Email of the day on PEG ratios

While not disagreeing with the system per se, utilisation of a PEG presupposes that companies have positive EPS. Multi-baggers in small cap land often come from identifying companies which are successful at the top of the P&L, i.e.: achieving superior sales growth, rather than at the bottom. Inherently more risky, of course, and one must be prepared to wear the occasional period of drawdown and volatility that the major indices do not see. Q2 this year is a good example. Nevertheless, over the medium to longer term, a diversified portfolio of 20 or so small cap names should have a place in larger investor portfolios.

Thank you for this thoughtful comment contributed in the spirit of Empowerment Through Knowledge and appended to David’s piece yesterday on PEG ratios.

As an exercise, I compiled a global list of companies with a market cap of less than $2billion and PEG ratio less than 1. There were 1774 results so I sorted them by country which resulted in a list of approximately 250 for the USA and 100 companies for the UK.

A brief perusal of the list highlights how useful price charts are in the examination of the prospects for companies since the vast majority of trends I viewed are deteriorating with little sign of support building.

In some cases this is because they are losers in a competitive sector (Pier 1 Imports) or because they are in sectors where investors are now less inclined to take on risks (homebuilding). However accelerating downtrends usually prick the interest of value investors and private equity firms so they are worth monitoring for signs that bullish interest is returning. Two shares with interesting chart patterns are:

UK listed Centamin Gold (PEG 0.48, Est P/E 9.03) has held a progression of higher reaction lows for a year and a sustained move below the 200-day MA, currently near 54.5p would be required to question medium-term scope for additional upside.

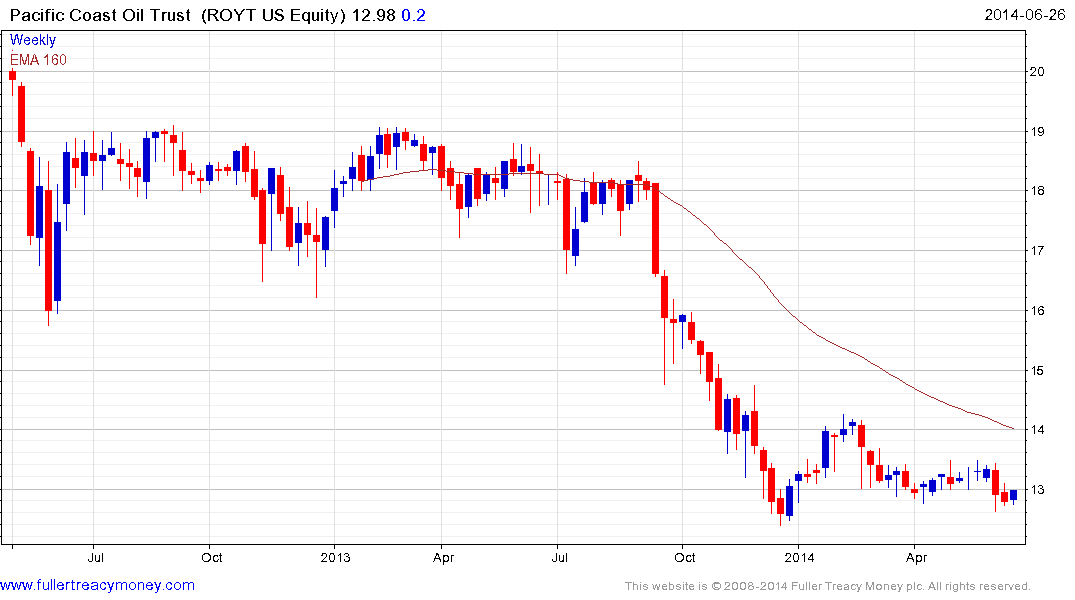

A subscriber recently requested that US listed Pacific Coast Oil Trust (PEG 0.66, Est P/E 9.05, DY 13.79%) be added to the Chart Library. The share continues to range mostly above $12.50 and a sustained move above the 200-day MA, currently near $14 would confirm a return to demand dominance.