Email of the day on real returns

Where can I find a chart plotting real returns of interest rates Thanks in advance.

Thank you for this question which is not easy to answer. The primary tools used by the market to monitor real returns on fixed income are heavily influenced by Fed actions.

For example, the Fed is buying large swathes of the inflation-protected securities market (TIPS). That’s supressing the yield.

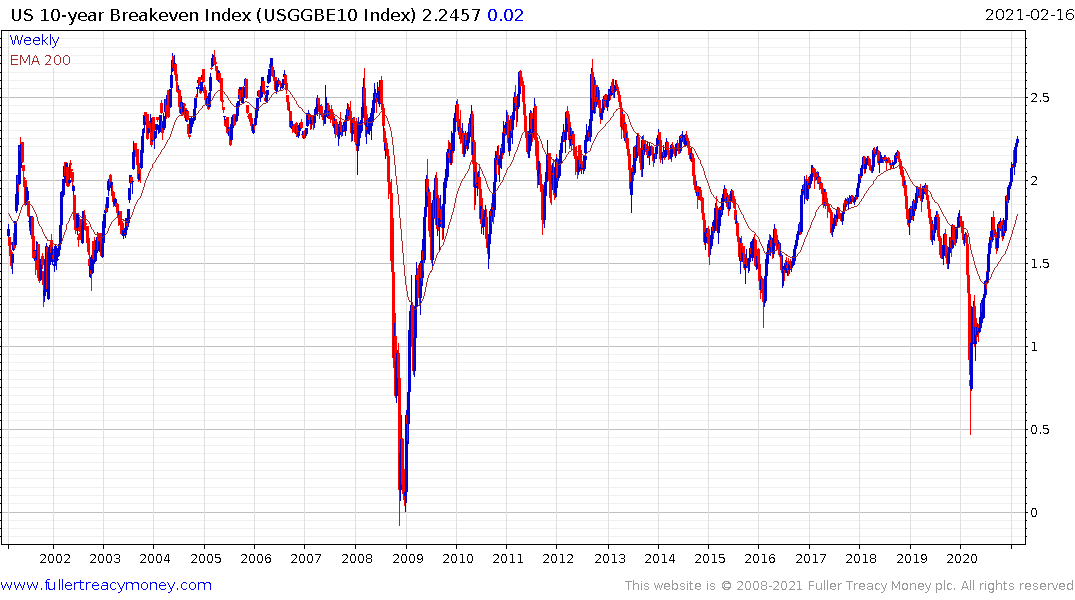

The favourite way of monitoring inflation expectations is to look at the breakeven. It purports to reflect the yield required to compensate for inflation. However, it is calculated as the spread between Treasuries and TIPS. Since the Fed is actively buying both, it is a distorted metric.

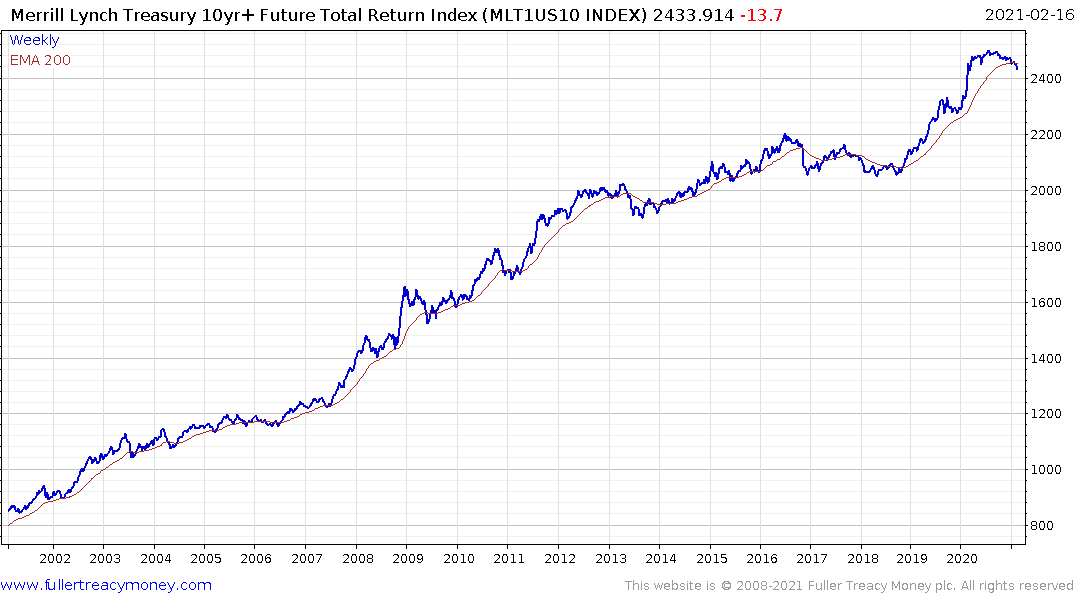

The Merrill Lynch 10-year+ Futures Total Return Index is the best instrument I know of for monitoring the health of the bull market in Treasuries.

If we adjust it for CPI, we get this chart which is in log scale. The modest retracement, so far, in real inflation-adjusted terms helps to explain the relatively sanguine attitude of bond investors even though bond yields are breaking out globally.

It suggests a significant additional uptick in CPI and decline in yields will be required to shake the resolve of bond bulls.

The big challenge is that it is absolute level of yields which influences the ability of governments to service their debts in the short term.

In the UK there are already calls for Rishi Sunak to abandon the election promise not to raise taxes. The USA has been running increasing deficits since 2017, that is not sustainable indefinitely which is why continued Fed support is inevitable.