Email of the day on shorting after taking profits

Thanks for the very good summary of the market situation after your well-deserved break.

I'm just puzzled by one thing. You seem pretty convinced that the Nasdaq will continue to go down for at least a while. Yet you say one should have a very small short on it. Why only a very small short, why not a big one? Regards

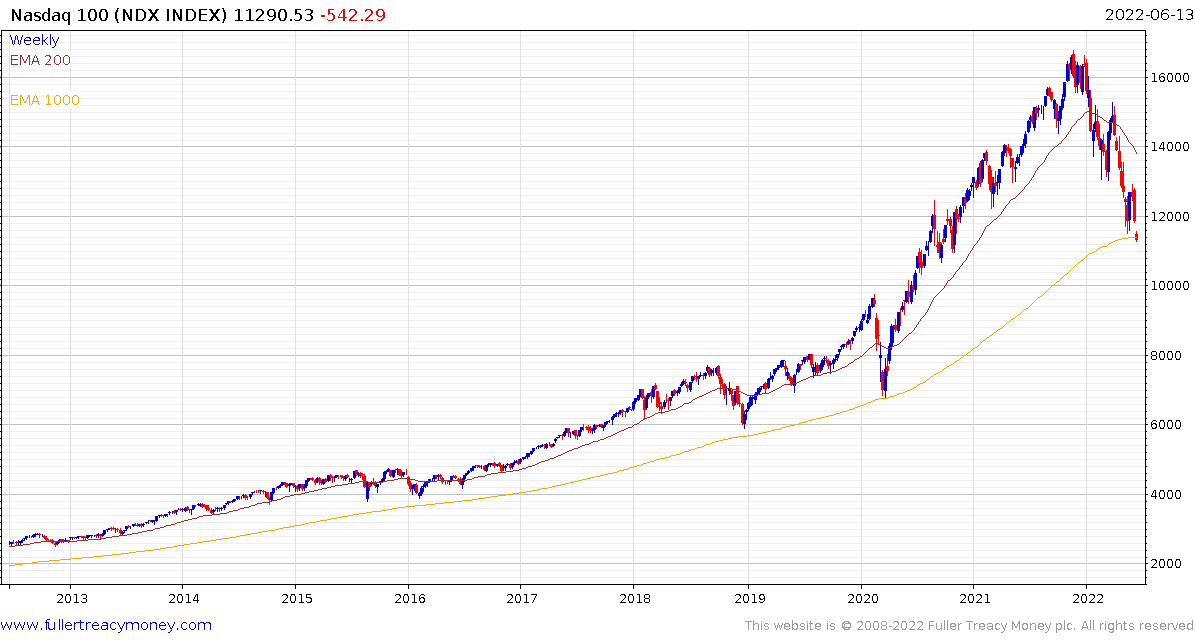

Thank you for this question which I believe related to the Friday audio. My concern arises from the reflection of investor sentiment I witnessed at The Chart Seminar. Investors still want to buy the dip. That strategy works well in a bull market. It can decimate a portfolio in a bear market which is what we have now. So how do you sit on your hands when the temptation to buy is so strong and has been such a positive experience for the last 14 years?

The answer is to go a little short. If that strategy works. Buying the dip won’t. If the short grows to become a bigger part of your p&l then you are being provided with an additional warning.

Going big on an initial short position in a leveraged market is very risky. The intraday volatility means there is scope for large swings. Over coming days, it would not be surprising to see a rebound after such a deep pullback over the last three sessions. It is also true that some of the biggest upswings in the market occur during broad declines.

I initiated my short closer to 15000 on the Nasdaq, I took a partial profit a few weeks ago before putting it back on a day later and I increased it on Friday. My breakeven is now above the early June peak.

I initiated my short closer to 15000 on the Nasdaq, I took a partial profit a few weeks ago before putting it back on a day later and I increased it on Friday. My breakeven is now above the early June peak.

This is a leveraged trading position. My aim is to both make money and hedge my risk of loss in my other positions. So far that is working out OK, but I’ll be a lot happier if the precious metals sector turns around soon.

.png) Meanwhile, the VIX Index is well shy of levels that normally signal market lows.

Meanwhile, the VIX Index is well shy of levels that normally signal market lows.

.png) The Advance-Decline for the NYSE is trending lower. It will be hard to argue a meaningful low has been reached until it turns about.

The Advance-Decline for the NYSE is trending lower. It will be hard to argue a meaningful low has been reached until it turns about.