Email of the day on Spanish property developers

Following on from the article on 26/5 covering property and with reference to the comments on Spanish property, I have been trying without success to identify suitable Spanish housebuilding shares. Any suggestions would be welcome.

Thank you for this question which may be of interest to other subscribers. The Spanish property sector has been through a major transition over the last five years with a number of major companies going bust or being taken over. Those that have survived and are still listed tend to have international operations which allowed them to survive the crash in the domestic market.

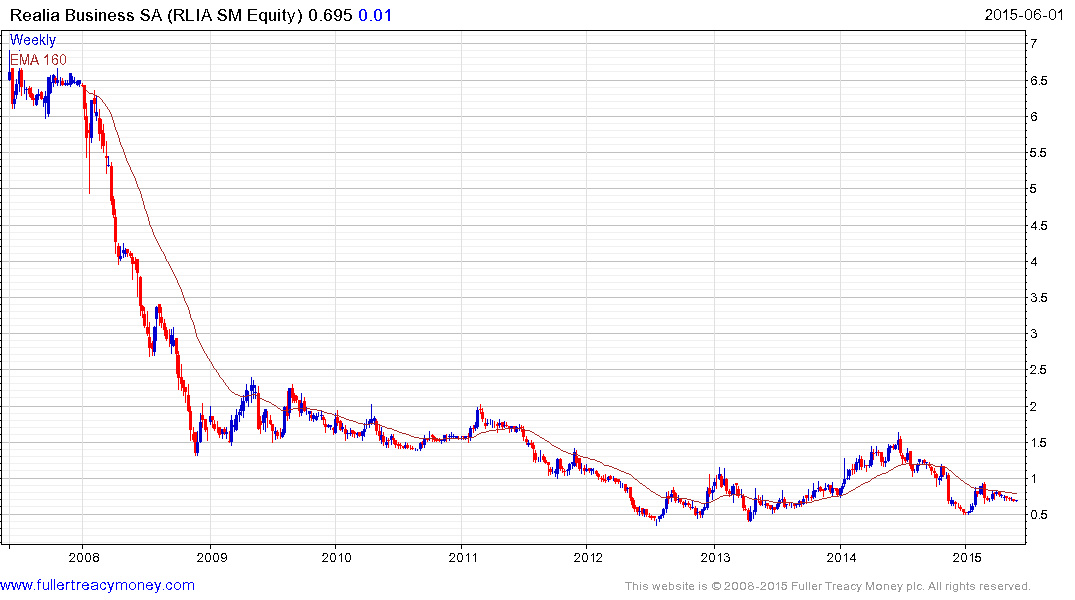

Carlos Slim announced in March his intention to acquire Realia Business to expand his footprint in Spanish property. The share bounced from the 50¢ area but will need to sustain a move above the 200-day MA to signal a return to demand dominance beyond the short term.

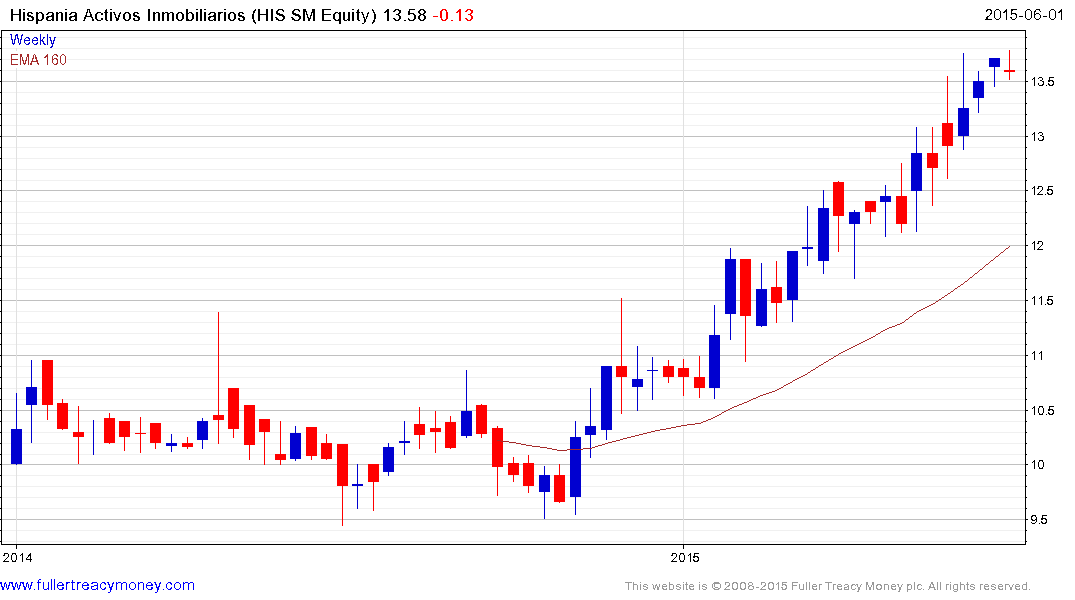

Hispania Activos Inmobiliarios has also been building a position in Realia Business. The trust has been trending higher since December and a break in the progression of higher reaction lows would be required to question medium-term uptrend consistency.

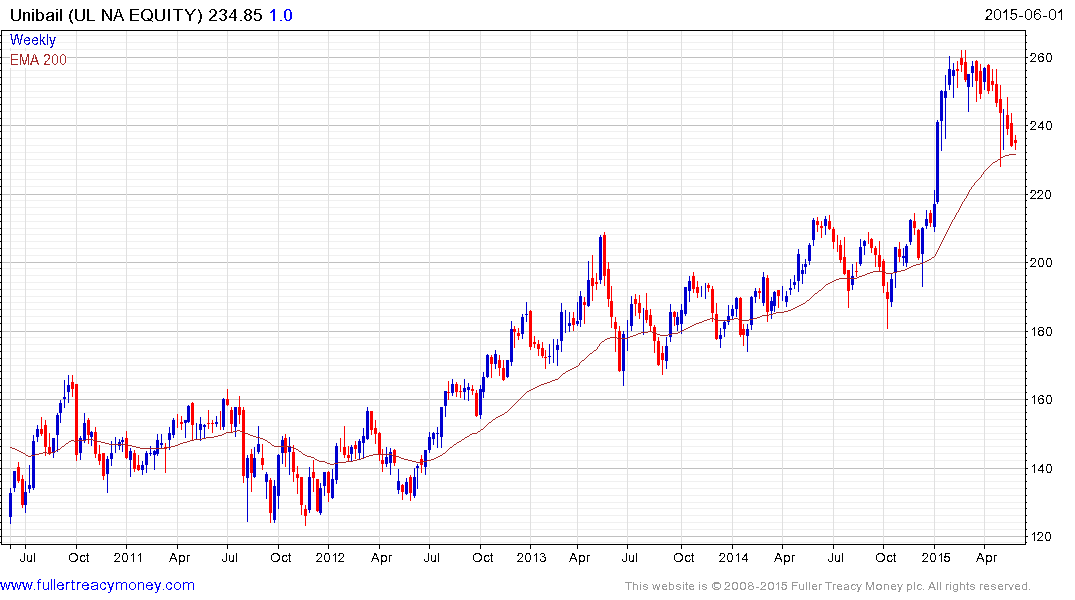

Metrovacesa S.A. which was the largest real estate developer in the Eurozone before the credit crisis was acquired by Unibail in 2007. The Dutch listing has returned to test the region of the 200-day MA over the last month and will need to find support in this area if medium-term upside potential is to be given the benefit of the doubt.

Acciona SA is primarily involved in the infrastructure sector. The share stabilised in the region of €40 from 2012 and has held a progression of higher major reaction low since. It will need to hold the region of the 200-day MA in the current pullback if potential for continued higher to lateral ranging is to be given the benefit of the doubt.

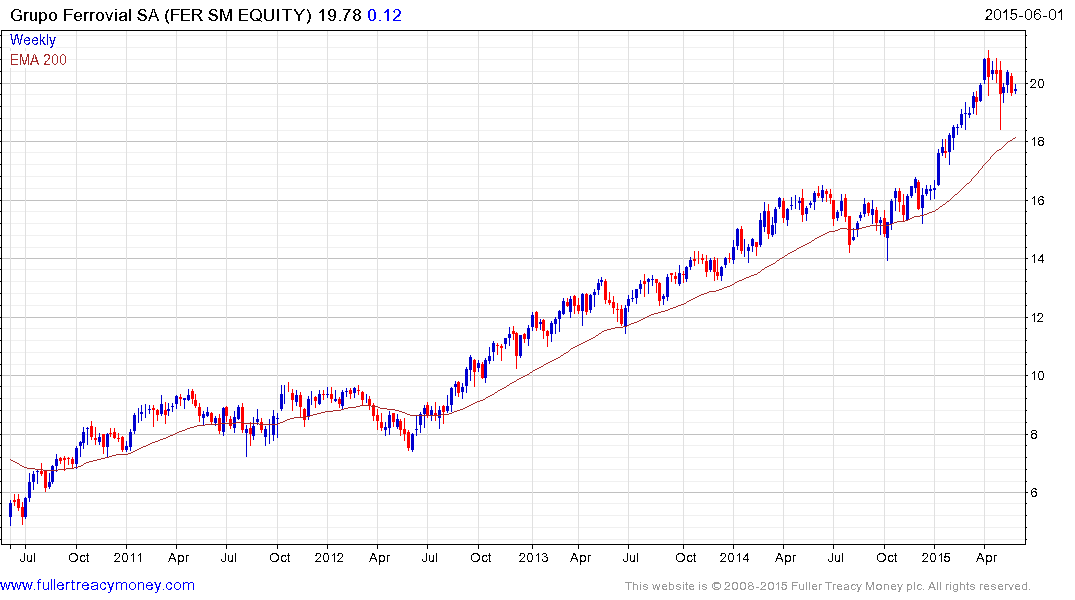

Grupo Ferrovial is also primarily involved in infrastructure development. The share is currently engaged in a process of mean reversion and will need to continue to hold above €18 if potential for additional higher to lateral ranging is to be given the benefit of the doubt.