Email of the day on Japanese small caps

Given that the second section is the outperformer, are there any second section stocks that look particularly good on the charts

Among some of the more notable constituents:

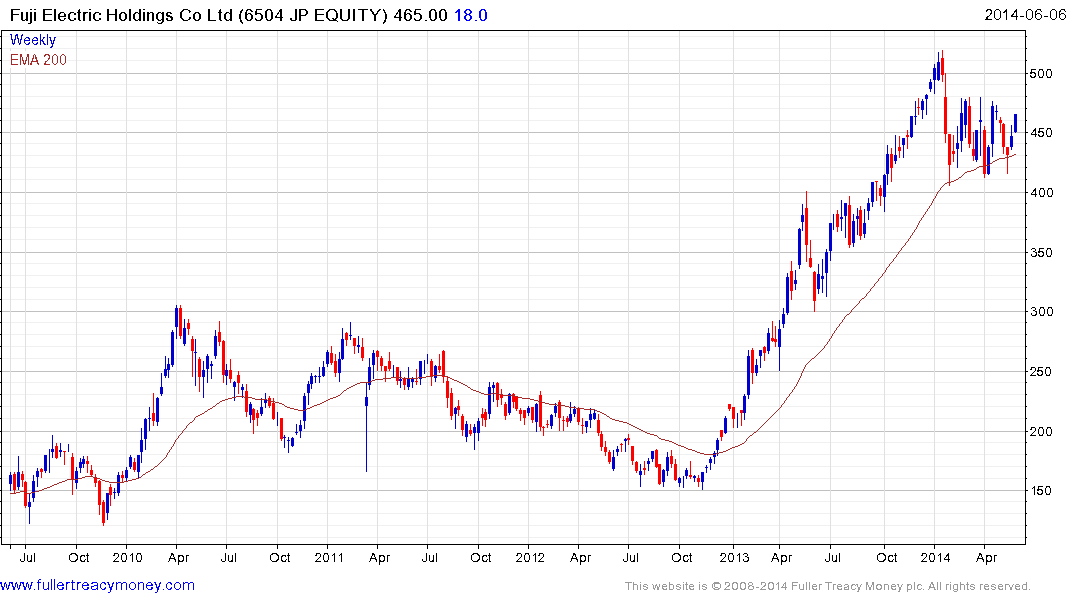

Fuji Electric Holdings is involved in the automatic vending and industrial innovation sectors. The share has been ranging in the region of the 200-day MA for the last five months and is currently rallying from its most recent retest. A sustained move below the ¥415 would be required to question medium-term potential for continued higher to lateral ranging.

Fuji PS (P/E 9.32, DY 0.99%) specialises in pre-stressed concrete and builds infrastructure projects. The share continues to trend consistently higher suggesting Japan’s reflation objectives are positive for the construction sector.

Enough of the regional banks are in consistent uptrends to suggest that the tide has turned in terms of domestic economic activity. Aomori Bank, while not in the 2nd Section is representative.

Elsewhere, Kurita Water may be about to complete a first step above its Type-2 bottom as taught at The Chart Seminar.

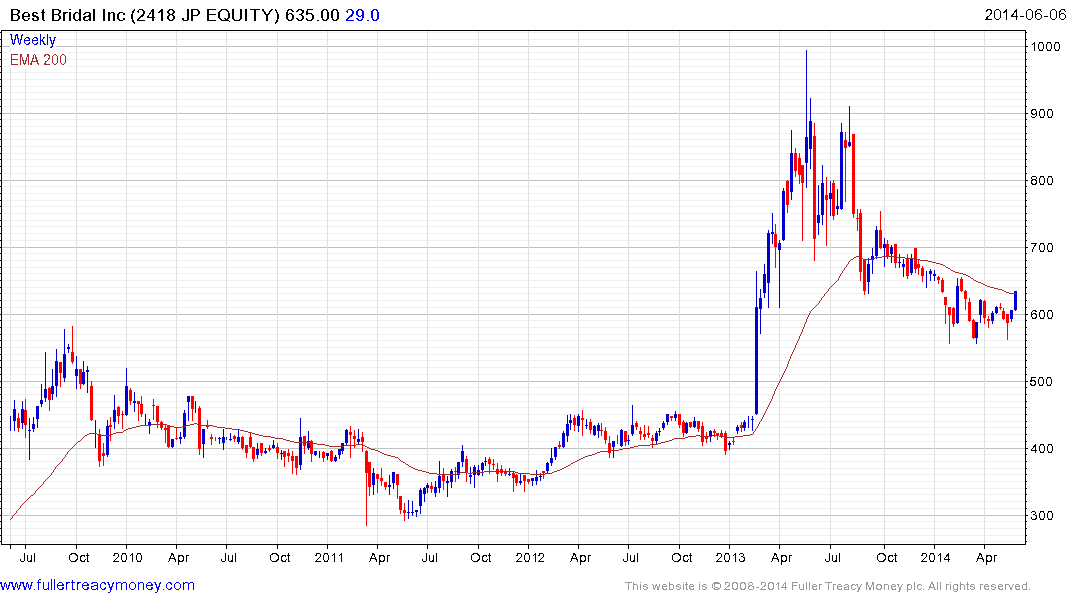

Best Bridal has unwound its earlier advance and has found support in the region of the upper side of the underlying base. A sustained move below ¥550 would be required to question medium-term recovery potential.

Back to top