Email of the day on the one day 8% decline in DXJ

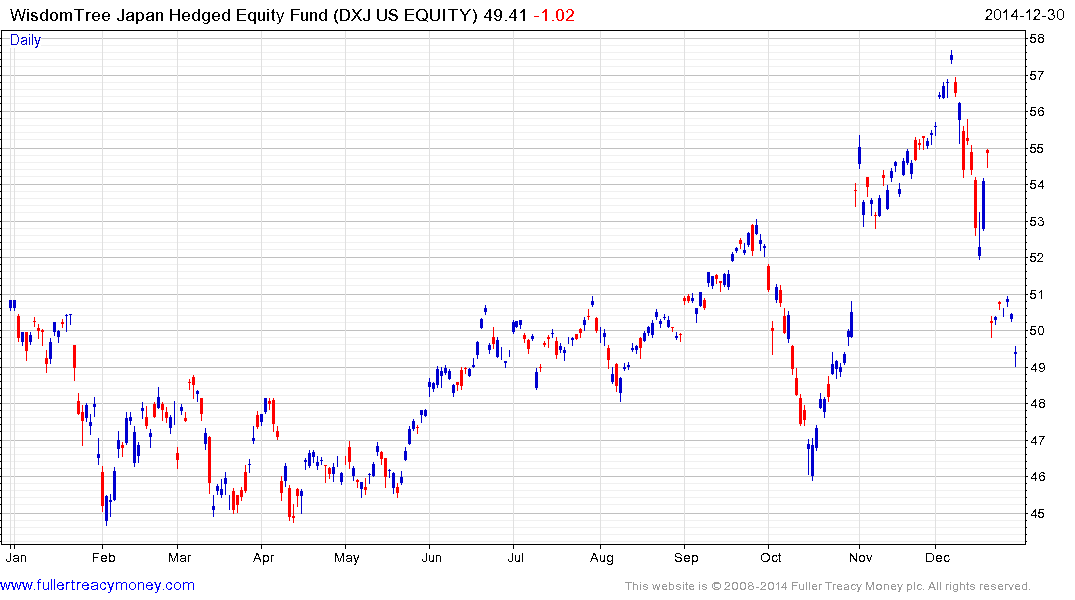

Your comment regarding the reasoning behind DXJ's fall by 8% the day the NIKKEI was up 389 points is technically and politically "correct".

Nevertheless it is a rip off for the average investor. Even knowing in advance that the fund was about to pay distributions one would expect a drawdown of about 1-2 % max. A figure of 8 % (on a rising market!) is an insult to investors.

?I would really like to know whether legal grounds for prosecution of the issuer (WisdomTree) exist. In any case this is not a product to be recommended as an investor should be more concerned in getting the market direction right than checking whether he or she are going to be ripped off by the issuer ! The SEC will be contacted anyway.

Thank you for this email but the 8% decline was in response to an 8% dividend resulting from short-term and long-term cap gain payments of more than $4 between the 11th and 18th. DXJ’s reference instrument is a dividend weighted total return index and it has spent time over the last year trading at a discount. If a fund trades at a discount and orients towards high dividend payers, the potential for it to return capital in somewhat larger payments increases.

The fund had omitted a payment in March and September so cash had obviously built up which was returned to holders on the 18th. This is not a bad deal for investors. However traders, particularly those participating on a leveraged basis may have been pressured by the short-term gyrations.