Email of the day on protectionism representing a headwind for global companies

I would like to know your opinion on this article about Autonomies the recently appeared in The Economist

Growth has been unimpressive over the last few years because many of the emerging markets they depend on to boost demand are export oriented. The US has been recovering from the credit crisis, the EU has been mired in a sovereign debt and banking crisis, and the commodity collapse knocked out demand from the emerging consuming class in related markets.

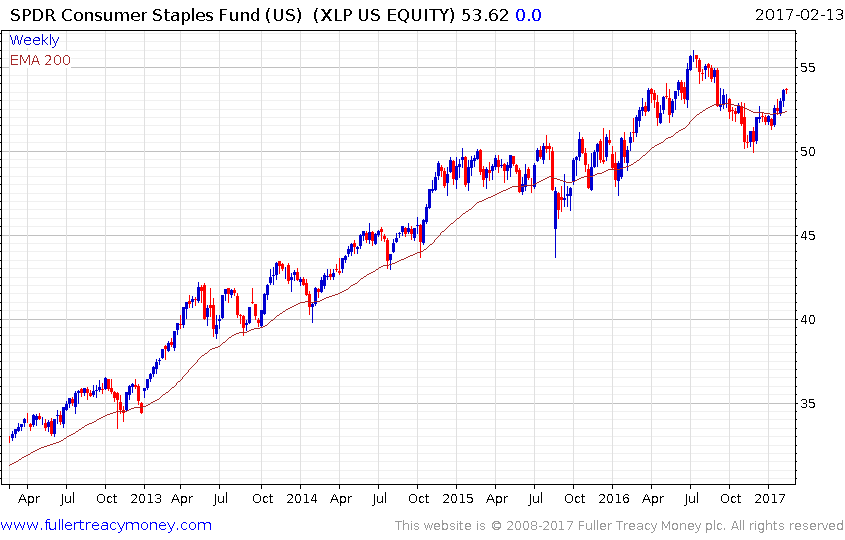

The rise of populism and protectionism is not only in developed markets but Xi’s China first policy represents additional headwinds. However, consumer staples companies have long histories of working together with domestic partners, setting up offshore operations and producing locally to develop successful relationships. Therefore, it is certainly a dynamic environment but global GDP growth fixes a lot of problems and stock markets are pricing in the potential for growth to accelerate.

The developing trend in manufacturing has been towards regional operations for a long time already but a pullback from globalization, if it in-fact occurs, could accelerate it. Companies like Inditex and H&M bring out new lines every week, Under Armor has never had a factory in the USA. Seamless knitting, already employed by Benetton, and robotic sewing machines will alleviate the cost advantage of producing far offshore within the decade which is why garment factories in Asia are in such a hurry to automate;. Value already resides in design and brand prestige in the consumer electronics and fashion sectors but that trend is only going to intensify as barriers to manufacturing come down.

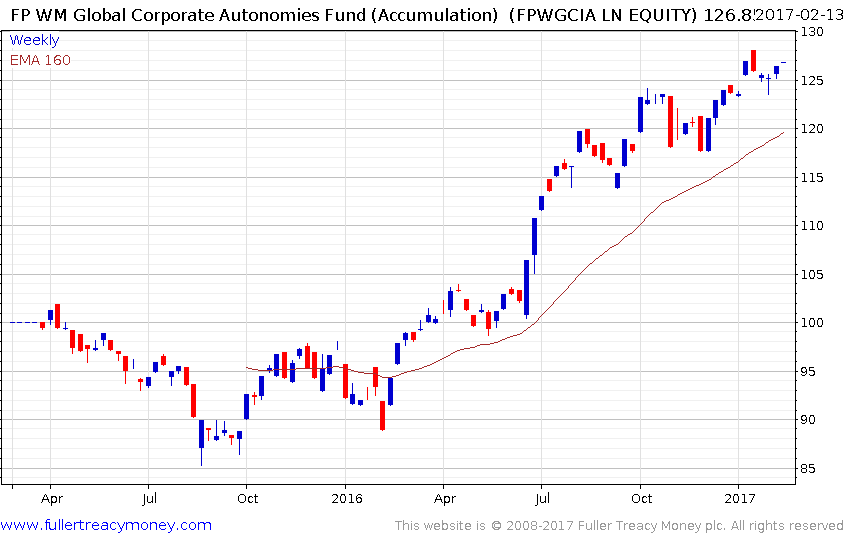

The reason we developed the Autonomies theme more than six years ago, is because we viewed big international companies that, importantly, dominate their respective niches as the most likely to benefit from the three evolving themes we had identified. They have long histories of breaking into new markets, after all that’s what allowed them to become global corporations in the first place. Therefore, they are well placed to harvest opportunities in the global market as they arise.

With big global businesses, they benefit from the lower cost of energy following the oil collapse engendered by the game changing evolution of shale oil and gas. They benefit as consumers but also by the fact that the global middle class will have more money to spend if energy prices are lower.

Technology companies represent a pretty significant number of the Autonomies already but large companies are some of the greatest beneficiaries of employing technological innovation to enhance margins and invent new products of their own. That’s a factor which is completely unimpeded by any uptick in anti-globalization rhetoric. In fact, for consumers of technology it could mean they have access to new products and methods ahead of their competitors elsewhere and sustain advantages longer.

When I wrote Crowd Money and championed the case for the Autonomies I had anticipated inflation would make a comeback a little earlier but the two-year range following a big breakout is right on schedule. Big companies with global operations and long histories of dividend increases are among the best hedges against inflation. The global bond market is at a pivotal juncture. US interest rates are rising and yields are testing a 36-year downtrend. If they break to a new low and hold that move it will confirm a completed top formation. Maybe it will take a little longer and rally back towards the mean will occur first so 2% is a big number for any short-term bond rally. It is certainly now for the bulls to prove their case because interest rates are rising.

Central banks and governments need inflation. They have a ton of debt and technological innovation is sharply deflationary. That means they don’t just need a little inflation, they need a lot so the prospect of synchronized global fiscal stimulus is looking increasingly likely. That would be positive for stock markets and the Autonomies.

The biggest threat I envisage is that increasing competition due to the issues many countries have with debt and how to devalue and/or trade their way out of it could lead to harsher geopolitical situations which could contribute to war (don’t you mean trade wars?) especially with higher rates and ensuing refinancing costs. For me that’s the biggest risk for the Autonomies and the global markets over the next decade.

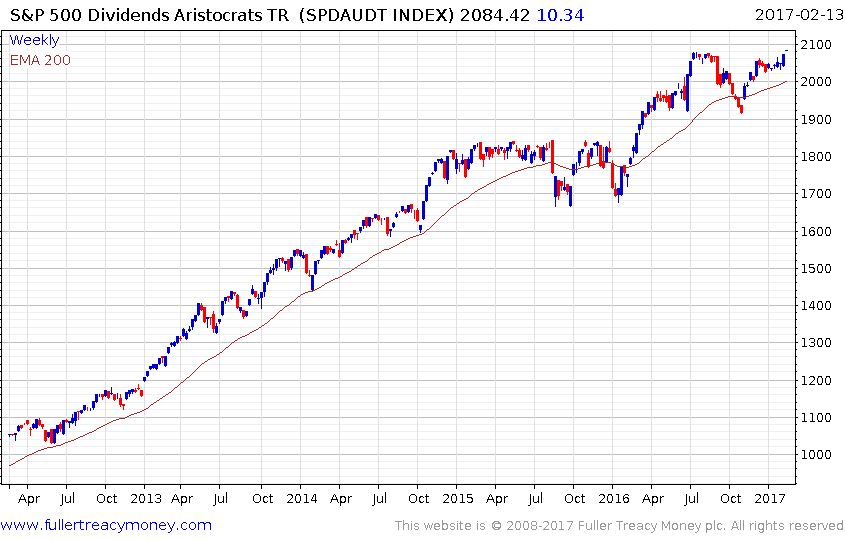

The most important thing we can do is to assess the situation by measuring it against price action measure it against the price action. The S&P 500 Consumer Staples, the Autonomies and the S&P 500 Dividend Aristocrats are still in consistent uptrends with no evidence of top formation development so we have to give the benefit of the doubt to the upside.