Email of the day on how the risk of a stronger Yen may affect Fanuc

Dear friends, I wonder if Fanuc would still be a good idea if this scenario develops. Best wishes for all of you

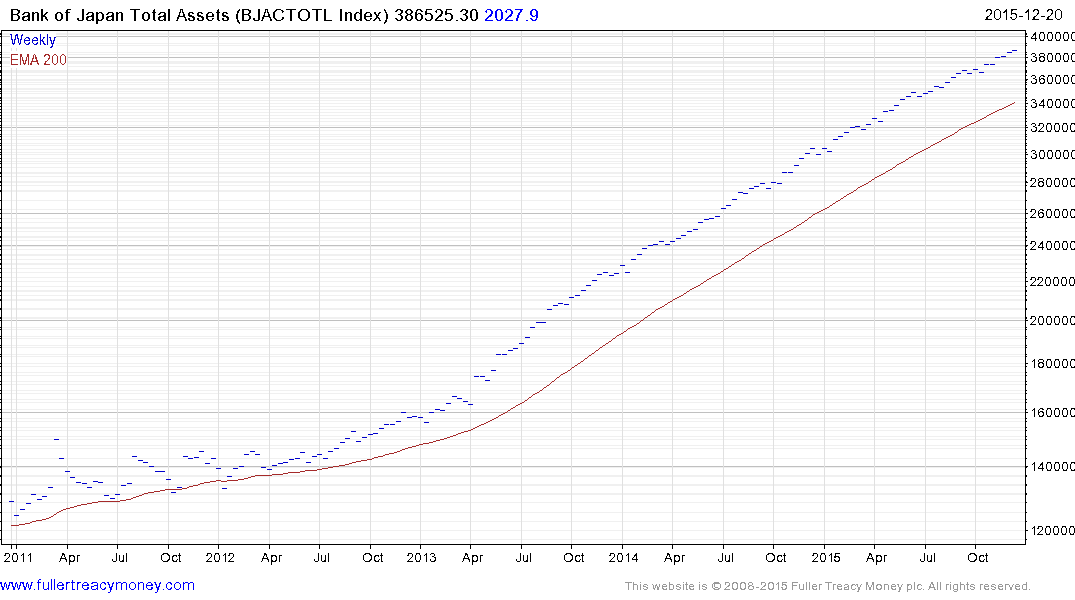

Thank you for this email in reference to the piece I posted on December 24th discussing JP Morgan’s view the Yen would potentially strengthen to ¥110 this year. The size of the Bank of Japan’s balance sheet continues to trend consistently higher. Its announcement in mid-December that it was not going to accelerate its printing policy resulted in a sharp pullback for stocks but it did not result in a sustained drop below ¥120.

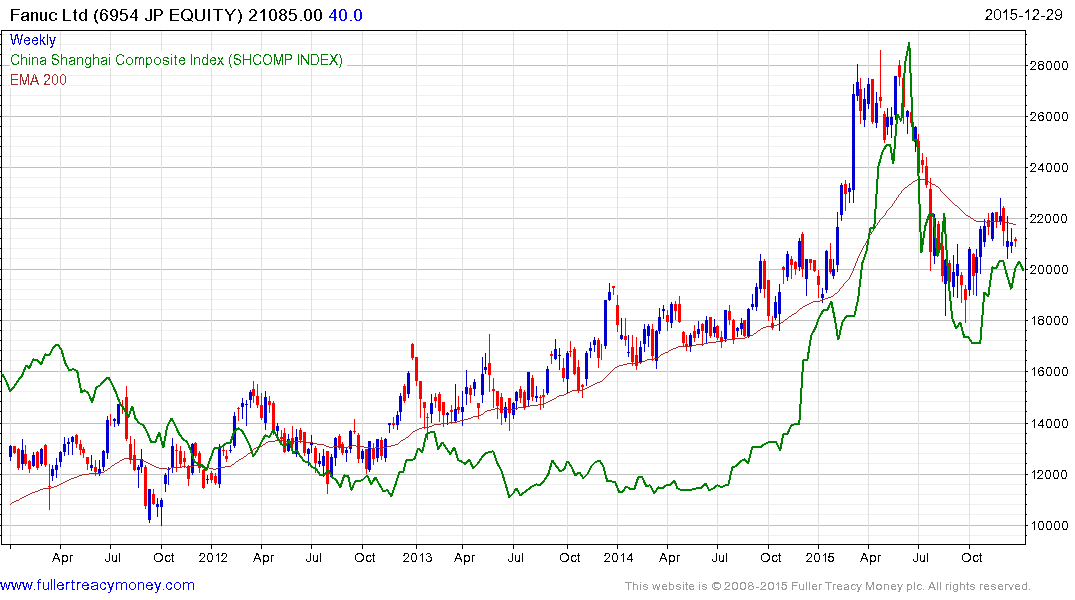

¥120 is a big level for the Yen since a move below it would question the Dollar’s progression of higher reaction lows which has been the primary consistency characteristic over the last two years. A jump in the Yen’s value would represent a headwind for domestic manufacturing operations such as Fanuc but medium-term demand growth for its products is a more important consideration.

One of the reasons Fanuc pulled back so sharply from its highs this year was because of fears surrounding a Chinese economic slowdown. It is interesting that it has bounced in line with the mainland Chinese market over the last four months and a sustained move below ¥18,000 would be required to question potential for continued higher to lateral ranging.