Email of the day on holding gold miners

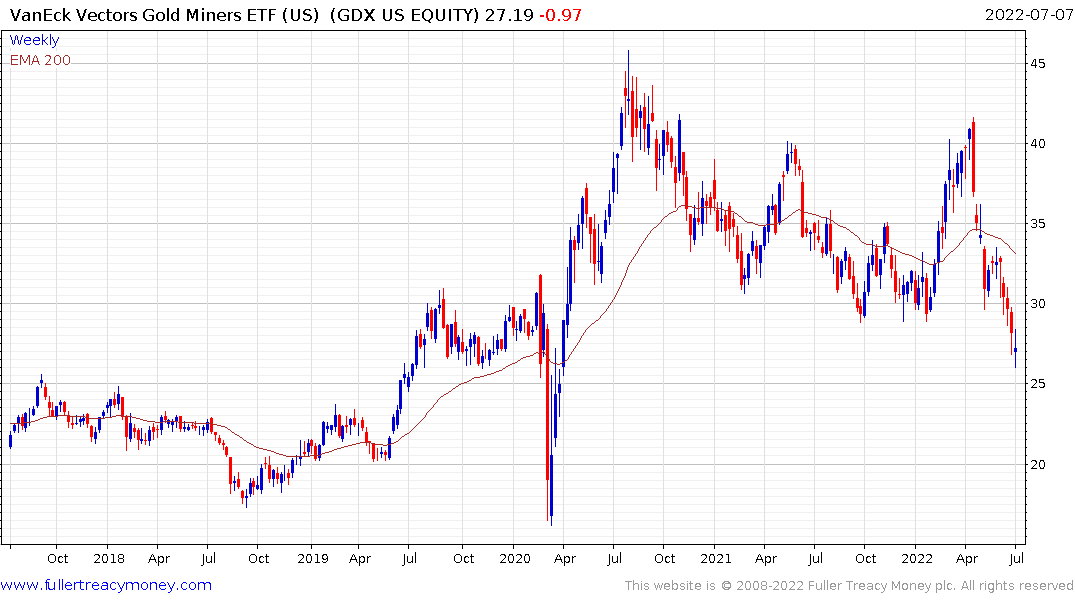

Eoin, what is the rationale for continuing to own GDX when it has cracked through the $30 mark which you have been very confident about holding, and you have now sold Gold? If Gold is going lower still, GDX is going to go with it, likely with higher beta. I am left with GDX which has been a horror show, now down 40% in just a couple of months, and pondering what to do with it.

Thanks for this question which I’m sure others are asking. I was hopeful the $30 area would hold because it is the upper side of the base formation. Unfortunately, the market doesn’t listen to what I think. Life would be a lot easier if it did. I bought my initial position during the pandemic panic of 2020 because I thought it was a no brainer. That was the correct instinct but my second purchase was completed at too high a level, so now my total position is now about break even.

I closed my leveraged gold and silver longs because they were eating into my trading profits for the year. I continue to hold my unleveraged long in GDX because I don’t think this weakness is going to last for all that long. If gold shares have a significant shakeout I will buy more. I value the opportunity to lower my cost basis.

During the credit crisis of 2008, the USA abandoned the practice of responsibly managing the supply of Dollars. That challenged the faith of global investors in the USA willingness to manage the global reserve currency responsibly. During the pandemic, the flagrant abuse of the money printing machine was an even bigger challenge to the idea of the Dollar as a store of value.

Now the Fed has no choice but to raise rates and withdraw supply because inflation is out of control and their credibility is in tatters. To do otherwise would be to cede responsibility for managing the world’s most accepted store of value to another country.

We are therefore in a period of competitive currency appreciation with the USA asserting dominance over upstart currency regimes like the Ruble and the Renminbi. That fact gold has held up for so long against the Dollar is a testament to the fact it the most reliable store of value and is outperforming most other currencies.

Ultimately, the Fed will need to make a decision about whether to priortise maximum employment and growth or the sanctity of the reserve currency. That won’t be until unemployment becomes problematic. They are free to continue to tighten policy until jobless numbers start making negative headlines. The data is heavily skewed by the pandemic but 250,000 was the big psychological level before the 2020 spike. It is currently at 235,000 and trending higher. That suggests we may see an easing back on aggressive rate hikes by September.

The debt market has not just gone away. Getting control of inflation to placate investors is the current priority. Rescuing the economy and promoting growth will return with QE. Currency debasement will follow. At that point I expect gold to rebound and hit new all-time highs.