Email of the day on money flows and the Nasdaq

The Nasdaq price action seems to indicate that the top reached on March 29th 2022 (+/- the high of February 2nd) is of significance since on the 16th of June the close was below despite the intraday spike and has been trading below for the past couple of days : is it a short or just a consolidation phase after some short term overbought condition before it roars again? Rates are pausing but QT resumed after the regional bank scare and its liquidity injection - which is equivalent to rate hiking - as well as M2 continuing to decline (I am not sure that the surge in velocity of money is offsetting it). Your thoughts are welcomed.

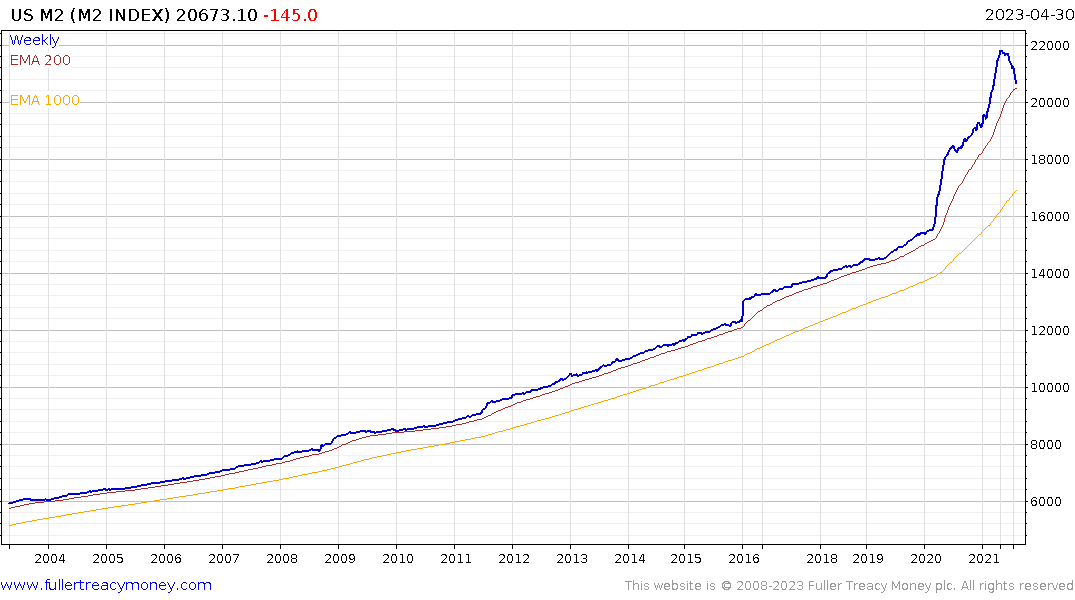

Thank you for this question, which is relevant today because monetary conditions are tightening, but from extraordinarily loose conditions. For example M2 is contracting for the first time on a year over year basis.

However, that is occurring following an historic surge. Valuations were flattered by that surge and the largest companies have not yet seen any evidence of a reality check.

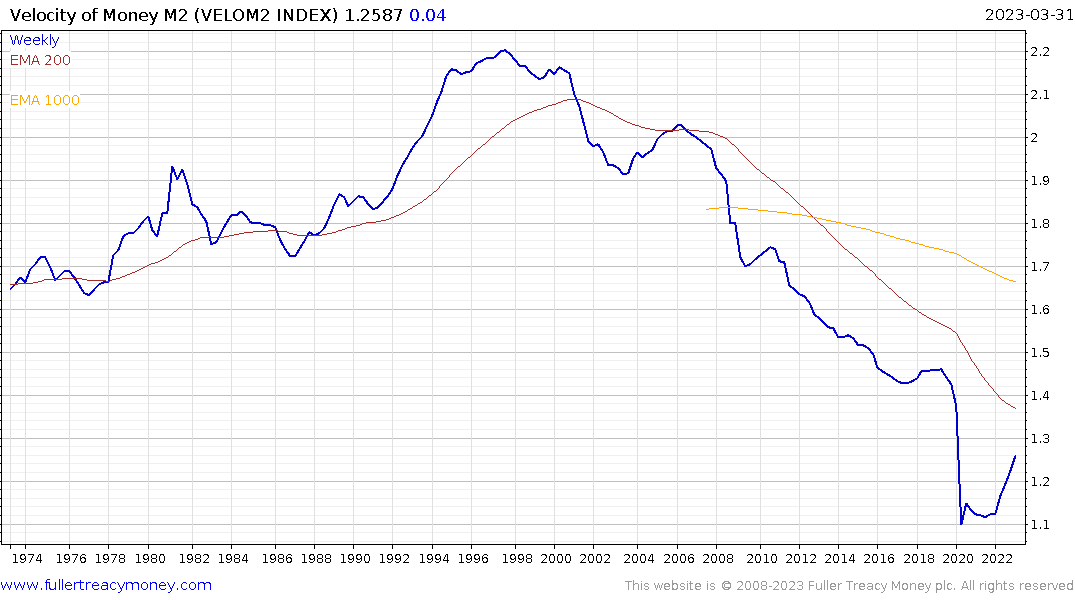

Velocity of Money has turned upwards which is consistent with an inflationary bias as consumers accelerate buying decisions. The figures are reported quarterly with a one quarter lag so the data reported at the end of Q1 looks at Q4 2022. The simplest logic is the Fed has to continue to reduce the volume of cash available as the velocity of money rises. To combat inflation it will have to remove it faster than velocity is rising.

As I have been saying for several months, the UK’s experience with the pension leverage crisis is a good analogue for the Fed’s monetary response to liability mismatches in the regional banking sector. They injected as much liquidity as was required to quell panic, then got straight back to reducing the size of their balance sheet.

It is well understood that quantitative easing creates asset price inflation. I find it peculiar that more analysts don’t see the link between quantitative tightening and deflationary forces. The ECB took €1 trillion off their balance sheet in 2012-14, it sparked serious deflationary fears across the region. The last time the Fed engaged in QT, bond yields collapsed. In 2019 there were fears inflation would never again return.

On both occasions, bond yields initially rose as investors worried about the loss of a major source of demand from central banks. Later yields accelerated lower because tighter liquidity conditions spurred deflationary fears. On this occasion the sheer volume of extra cash in the system is delaying the deflationary trend but it is coming.

I have seen more than a few commentators expound on the likelihood of the Fed needing to eventually introduce yield curve control. The US deficit is still expanding, the Fed is no longer remitting profits to the Treasury, the cost of servicing the debt has jumped 50% to $600 billion in the last two years and no politician is willing to raise taxes or address the unfunded liabilities cliff. The logic is no one will buy the nation’s debt so the Fed will have to control yields.

That argument assumes inflation cannot be brought back under control. The jury is still out, but it is within the ability of central banks to achieve that goal if they are willing to inflict pain on consumers. The fact they have not abandoned QT despite the trouble in the regional banks suggests they are serious about combatting inflation.

That is also a necessary action to ensure confidence in the Dollar as a reserve currency. Faith has been shaken following the use of reserve currency status as a weapon against Russia and several countries are talking about cutting the Dollar out of cross border transactions. If that trend is to be arrested, confidence in the Fed’s ability to manage inflation is essential.

As you point out the Nasdaq-100 has returned to test the region of the early 2022 peaks. It is short-term overbought and at least some consolidation is underway. Potential for a reversion back down to the 200-day MA is high.

My concern is the bullishness around AI has been all encompassing. For a major bull market you need both a compelling story capable of inspiring investors to buy and hold. You also need liquidity to feed that appetite. Right now, we have the story but liquidity is being drained, so one of the necessary ingredients for a big bull market is missing.

The chart parallels between now and the Nasdaq-100 bubble peak in 2000 are quite interesting. The initial peak to trough reactions are about similar and so are the short covering wishful thinking rebounds.

The most important point to remember is the first interest rate cuts are seldom good news for the stock market. The Fed is unlikely to relent until they have clear evidence of deflationary forces. When the discussion is about the magnitude of a recession versus whether one is likely, that’s not great news for earnings.

Back to top