Email of the day on palladium

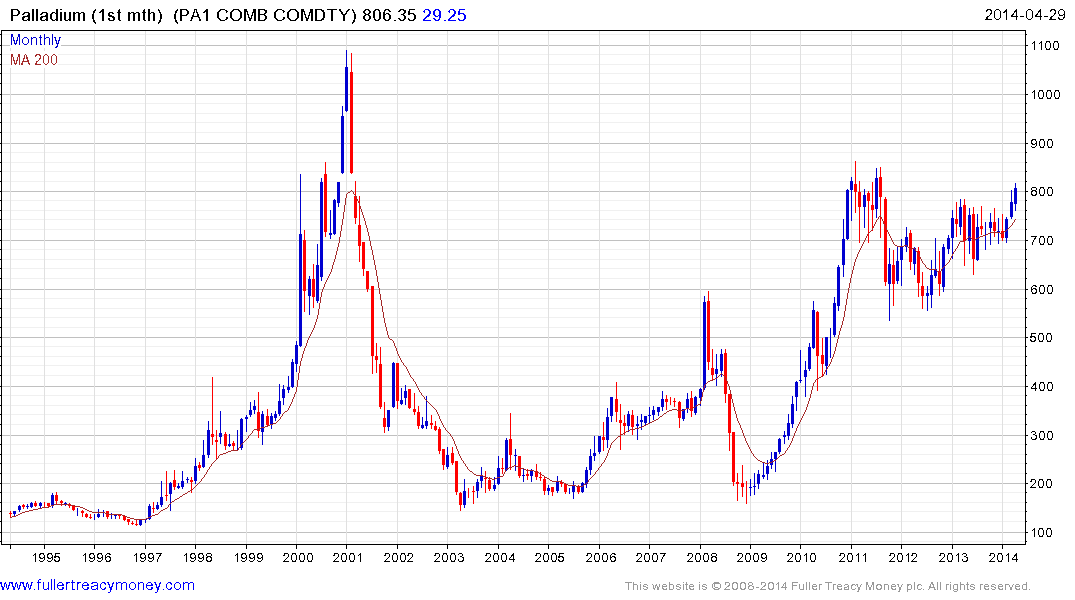

Thank you for this question which may be of interest to subscribers. The geopolitical risk attached to palladium supply helps to explain the metal’s recent outperformance relative to the other precious metals. However, it is also worth highlighting that the market has been reasonably firm for much of the last year even as the other metals experienced deep corrections. This demonstrates that the supply situation was tight before the recent tensions.

Yesterday’s announcement of 7 people and 17 companies that could be targeted for additional sanctions by the USA was notable for the absence of banks and Norilsk Nickel. It is not in the interests of either Europe or the USA to disrupt Russian palladium and nickel supplies. The question remains whether Russia will choose to use its dominant position in these markets as a bargaining chip.

I opened a long in the June palladium contract on March 28th as it rallied to break a yearlong progression of lower rally highs and continue to hold the position because I believe the potential for additional upside continues to outweigh downside potential. Prices continues to range higher and a break in the progression of higher reaction lows, currently near $765 would be required to question medium-term upside potential