Email of the day on historical cyclically adjusted valuation metrics

Just wondering, would you know of reputable data providers for graphs of cyclically-adjusted PER, cyclically-adjusted P/BVPS, cyclically-adjusted DY for equity indices and individual equities? Preferably if the service is free/cheap and dependable ; but ok if paid too. I know of www.multpl.com (free) for the PER of S&P500. Regards.

Thank you for this question. Bloomberg does not carry cyclically adjusted valuation measures so we do not have access to them. A number of third party sources calculate these measures independently and each has its own idiosyncrasies in how they compute the level. Multipl.com is a great resource for the USA both for CAPE and historic Treasury yields.

German based Star Capital is the best source of CAPE, P/E, Price / Cash, Price / Book, Price / Sales and Dividend Yield for individual countries I know of. They also present the data is a very attractive easy-to-use format.

If you take a look at the valuations they present then a number of Eastern European markets stick out.

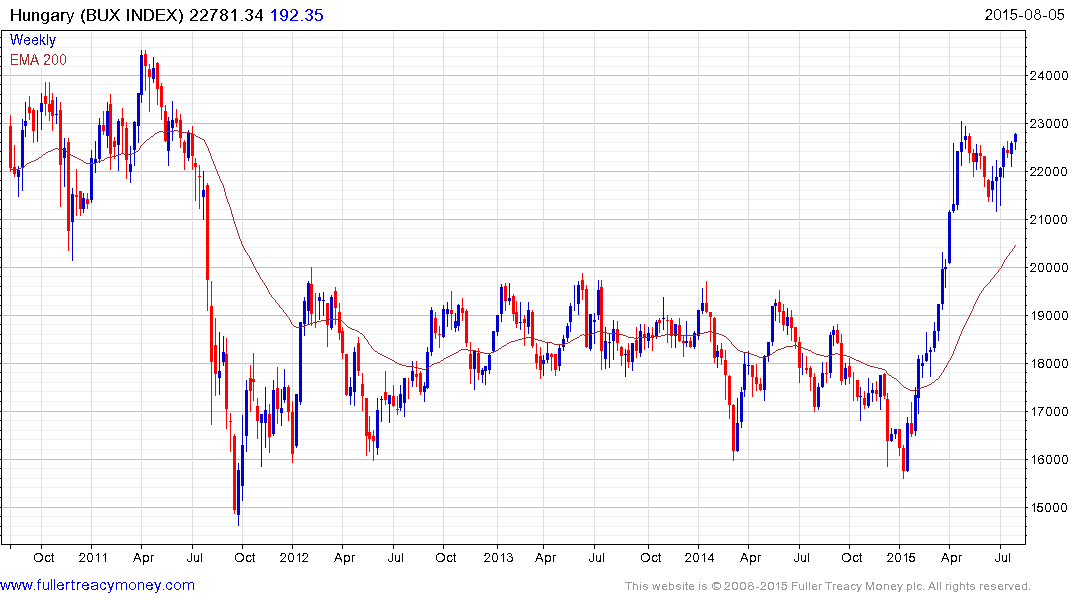

Hungary broke out of a three-year range in March, spent much of the last three months consolidating and is now back testing its highs.

Czech Republic is testing the upper side of a four-year base and a sustained move above 1050 would confirm a return to medium-term demand dominance.

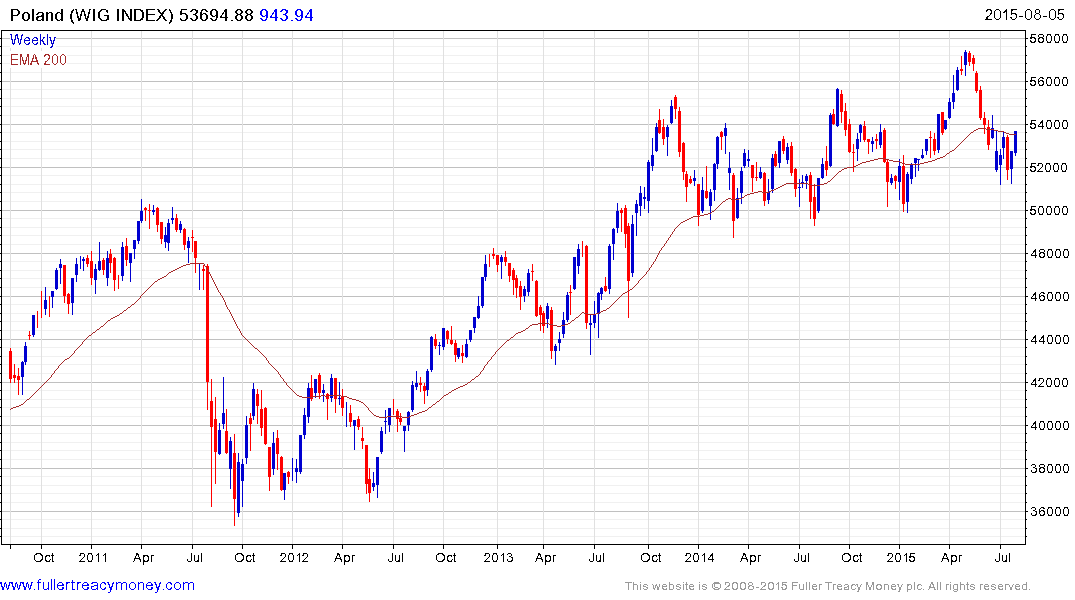

Poland has been ranging for two years and is rallying having confirmed at least short-term support in the region of 51500.