Email of the day on quantitative tightening

What is your opinion on the latest figures of the Fed's policy of quantitative tightening?

Quantitative tightening remains a central part of the Fed’s tool kit as they attempt to bring inflationary pressures back to an acceptable level.

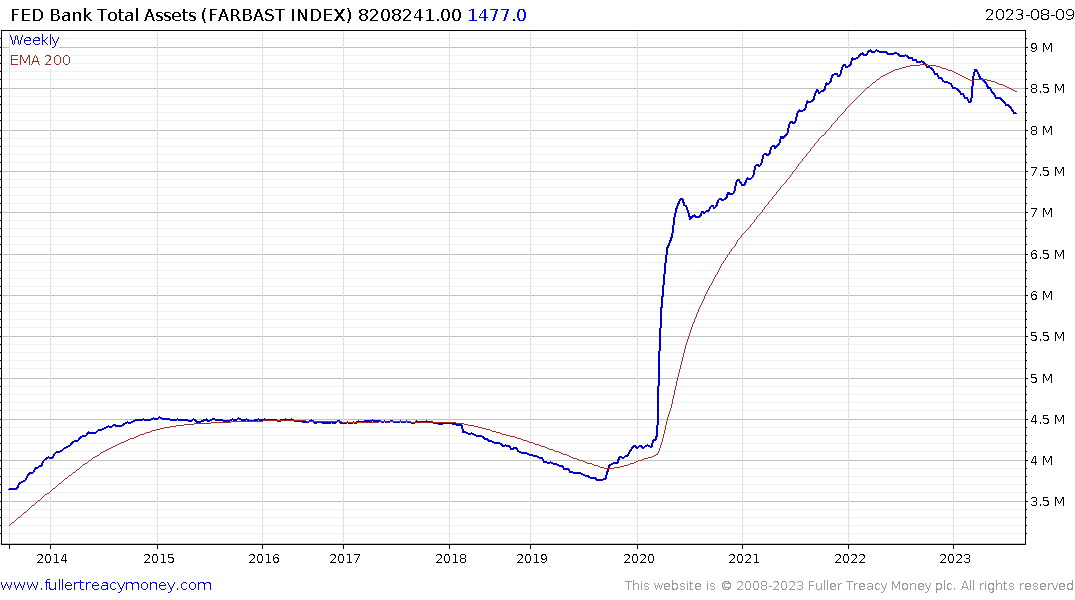

The Fed’s balance sheet continues to contract and moved to new reaction lows a month ago. The process is slow relative to the accumulation phase between the low in 2019 and the peak in 2022 and it will continue until deflationary forces replace inflationary fears.

The fact that quantitative tightening has persisted, even after the emergency assistance provided during the March regional banking crisis, tells us inflation rather than asset prices is the Fed’s priority right now.

The fact that quantitative tightening has persisted, even after the emergency assistance provided during the March regional banking crisis, tells us inflation rather than asset prices is the Fed’s priority right now.

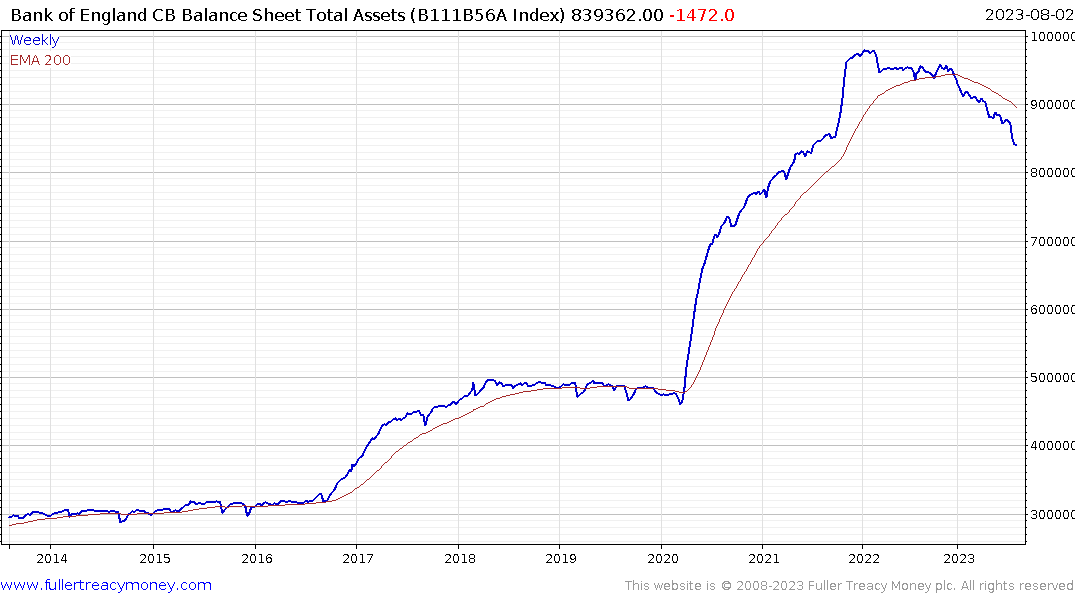

The Bank of England displayed an identical pattern of behaviour following the pension crisis last year. They are also continuing to contract their balance sheet.

The Bank of England displayed an identical pattern of behaviour following the pension crisis last year. They are also continuing to contract their balance sheet.

Between the peak in 2017 and the low in 2019, the Fed took $750 billion off its balance sheet which was a 15.77% contraction. This time around, they have removed a similar amount, but it only equates to 8.45% of the total. That suggests there is still have some way to go before the full effect of removing liquidity will be felt.

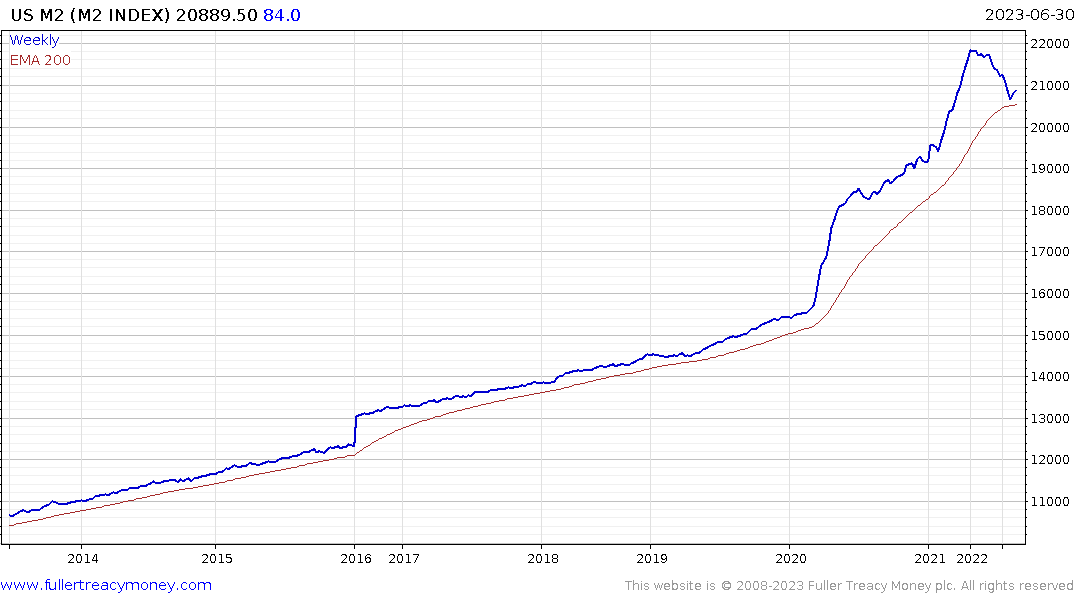

The same argument can be made for the historic decline in money supply growth. It is coming off such an incredible high that the decline has barely been felt in the nominal data.

The same argument can be made for the historic decline in money supply growth. It is coming off such an incredible high that the decline has barely been felt in the nominal data.

Regional banks rebounded impressively from the March lows but are now encountering some resistance in the region of the 200 and 1000-day MAs. They have plenty of room in which to consolidate but the low around 85 needs to hold if recovery is to remain credible.

Regional banks rebounded impressively from the March lows but are now encountering some resistance in the region of the 200 and 1000-day MAs. They have plenty of room in which to consolidate but the low around 85 needs to hold if recovery is to remain credible.