Email of the day on the depreciating value of fiat currencies

If you could clarify a few points you raise it would help understanding. Thank you.

1. "However, it would not be hard to see inflation higher than it has been over the last decade and that is likely to flatter nominal prices."

Perhaps this is just overstated, but does this mean inflation will result in inflation, or does "flatter" add some additional meaning?

2. "If bond yields rise there are logically going to be ramifications for the relative value argument based on the spread between the return on bonds versus equities."

"Ramifications" opens paragraphs of thought for me. Let's see...bond yields rise, so bond prices fall, but yields on equities become less attractive, so equities fall. Are those the ramifications you anticipate?

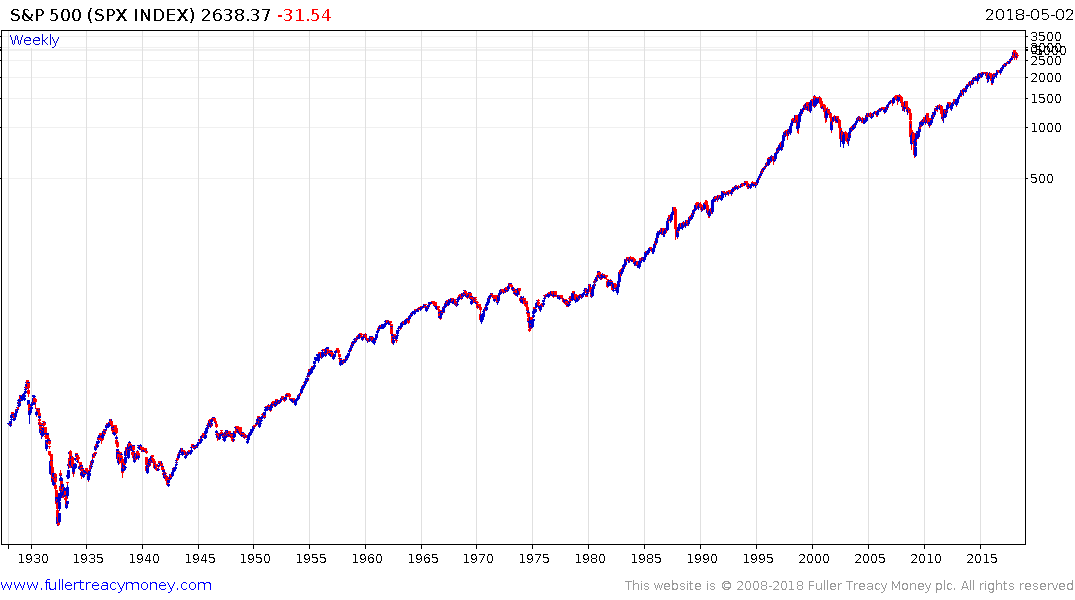

3. "The only problem I have with comparing the current environment to that which prevailed from the early 1960s is that the market spent 13 years ranging from 2000 to 2013 so it would be unusual to begin another similar range so soon after the last one ended."

The SPXPPP chart from the early 60's looks very dissimilar to the pattern from 2000-2013. The peaks and valleys of the 2000-2013 are much more pronounced on the mathematically correct log chart. It appears to me it negates the assertion "...it would be unusual to begin another similar range so soon...?" Nevertheless, unusual is usual in charts, n/est-ce pas?

Thank you for these questions which I would like to take in order.

Inflation has been absent from official statistics for over a decade because wages have been flat. Since the kinds of things we spend money on every month are often not included in how inflation is calculated, the rising cost of living has not appeared in official statistics. However, there is growing evidence of wage demand growth and more job openings. The fiscal stimulus enacted in the USA is also inflationary because is being introduced at a mature stage in the recovery although it may delay wage demand growth in the short term.

As if that were not enough, the Fed’s own PCE Deflator, (the clue is in the name), is at 2% while the Fed Funds Rate is at 1.75%. That highlights the fact that policy is still accommodative.

If inflation picks up it is likely to flatter nominal price because the quantity of currency required to buy individual shares will rise. In real terms, or adjusted for inflation, the result will likely be less impressive. The period from the 1970s through to the early 1980s is a good example of that. The Index went broadly sideways in nominal terms, but because the Dollar was losing its purchasing power so rapidly the adjusted price was falling.

If bond yields rise then the sectors that are likely to do best are those that can either generate outsized growth or those that can raise their prices, and therefore dividends, well in excess of the rate of inflation. Companies that deal in hard assets whose supply cannot easily be increased also tend to benefit. Highly leveraged companies, that depend on access to cheap credit to fund loss making enterprises will be among the biggest losers.

There are two ways of looking at any chart. You can accept what you see as fact or you can make the case that the current environment, whatever that is, represents a special set of circumstances. When looking at almost a century of history there is always going to be a sound rationale for saying this time is different because there will be materially different circumstances.

However, we also have to pay some attention to the fact that we have evidence of long-term cycles in the market that play out regardless of the minutiae that occupy our attention from day to day. Everything I see points towards the secular bull market that is still in its early stages.

Our whole rationale for looking at markets is to seek consistency in the way supply and demand interact. That is basically hewing to the belief that usual is usual until something happens to change it.

I think that we are living through the end of a secular bull market in bonds and the lesson I draw from the charts of oil, gold and stocks adjusted for the purchasing power of the dollar is that they have tended to hold their value better than bonds in a rising yield environment.