Email of the day on the delta variant

40 minutes but really good (essential) analysis of where we are now with the virus. Martenson has been an excellent guide throughout. One for the collective perhaps.

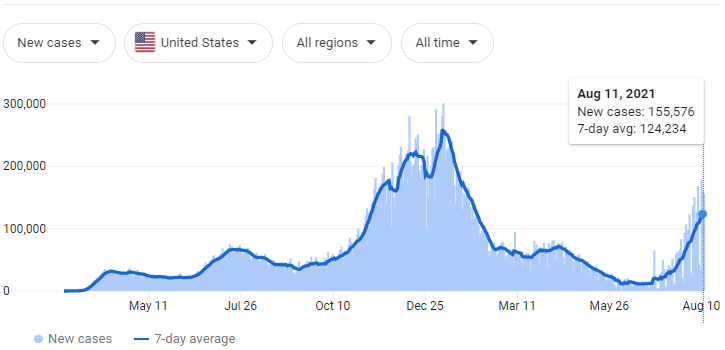

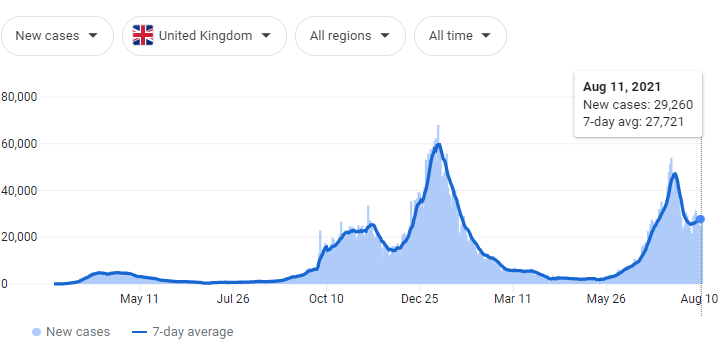

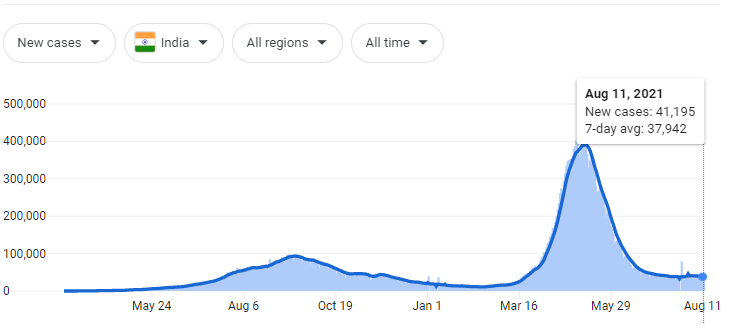

Thank you for this informative video. The primary points are that the delta variant is much more transmissible that previous versions of the novel coronavirus but it is less deadly. That stands up to logic. If the transmissibility is indeed anything approaching that of chickpox, everyone will be exposed to the delta variant in a short period of time. The UK’s high case count but low death count confirm it is less deadly. India’s experience, as the country where delta evolved, suggests a rapid flare up of cases and equally rapid decline as something approaching herd immunity is reached.

That suggests the market is correct not to worry about this variant. There is enough to force people to reassess but not enough, at least not yet, to force selling.

The biggest challenge is that there is likely to continue to be a succession of new variants. Some will be more trying than others and at the same time there will be a succession of new therapies and vaccines with some being better than others. This suggests an initial phase of volatility as threats and solutions vie for dominance but as understanding grows the volatility should die down.

From an investment perspective there is micro and the macro. Vaccines offer incomplete solutions so there will be both a push and pull versus treatment options. So far healthcare systems have focused on vaccines. It is inevitable there will also be a significant drive to develop treatment options too.

The macro question for everyone to consider is whether this war of attrition against novel viruses is going to act as a tax on productivity. What I find particularly interesting is productivity rose in the USA last year but that may have been influenced by a large portion of the least productive people losing their jobs. This will be a vital trend to monitor as wages rise because it could help to keep a lid on inflation.

At the other end of the spectrum the sheer quantity of outstanding debt and significant plans to expand the total in coming years represent a limiting factor on future growth if productivity does not continue to trend higher.

On a personal level our best course of action is to favour fruits and vegetables in our diet, get lots of fresh air, exercise and sunshine. We need to allow ourselves to enjoy life. Taking precautions is part of life, just like looking both ways when we cross the road, but worrying about things we can do little about is a waste of time.

Back to top