Email of the day on lengthy bond market top formations

We may not be done with the bull market in bonds, or at least a very extended period of ranging if this article has merit. It is publicly available so ok to post. Would appreciate your comments https://realinvestmentadvice.com/the-long-view-rates-gdp-challenges/

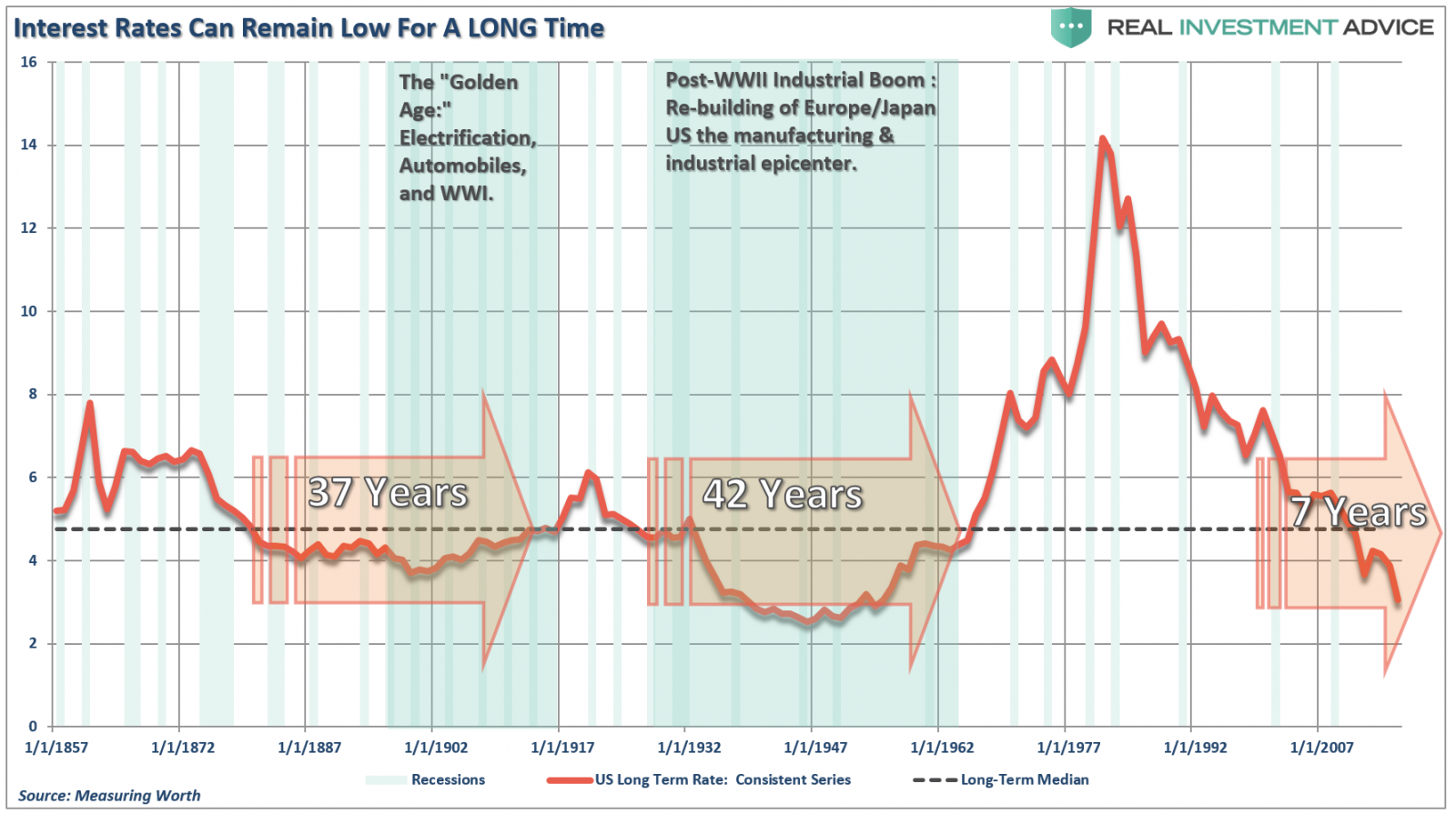

Thank you for this article which may be of interest to subscribers. I too think of the declining velocity of money as a headwind to inflationary pressures getting out of control. However this image of what they consider low interest rates, as below 4.5% is an average level over the last century rather than what might be considered low.

10-year US Treasury yields have been ranging mostly above 1.5% since 2012. Even if the upper side of the range is 4.5%, that’s almost a doubling in the yield from here. To put some real numbers on that, the on-the-run Treasury is priced at 98 today and would need to fall to 85.8 to generate a yield of 4%. That’s a substantial implied loss on a yield to maturity basis. Bonds are a heavily owned asset class in pension funds and retirement accounts and such a move would represent a significant problem for them.

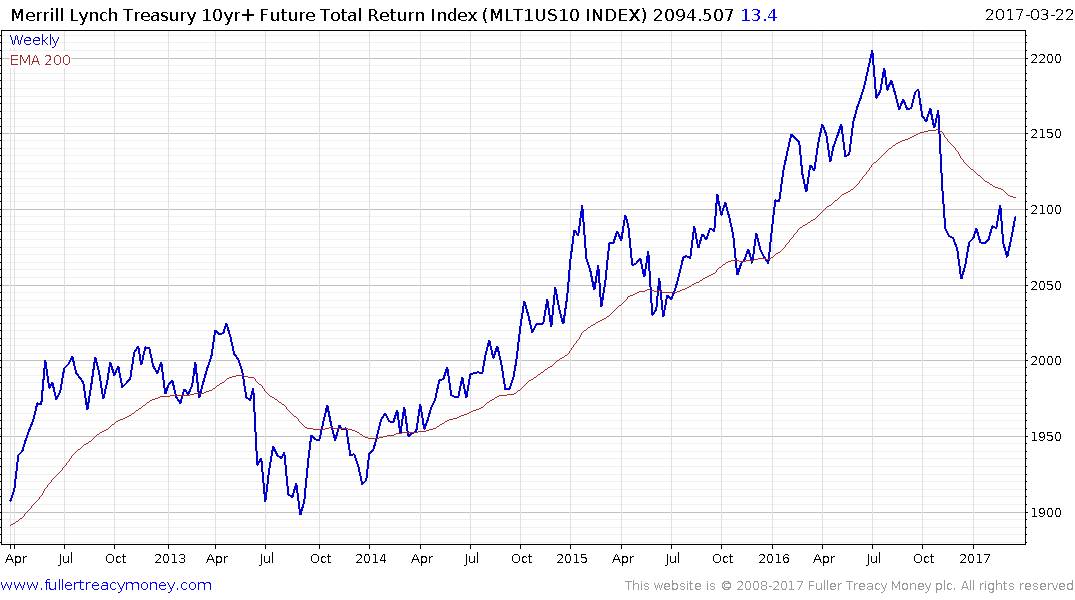

The Merrill Lynch 10yr+ Total Return Index is now at an important juncture. It has closed the oversold condition relative to the trend mean and if the bear base is to be fulfilled it will need to fall back from the 2100 area.