Email of the day on the decision to go long

Is it time to now throw in the towel and go long stocks, hang all our fears (of which there are many!)?

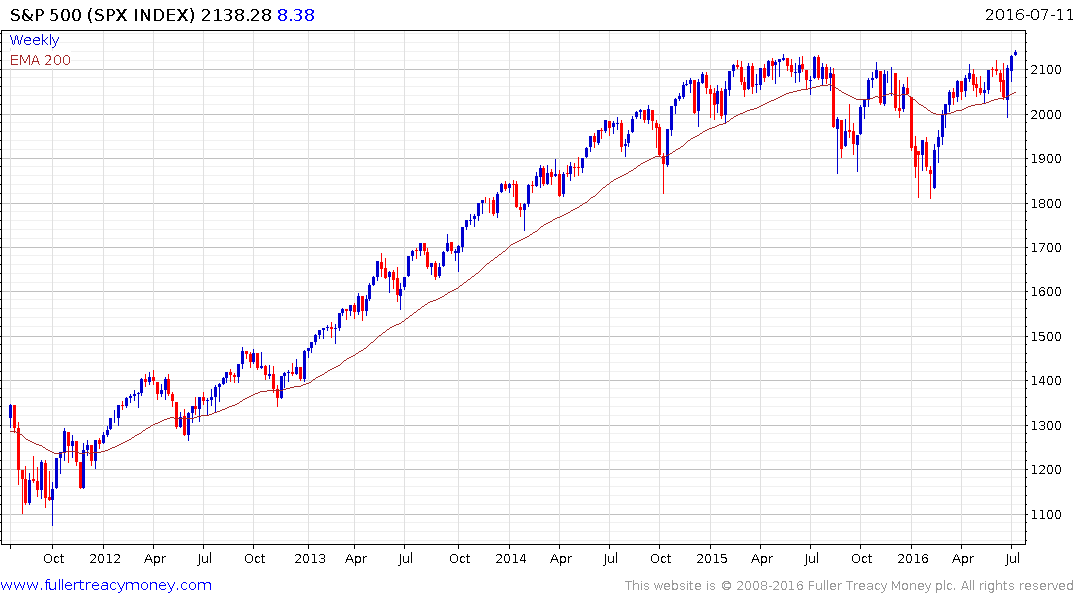

Thank you for a question which will likely be to the front of everyone’s minds as the S&P500 closes at a new all-time high for the first time in more than a year.

As George Eliot (Mary Ann Evens) wrote in Middlemarch “Our deeds still travel with us from afar and what we have been makes us what we are”. How one feels about this event will in large part be dictated by how you have interacted with the market over the last few months.

If you have been in cash for much of the last few years then the move to new highs will be an additional signal that you have waited too long to get into the market but will only heighten the fear that to cave in now would be an even greater risk than it was when the original decision to hold cash was taken. The reality is prices are now much higher than the level at which the decision not enter the market was made. These people are under perhaps the most pressure because they have been out of the market for so long and risk losing even more of the potential upside if the breakout is sustained.

If you have been whipsawed out of the market, by what have been two quite acute bouts of market volatility in less than a year, you will probably have a different disposition. You will know that the best time to buy is immediately following a swift drawdown and new highs have not previously been sustained. If you sold closer to the lower side of the range you are unlikely to be inclined to pay up now that prices are just hitting new highs.

If you have been long and are still long then the move to new highs will reconfirm your buy-and-hold strategy. Your resolve to sit through a big shakeout will likely have been strengthened by the positive outcome of holding on. While that is the best way to engage with what is an overall long-term bullish environment it will make the eventual decision to sell all the more difficult.

For short-term traders some will be enticed to buy the breakout while those who were short at the upper side of the range will be under pressure.

At The Chart Seminar we define ranges as explosions waiting to happen so in the absence of a clear downward dynamic we have to give the upside the benefit of the doubt.

Longer-term, the S&P500 is seven years into a bull market and valuations are no longer cheap. The bullish argument rests on the potential return of synchronised global monetary expansion accompanied by the prospects for fiscal expansion in a number of countries not least Japan, China, much of the Eurozone and the USA. That is leading investors to the conclusion fuel, in the form of liquidity, for this bull market is about to be reignited. That could take the market into the third psychological perception stage of euphoria.