Email of the day on sugar companies

What are the implications for Tate and Lyle of a secular bull market in sugar?

I agree there is a secular demand growth story for sugar but that does not mean there is a secular uptrend in sugar prices considering the ability of farmers to increase supply over the medium term. Nevertheless, the current outlook is for additional strength is sugar prices following the break of the five-year downtrend.

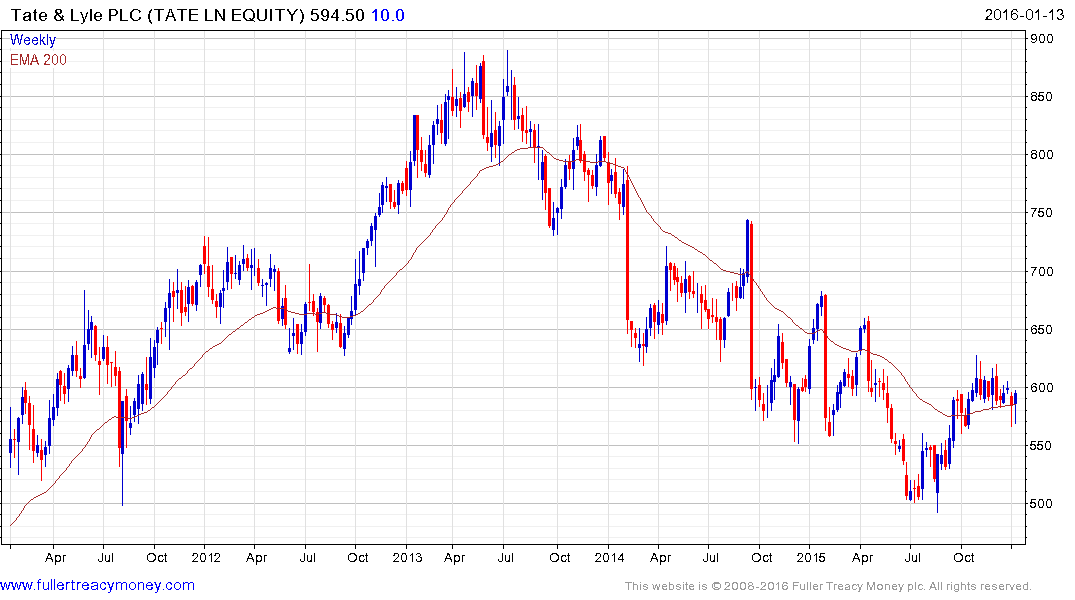

Tate & Lyle (Est P/E 17.13, DY 5.23%) sold their sugar business in 2010 and now concentrates on artificial sweeteners, starches and other ingredients. The share continues to range in the region of the 200-day MA and a sustained move below last week’s low would be required to question medium-term recovery potential.

US listed Adecoagro (Est P/E 36.72, DY N/A) has substantial land holdings across South America and produces sugar and ethanol among its other products. The share completed a four-year base in December and a sustained move below $11 would be required to question medium-term scope for additional upside.

German listed Suedzucker (Est P/E 32.34, DY 1.77%) pulled back sharply today and will need to find support in the region of the €12 if the medium-term progression of higher reaction lows is to be sustained.