Email of the day on the auto sector

The auto industry has seen significant down moves of 30-40% since this year’s highs. I have copied a chart of an ETF below, but VW (PE 7.6, Div% 2.91), BMW (P/E 9.5, Div% 3.45) and Daimler (P/E 9.8, Div% 3.33 have similar moves. This leads one to ask the question: have these shares fallen far enough? Of course the market will decide, but the sector has seen an acceleration to the downside in August, which is an indication the down move since March could be ending. Daimler and BMW are breaking above the most recent reaction high today. Would be interested to hear your views.

Thank you for this detailed question sure to be of interest to other subscribers. The auto manufacturers have been under stress because they are exposed to the slowdown in the Chinese economy which is their largest market. As you point out their valuations are not challenging and their yields are competitive particularly versus government bonds.

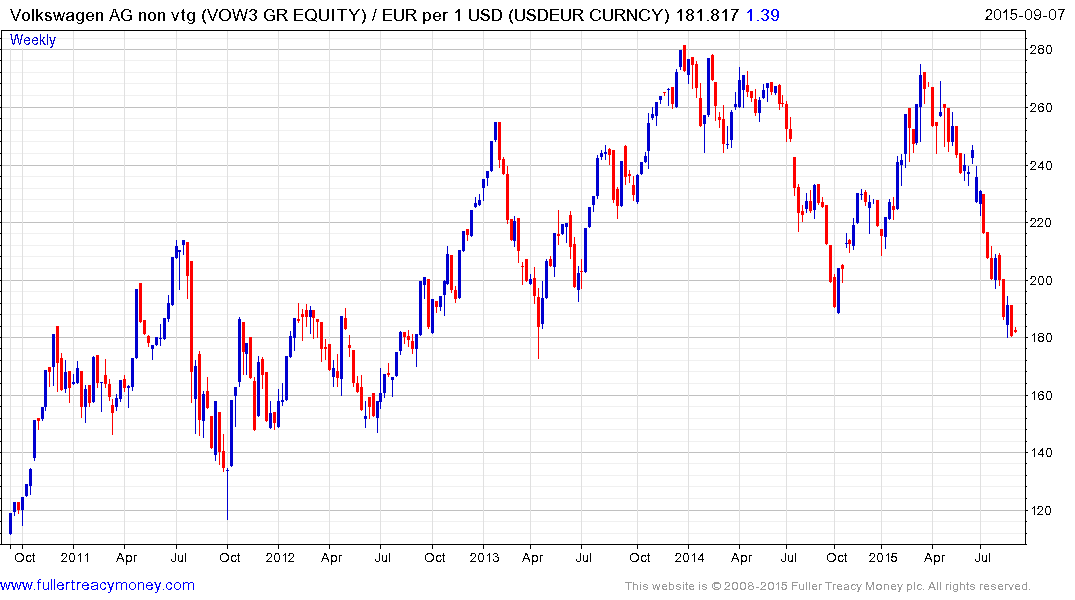

The weakness of the Euro at the beginning of the year contributed to their outperformance but they have given up that entire advance despite the fact the Euro has posted only a modest rally relative to its decline. Contrast these two charts of Volkswagen; the first in local currency terms, the second in US Dollars.

.png)

Thank you for this detailed question sure to be of interest to other subscribers. The auto manufacturers have been under stress because they are exposed to the slowdown in the Chinese economy which is their largest market. As you point out their valuations are not challenging and their yields are competitive particularly versus government bonds.

The weakness of the Euro at the beginning of the year contributed to their outperformance but they have given up that entire advance despite the fact the Euro has posted only a modest rally relative to its decline. Contrast these two charts of Volkswagen; the first in local currency terms, the second in US Dollars.

I agree the share is back at an interesting level on both charts and potential for mean reversion back up towards the moving average is improving. Today’s rally on Volkswagen is at least a near-term higher reaction low and a sustained move above €175 would break the six-month progression of lower rally highs and suggest more than temporary support.

Both Daimler and BMW, as you point out, share this characteristic.

Both Daimler and BMW, as you point out, share this characteristic.

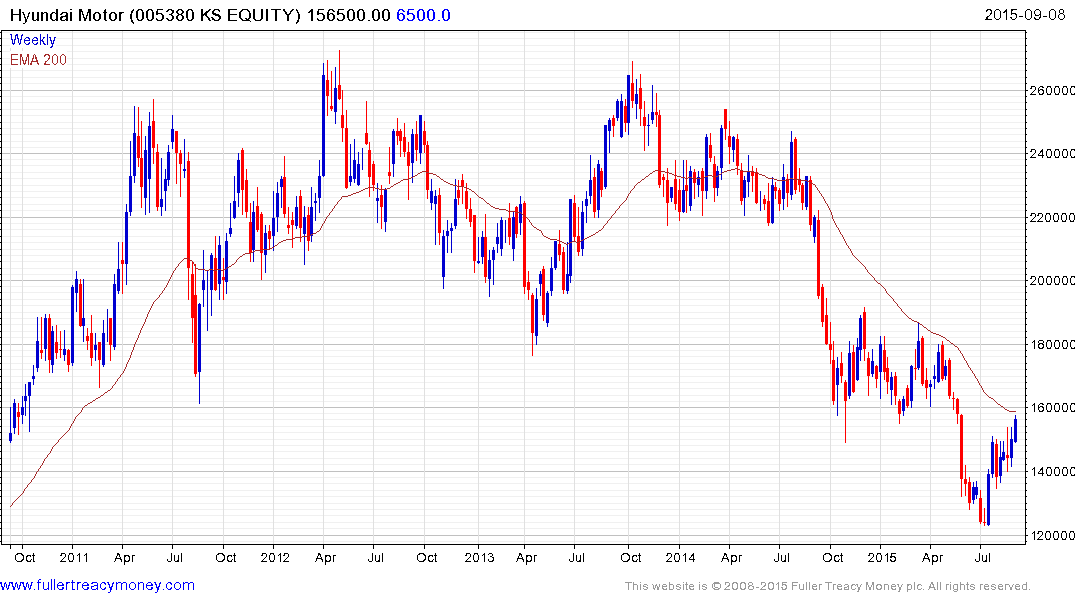

I clicked through the constituents of the Auto sector in the Chart Library. Commonality across the Eurozone’s sector is high but my attention was drawn to South Korean and Chinese manufacturers which have experienced much deeper declines.

For example both Kia and Hyundai have rallied impressively over the last month as the Won has deteriorated. The Won was among the strongest currencies in the region so its downtrend will be a major tailwind for South Korea’s world class export sector.

.png)

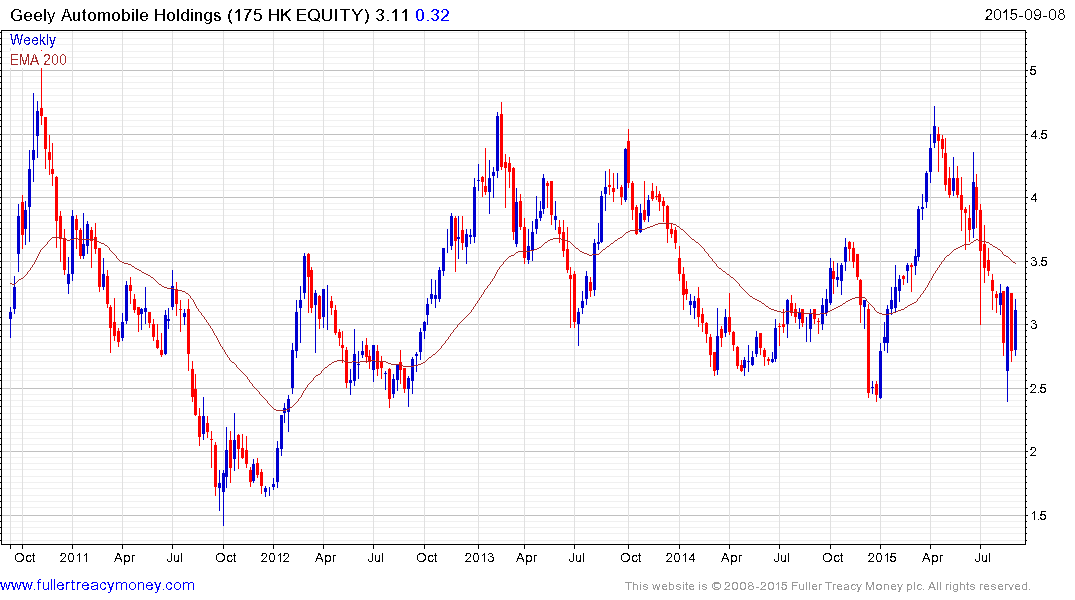

Greatwall Motor has fallen from HK$60 to HK$20 since April and is overextended on the downside regardless of what measure one uses. Today’s upward dynamic is the largest advance in months and suggests a low of at least near-term significance.

Geely Automobile Holdings has a similar pattern to the H-shares Index and is bouncing from the lower side of an almost four-year range.