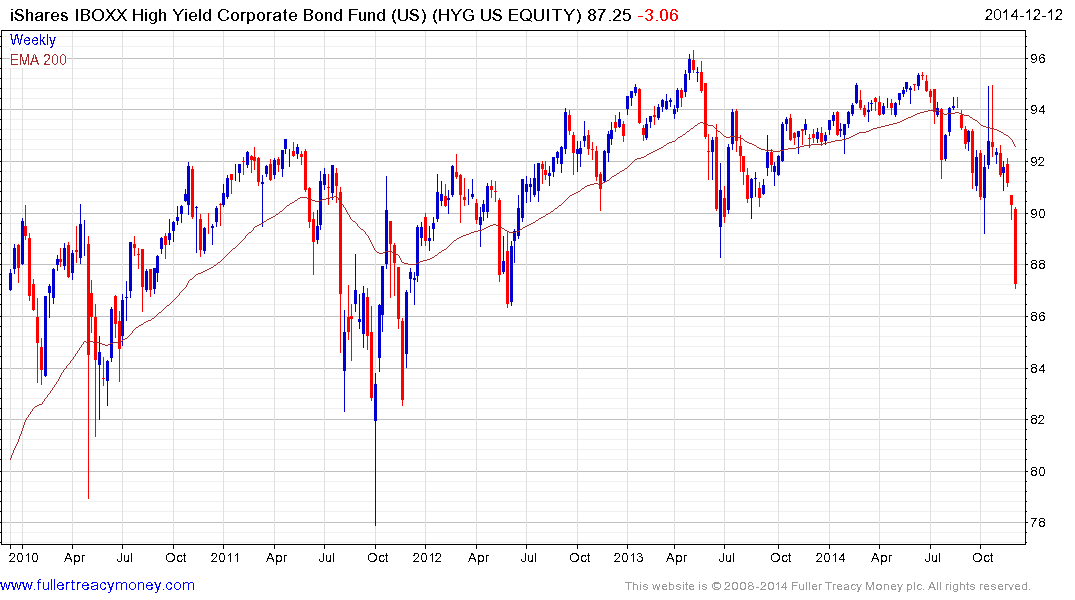

I was reviewing the charts for ETFs like HYG and JNK this morning and looked up their holdings to find that they do not hold energy related instruments. This suggests that the sell-off in high yield is not limited to energy related bonds and is more broad based.

If we review the charts we can see that on previous occasions major pullbacks have been favourable entry points and prices are certainly getting increasingly oversold in the short term. However, clear upward dynamics will be required to signal short covering.

One of the reasons bond bulls are maintaining such a positive outlook on Treasuries is because of the deterioration seen in the high yield sector, the falling oil price, the narrowing of breadth in the stock market and the effect this will have on the willingness of the Fed to raise interest rates.

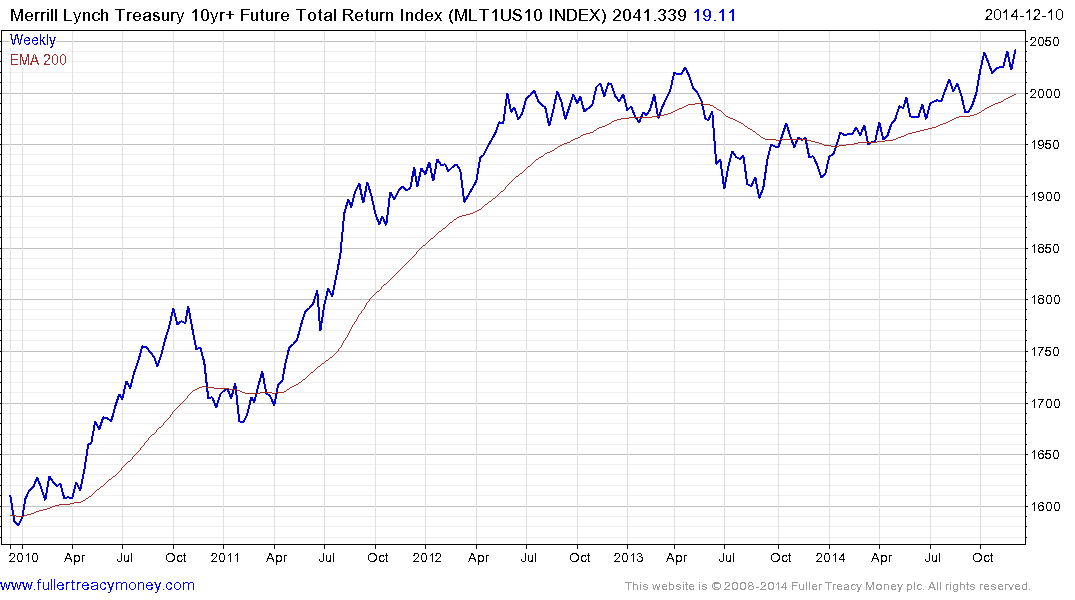

The US 3.75% 2043 Treasury chart remains in a consistent uptrend and a break in the progression of higher reaction lows evident since issuance would be required to question the integrity of the uptrend.

The Merrill Lynch 10yr+ Treasury Futures Total Return Index has held the break above 2000. A sustained move below that level would be required to question a resumption of the medium-term uptrend. As long as this trend remains reasonably consistent there will be no confirming evidence of the Treasury bull market ending.

At the present time, Wall Street is susceptible to mean reversion following a particularly strong rally from the October lows. Those levels now represent the latest higher reaction low and will need to hold if the medium-term upside is to continue to be given the benefit of the doubt.

From a medium to long-term perspective would you rather bet on a 34-year bull market persisting or a market that has only broken out of a more than decade long range in the last 18 months. Even though equities are prone to more volatility, I would continue to favour the latter.

Back to top