Email of the day on the need for Eurozone fiscal reform

I think this is quite an interesting intervention from Mr Draghi:

Interesting also the angle given by this article on Bloomberg:

It seems to me that we may be entering into a make or break phase for the Euro area, where the ECB gives all the support it can but really is also – more than ever - giving the message that this is it and other levers will have to be used to improve the situation in the Euro area. It is also the recognitions that so far ECB monetary policy over the last months has only bought time to governments, which basically have done nothing but wasting the nth opportunity to push through reforms and improve the fundamentals of the region.

The Italian case I think is particularly relevant: an unfocussed political system once again puts the interests of a few in front and above the national interests, whose only champion seems to be the ECB and the European institutions. Italian banks continue to be a mess (see – if you can stomach it – what’s going on with the Banca Popolare di Milano/Banco Popolare), spending reviews are forgotten and the only solution suggested is more fiscal deficit, the ultimate insult in a country where taxation is asphyxiating. And of course it is all the fault of the Germans, and the EU.

Mario Draghi is pointing out what Euro sceptics in the UK have been saying for decades: You can’t have a successful economy when there is one monetary policy and 19 fiscal policies. Regardless of whether the UK decides to stay in the EU, the members of the Eurozone need to prepare for further integration because without it the solutions to the challenges facing the economic block will be piecemeal at best. Unfortunately, there is no evidence to suggest there is any appetite for anything other than the reactive approach taken over the last 8 years. Muddle through remains the base case.

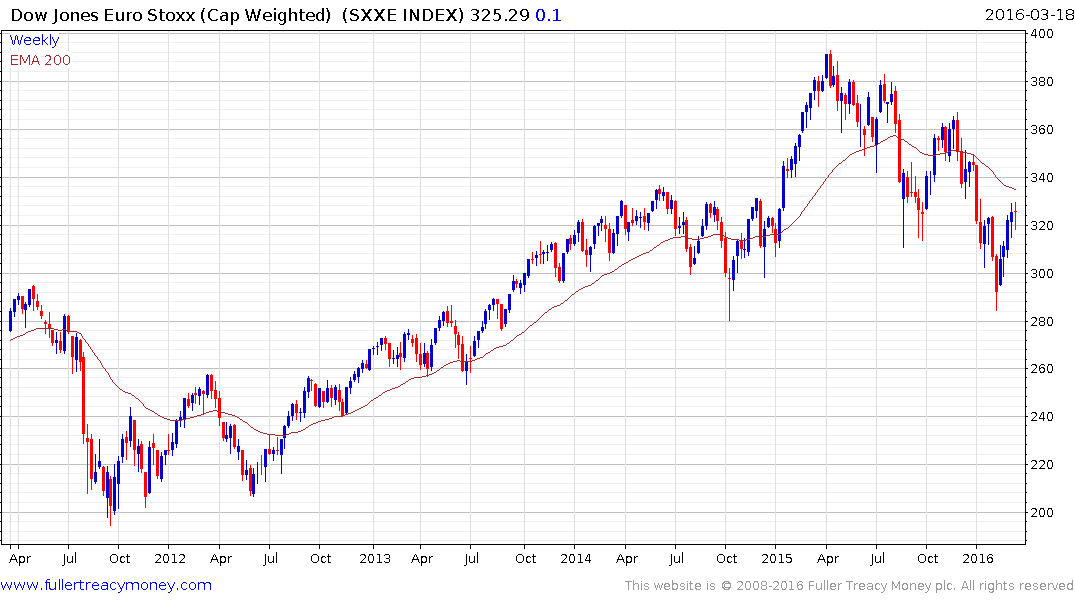

That suggests the ECB has little choice but to continue with its accommodation since it is duty bound to pursue an inflation target of 2% and is nowhere near achieving it. That tailwind needs to be considered when looking at stock markets and the area’s export sector. The Euro Stoxx Index has now unwound its oversold condition relative to the trend mean and is overbought in the short-term following an impressive rebound. Some consolidation is looking increasingly likely but recovery potential can be given the benefit of the doubt provided it holds the 290 area during any pullback.

I agree there is clear evidence of a two speed Eurozone with countries like Ireland and the Baltic Tigers reaping the benefits of deep fiscal reforms in 2010 while Italy, France and Spain have been slower to recover because they did not embrace the same fervour for reform. Of course you could also argue that smaller countries had little choice in the matter because fiscal reform was imposed in return for access to capital.

The Eurozone banking sector is heavily weighted by Spanish, French and Italian banks. That might strike people as odd because the German, Dutch and Austrian economies are in much better shape but it is explained by the fact that the majority of German, Dutch and Belgian banks have been nationalised. The Index pulled back this week from the region of the trend mean following a rebound and will need to find support above its low to demonstrate demand returning to dominance at progressively higher levels which would signal more than a short-term low.