Email of the day on imminent recession risk

What’s your view of global recession in late 2022 or 2023? thanks for given some information on this.

Thank you for this question which may be of interest to the Collective. Financial conditions are tightening almost everywhere so recession risks are certainly rising. The dilemma for investors is we are only two years on from the pandemic panic, so it is very early to think about recession risk. Nevertheless, it is a question we need to deal with because exogenous factors are more relevant today than at any time in recent memory.

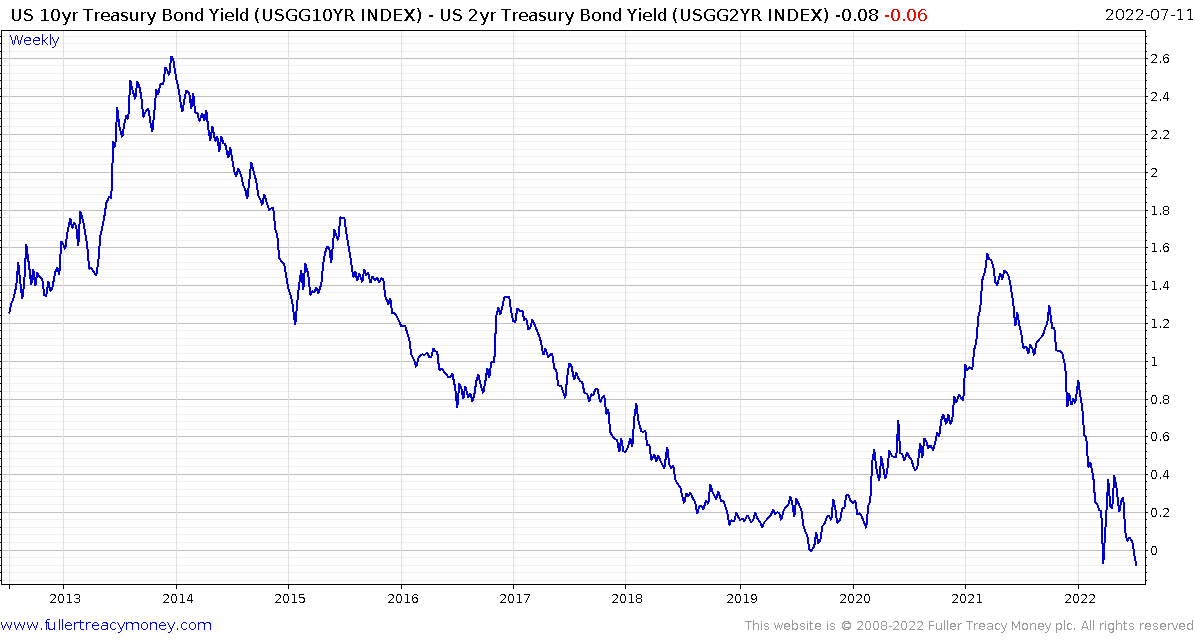

In 2019, the yield curve was inverted for months, valuations were high, and the odds were heavily in favour of a US recession beginning in 2020. Then we had the pandemic. The economic contraction was a cessation of all activity. Money supply growth exploded, helicopter money was suddenly a reality and demand roared back. Everything accelerated. In very simple terms, acceleration is a trend ending.

The 2020 recession was deep, but so short as to be inconsequential relative to the size of the money creation. Valuations did not correct. In fact, they took off as money printing went into overdrive. The sums fetched in private sector funding rounds were extraordinary by any measure.

The 2020 recession was deep, but so short as to be inconsequential relative to the size of the money creation. Valuations did not correct. In fact, they took off as money printing went into overdrive. The sums fetched in private sector funding rounds were extraordinary by any measure.

Apple got to a market cap of $3 trillion. At one point it was worth more than the entire energy sector. Tesla was worth more than the entire global automotive sector combined. These superlative headlines were individual marks of short-term peaks, but collectively signaled euphoric activity on behalf of investors.

Inflation ripped higher as a direct consequence of money printing. Central banks have learned two lessons over the last decade. The first is balance sheet contraction leads to deflation. The second is massive money printing leads to inflation. Each is a solution to the other. That suggests we are going to lurch from one extreme to the other. It points to short sharp expansions and contractions and the end of decade-long economic expansions.

The Federal Reserve is both raising rates and reducing the size of its balance sheet. That will create a deflationary shock because they will keep going until it does. Earlier this year, I thought the economic response to rising Treasury yields would be swifter. I did not think they would be able to raise rates as much as they already have. Nevertheless, the result will be the same. We are heading for a significant slowdown in demand. Private sector valuations have already contracted significantly. Klarna’s down round from a valuation of $46 billion to $6.7 billion is just one example.

The US economy contracted in Q1. It could easily have contracted in Q2 but the slowdown is underway. Meanwhile Europe is dealing with a massive energy shock. Not only can they no longer pay for Russian imports in Euro but the price of both oil and natural gas have surged.

Canada returned a crucial turbine for the Nord Stream 1 pipeline today, but Russia has no incentive to increase supply of gas. The reason for reducing supply was to gain leverage over Europe as the war in Ukraine moves into a new phase over the winter.

Refilling gas storage to 80% is just about possible if everything goes right for Europe. That was before US exports were shut down for the rest of the year from the Freeport LNG facility in Texas. Russia has a clear reason to ensure Europe is at least uncomfortable.

Before the war they had 2,800 tanks in service and 10,000 in storage. Today, Russia is using World War II era weaponry in Ukraine. It is quite likely this is aimed at forcing Ukraine to use their available inventory of anti-tank missiles so their defenses will be less formidable when winter comes. If Russia is going to negotiate with Europe they will want to do so from a position of strength. That means they will seek to put pressure on the region.

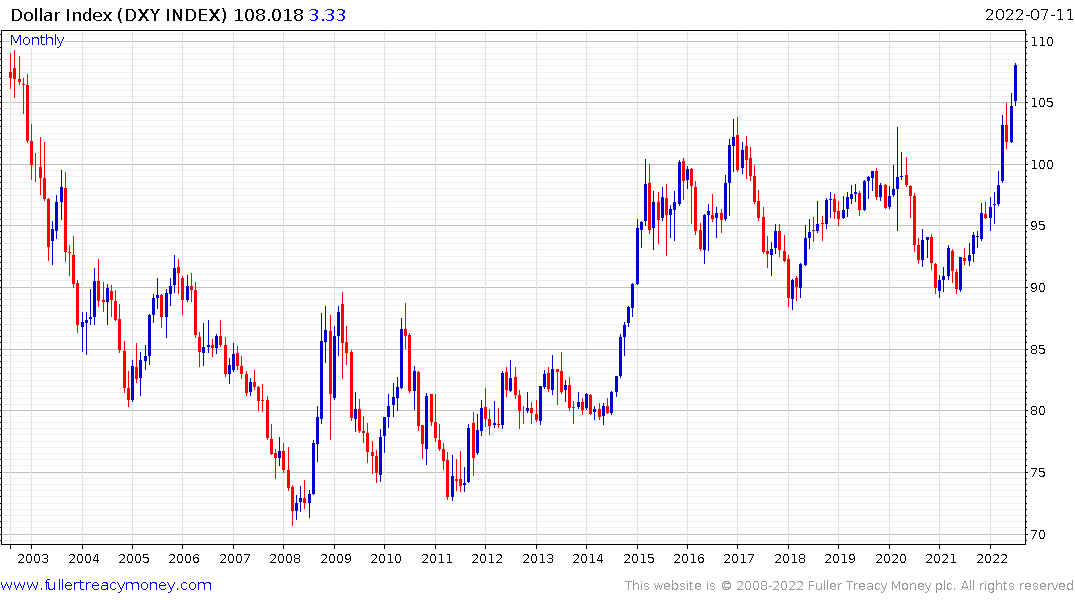

The Euro’s decline and ECB’s inability to do raise rates aggressively continue to support the stagflation outcome for Europe but it could easily transform into a high inflation contraction too.

China and Japan are the only major economies actively engaged in monetary and fiscal stimulus. However, China is less than eager to bail the world out and is more worried about the social implications of an epic property/infrastructure bubble bursting. It is very likely the economy contracted in Q1 because of the politically drive COVID-zero policy. Japan is not printing enough to make a difference to the rest of the world.

Meanwhile the continued strength of the Dollar is siphoning liquidity out of many emerging markets. The graphic scenes of the Sri Lankan presidential palace being overrun this weekend are a symptom of the deep trouble many smaller countries are in.

Major economies are already teetering on the edge of recession. Geopolitical risk premia are very high. Major central banks are tightening policy and stock markets are trending lower. This supports the view we should expect recessions to spread this year in much of the world and for the USA to experience a recession either this year or next.

Back to top