Email of the day on how many interest hikes are likely

I and probably many others will be intrigued in your contrarian view that the Fed will hike once and be "done". Whereas as per enclose Bloomberg article others expect seven rate hikes this year.

If only one rate hike does that mean USA stock markets will revert to their bull run?

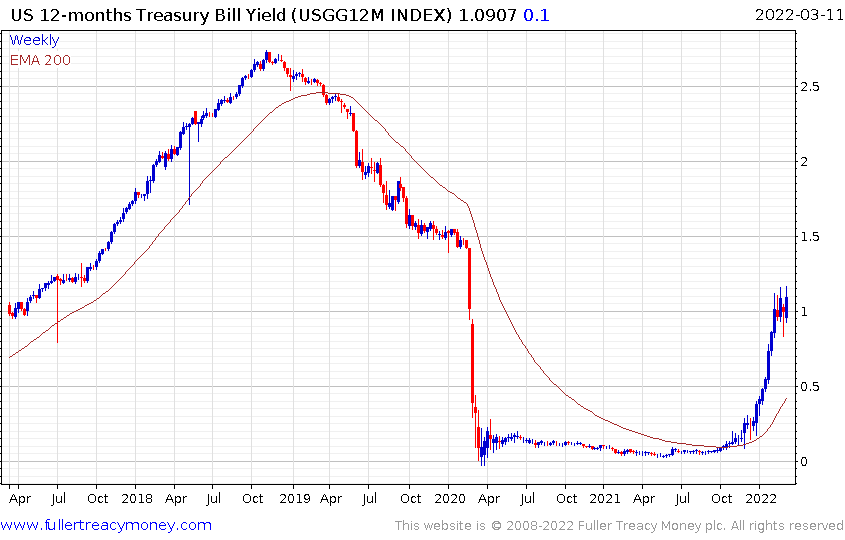

12-month yields are at 1.19% and climbing. That implies four hikes within the year. The Fed will hike this week, so that implies three additional hikes. I have been of the opinion the Fed will have an extraordinarily difficult time raising rates. If the Fed raises 7 times a recession is inevitable. With three more hikes the chances of a recession are better than even. One and done sounds about right to me.

Growth is already slowing. The Atlanta Fed’s GDP Now measure is at 0.51%. It was negative last month.

The US GDP Economic Forecast for growth in 2022 has deteriorated from 4.3% in September to 3.55% now and is still trending lower.

The quantity of outstanding debt and the constant need to refinance represents a significant fiscal drag. The US infrastructure budget is now being spent but there is no additional social stimulus. That represents an additional fiscal drag on the economy and reduces liquidity. That’s also helping to support the Dollar.

US financial conditions are tightening, liquidity measures are also expressing caution, high yield bond ETFs are accelerating lower, and the total assets of central banks are testing the sequence of higher reaction lows.

US financial conditions are tightening, liquidity measures are also expressing caution, high yield bond ETFs are accelerating lower, and the total assets of central banks are testing the sequence of higher reaction lows.

Against that background the S&P500 is has fallen 14.6% from the peak to the February 24th near-term trough.

Against that background the S&P500 is has fallen 14.6% from the peak to the February 24th near-term trough.

The uncertainty in Ukraine is a potentially significant factor in how interest rates decisions are made. The locking down of Shenzhen is an additional factor which could contribute to supply shortages of manufactured goods. Then there is the emergence of the Deltacron variant in France. At the far extreme, the fringe internet is blowing up with concern about the potential weaponization of hantaviruses.

The problem for every central bank is interest rates only serve to kill demand, they do nothing to address the supply shortages we see today. So, the only way to kill off inflation is with a massive recession. No one wants that so they can’t raise rates aggressively. Seven hikes is fantasy.

I expect the Fed to raise rates this week and to say they will make decisions about additional hikes as events unfold. The Fed has an open-ended liability from its standing repo facility. We could see some fund or sovereign become a problem that will draw on that facility any day.

The short answer is yes. If we see liquidity begin to increase again, liquidity sensitive asset prices like tech, innovation and meme stocks will rebound. The caveat is such a rebound is unlikely without a liquidity infusion. Thanks to a subscriber for this report from Mike Wilson at Morgan Stanley. Here is a section:

The bottom line, we have high conviction that Chair Powell and the Fed are very focused on getting off the zero bound this week and moving forward with more rate hikes as fast as possible to fight inflation. With the war posing a new threat to demand, we think the Fed will keep a watchful eye on the data but err on the side of hawkishness given the state of inflation is now arguably out of control. This likely means a collision with equity markets this spring with valuations overshooting to the downside. Using our equity risk premium (ERP) framework, we have been suggesting 18x NTM EPS is "fair value" based on a 10-year Treasury yield of 2.1% and an ERP of 350bps. However, with this new exogenous shock, and much higher volatility, the ERP appears too low at the moment and could easily overshoot to the upside by ~100bps. Using such an adjustment yields a P/E closer to 15x which suggests an S&P 500 of 3500 assuming earnings don't take a hit. Given the closing price of 4200 on Friday, the risk/reward remains poor over the next several months.

If the market believes the Fed is serious about more than one or two hikes, a full reversion back towards the 1000-day MA.

Back to top