Email of the day on investing in Africa

Thank you for a very informative big picture on Friday. Do you know of any fund managers that are investing in Africa with good track records for us to consider investing with?

Thank you for this question which I’m sure will be of interest to subscribers. Investing in Africa is not a simple matter. The entire continent has 1649 listed companies with major markets like South Africa, Nigeria and Egypt representing significant weightings.

Most countries still have a heavy reliance on resources, so when investing one has to at least keep an eye on what is happening in commodity markets because of the impact flows can have on consumer demand. An additional point is to be aware of the challenges of investing in illiquid markets. It is often easier to buy that sell. Another important consideration is how strongly property rights are enshrined in the constitution of the country one is investing in. After all, once we purchase an asset it would be nice to think we still own it when we come back a few years later to sell it.

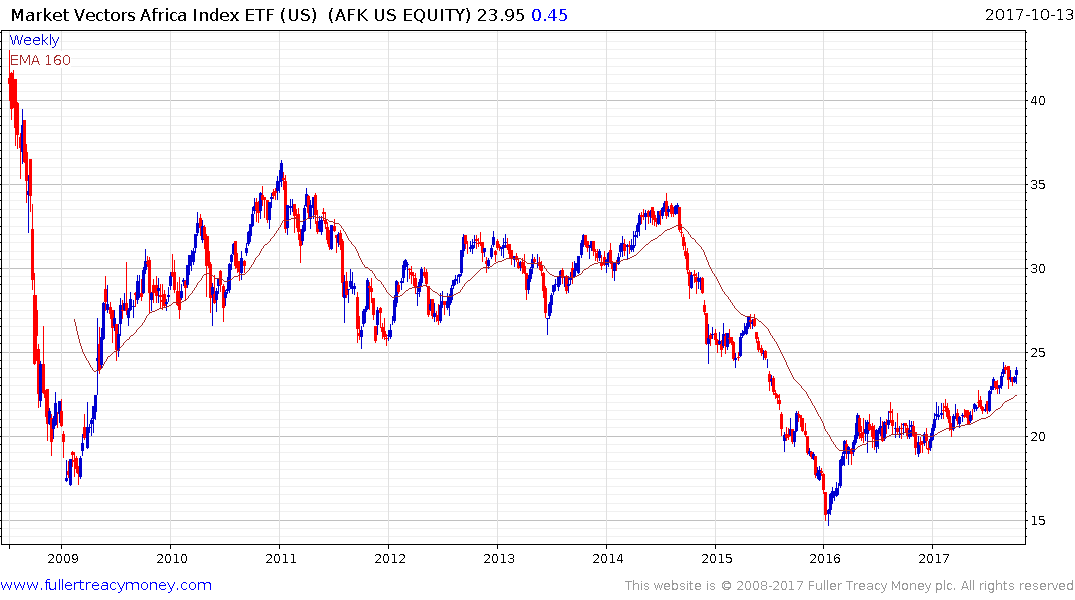

The Market Vectors Africa ETF tracks the Dow Jones Africa Titans and is primarily comprised of banks and resources companies. It hit a low in early 2016 and remains on a recovery trajectory in line with the resources sector.

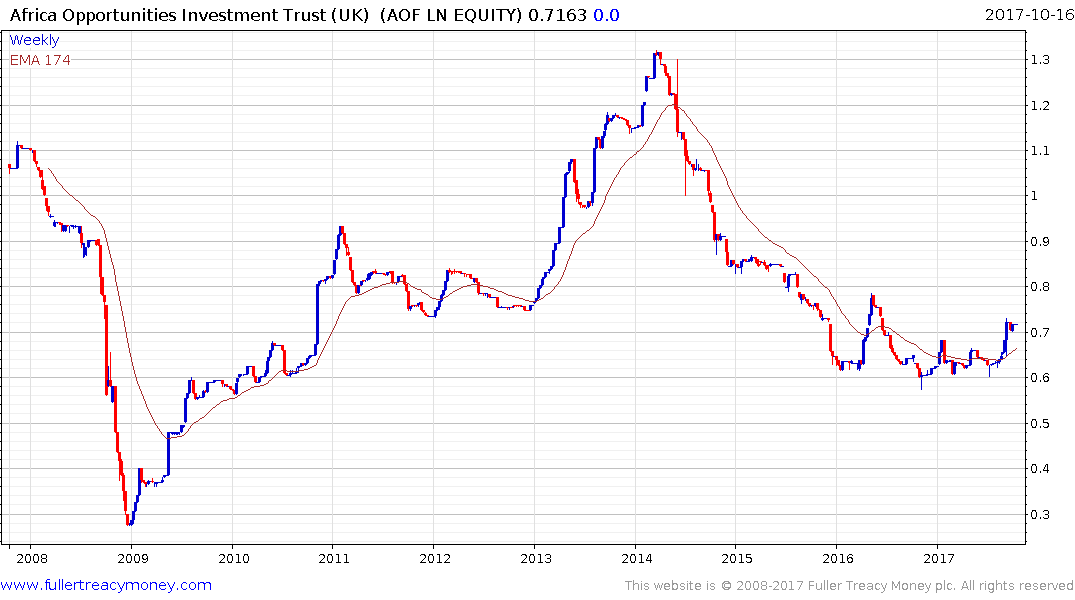

The UK listed, but Dollar denominated, Africa Opportunities Fund is reasonably well diversified and attempts to offer leverage to the growth of the consumer. http://africaopportunityfund.com/wp-content/uploads/2016/05/aof-february-2016-presentation.pdf It is currently trading at a discount to NAV of 25% and rallied in September to break back above the trend mean for the first time in a year.

Also take a look at the Africa Funds section of the Chart Library which has a number of offshore offerings.

Back to top