Email of the day on inflation expectations and rates

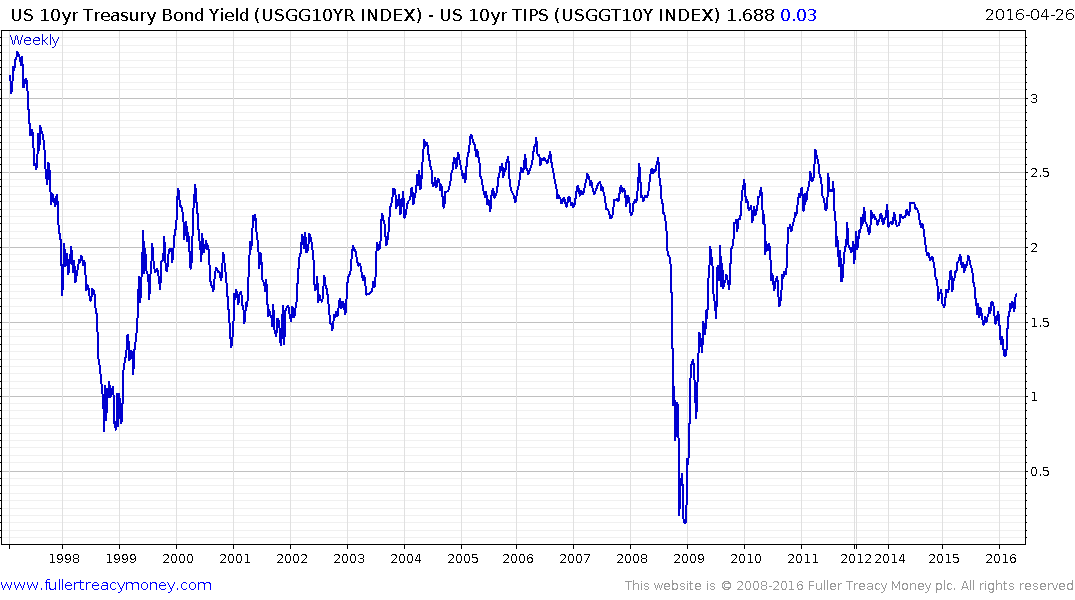

You've drawn attention to the 12 month T-bill rate a couple of times over the past week. Additionally, it is also very instructive to monitor inflation expectations to gauge what is discounted in terms of the future direction of interest rates. The five-year “breakeven” rate, a market measure of inflation expectations derived from comparing the yield of Treasury Inflation protected bonds (Tips) and conventional Treasuries, has climbed from a low of 0.95% in early February, to 1.56% now. It peaked at 2.4% in October 2012 after reaching an unprecedented minus 0.9% in 2008.

Movements in Tips have tended to reflect investor expectations about future consumer price inflation, and these have been stoked by the recent rise in oil prices and a weaker dollar, which means higher import prices. In fact, the breakeven rate has been rising in tandem with oil prices since February. Interestingly, the “core” US inflation rate, which strips out the impact of volatile components such as energy and food, has also been rising. The current buying of Tips reflects a view that the cycle of dollar strength and commodity weakness has come to an end.

Like you and David, I also think that commodities have bottomed. However, there are no signs of strong underlying demand and inflationary pressures from the real economy at the moment. Furthermore, Janet Yellen, the Fed chair, has cast doubts on the durability of the recent pick-up in core inflation and inflation expectations, arguing that the case for moving cautiously on interest rates was still strong. It is not surprising that she would say that given that the Fed has reduced the likely number of rate rises this year.

My view is that the US breakeven rate will rise with commodity prices which will push conventional yields up and stock markets down but I don't believe that oil prices, for example, will get anywhere near the previous peak for the reasons discussed by this Service. Thus bond yields too will peak at a much lower level. The collapse in commodity prices in the last few years has distorted valuations in various markets and there will be a ripple effect across the other asset classes.

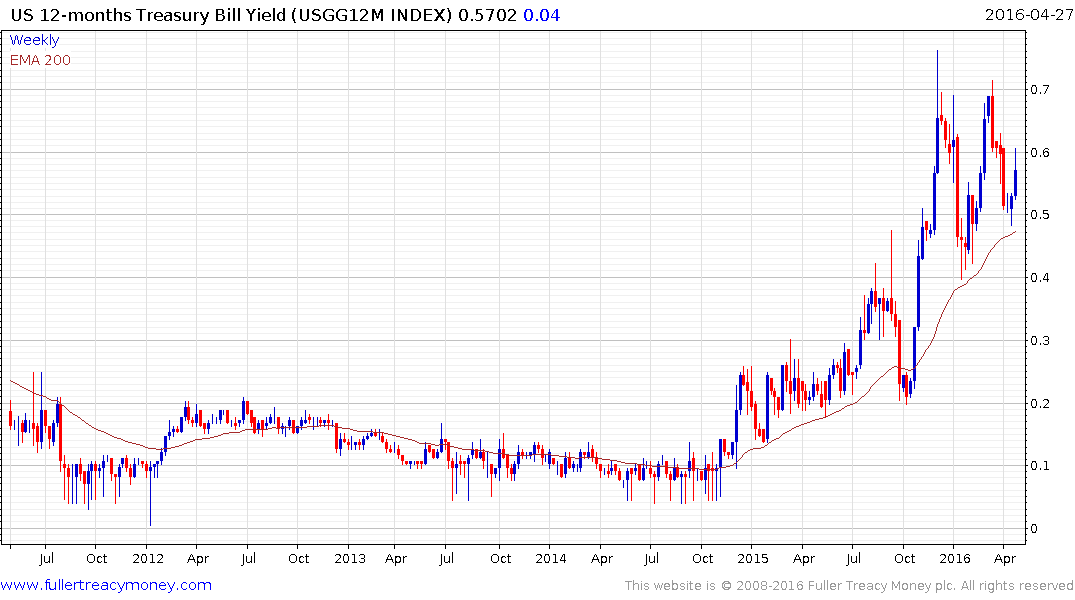

Thank you for this thoughtful email and for highlighting breakeven rates which I have not looked at in a while. I watch the 12-month yield because if gives us a good indication of how the bond market is pricing the risk of the Fed raising rates.

The yield has bounced from the region of 50 basis points over the last couple of weeks and surged higher intraday, ahead of the Fed meeting, to confirm at least near-term support at that level. That suggests at least some pricing in of the possibility the Fed will raise rates later this year.

Breakeven rates, defined as the Treasury – TIPS spread, rallied this week to break the medium-term progression of lower rally highs suggesting a low of at least near-term and potentially medium-term significance.

The Continuous Commodity Index broke back above the 200-day MA for the first time in two years last week and is improving on that performance this week. A sustained move below 375 would be required to question medium-term recovery potential.

When we observe such commonality in charts that reflect inflation expectations the only conclusion we can draw is that at least some investors are beginning to price in the potential that deflationary fears were overdone not least as oil prices continue to firm from relatively depressed levels.

Back to top