Email of the day on the credit, monetary and economic growth cycles

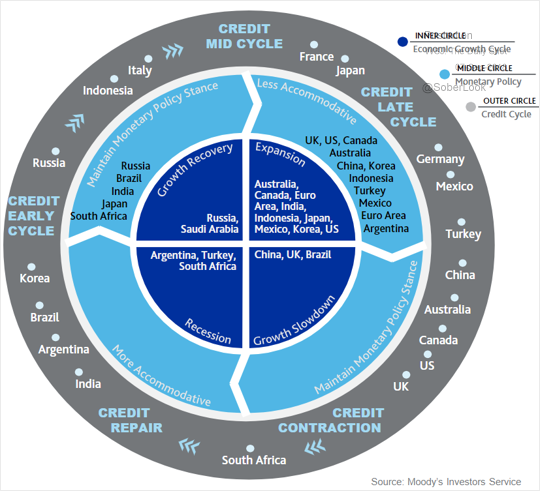

The Credit Cycle diagram from Moody's that you had in the long-term video presentation on Friday was very interesting. Is it possible to post it?

Thank you for this request and please find the graphic posted below.

Perhaps the most important thing to remember is that credit leads. The fact that the UK and USA are well into the credit contraction part of the credit cycle is a testament that we are late in the market cycle. That does not mean the cycle is over but that it is time to closely monitor the credit markets for signs of stress.

US high yield spreads remains contained and have been trading in a tight range for more than a year. It is not usually until the spread has been trending higher for a while that it begins to have an impact on the stock market so this lead indicator is not flashing red right now.

EU high yield spreads are still at relatively low levels but have been trending persistently higher since late last year. The fact credit is tightening is at least in part a reflection of the ECB’s drive to end quantitative easing with its final purchases this month. That decision has weighed on regional stock markets.

Asian high yield spreads have been trending higher since early this year, in conjunction with the additional risk premium attached to China.

If we look at the relative rates 479 basis points for Asia, 377 for Europe and 339 for the US that gives us a perspective on where investors currently think the greatest credit risk is at present.

Back to top