Email of the day on the Dow/Gold ratio scenarios

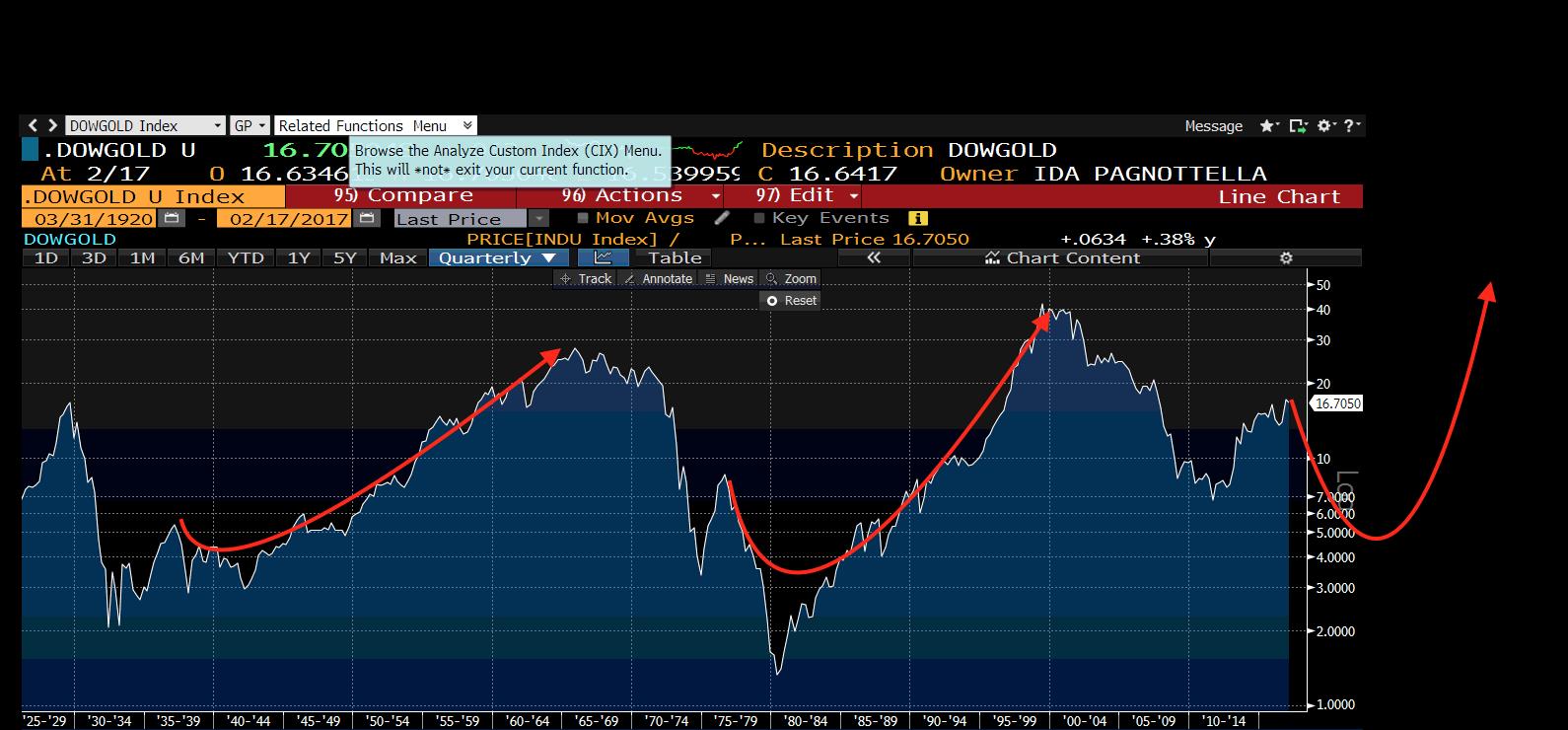

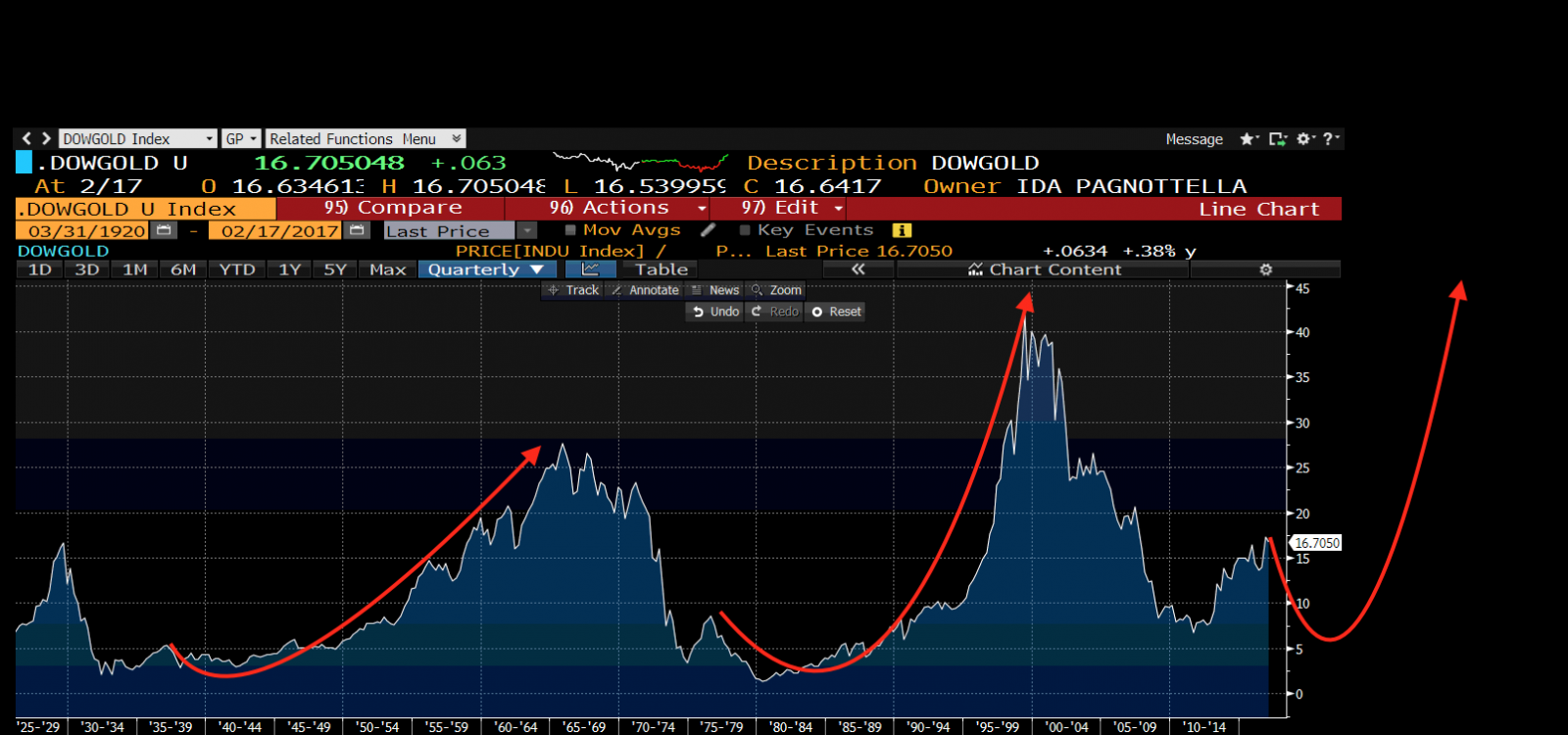

I have been following your Dow/ gold analysis, but while in the long term you are probably right, in the short term there are other interpretations of how the ratio could move, especially if you put the ratio on a log scale

I’m attaching another possible and probable path in normal scale, and in log scale. the short term rise could be a pause before the real bottom, it has happened in the past.

PS: considering you are a real international traveler and investor, where would you say are the safest banks today? I think Singapore, but I heard it is getting difficult to open an account there

Thank you for these nicely illustrated charts. Is there the possibility that the Dow/Gold ratio will pull back? Absolutely. It posted a higher reaction low in the early 1930s and a lower low in the early 1980s. In both cases it pulled back following the initial breakout out.

Since this is a ratio a pullback could represent a pullback by the Dow while gold remains steady, a rally by gold while the Dow remains steady, they could move in opposite directions or in the same direction with one moving faster than the other.

Right now the Dow Jones Industrials Average continues to extend what has been an explosive breakout from a two-year range? It will eventually roll over into a consolidation but there is little evidence of that just yet. Meanwhile it is for the bulls to prove that gold can sustain a break above the trend mean.

I suspect the US has some of the best capitalised banks anywhere and their margins should improve with higher interest rates.