Email of the day on robotics and the Eoins Favourites section of the Chart Library:

Regarding your optimism of the robotics and tech story and the prospects of the likes of FANUC in Japan, could you recommend a UK based investment vehicle to access FANUC and its peers? Also could you explain the criteria on the "Eoin’s favourites" section of the chart library?, I am assuming that they are favourites as in best of class as opposed to just favourites/watchlists from a both long and short perspective? Best regards

Thank you for these questions which I’m sure will be of interest to subscribers. Let me take them in reverse order.

Over the years every time I have posted a review of a stock market sector I created a section in my Favourites so that I could easily return to the list in future. At The Chart Seminar I use my Favourites to go through examples of Commonality and to review sectors of interest to delegates. One of the most common requests in the feedback we get is that subscribers would like to have access to my Favourites list rather than recreating their own. With that in mind I started recreating the various sections from my Favourites in the main Chart Library about six months ago.

All of my lists of Dividend Aristocrats, Dividend Champions and Dividend Contenders can be found here.

The Eoin’s Favourites section contains the lists I have so far entered. It’s not complete yet but it is meant to function as a resource rather than a recommendations list.

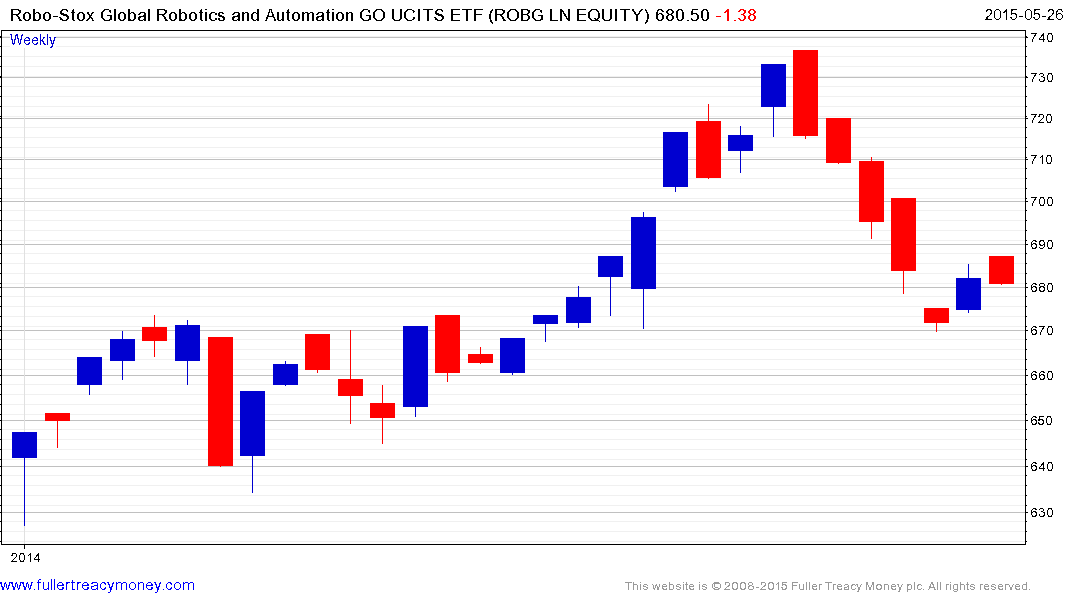

Turning to your second question: As interest in robotics has increased the number of products offering exposure has also grown. The recently UK listed Robo-Stox Global Robotics and Automation GO UCITS ETF holds a number of the companies one might associate with a robotics portfolio but also holds industrial automation, software and 3-D printing companies. Here is a link to the constituents as posted on the firm’s website.

The fund has returned to test the region of the 200-day MA and found at least short-term support. It will need to hold the 670p area if potential for additional higher to lateral ranging is to be given the benefit of the doubt.

Clicking through the industrial automation section of the Chart Library, the software companies with a focus on robotics are outperforming while the main robot manufacturers are engaged in a process of mean reversion.