Email of the day on gold share benchmarks

Here's a link to an educative article by Adam Hamilton - an explanation and comparison of the gold benchmarks, HUI and GDX. I thought it might be of interest to subscribers: Warm regards and great appreciation to you and David for all you do.

Thank you for your kind words and the link to a history of gold share benchmark indices. The financial repression referred to in my first piece above, where governments are creating a ready market for their paper harks back to a time when gold was considered a powerful hedge against too much government interference in one’s financial affairs. Here is a section on some of the primary differences between the GDX and HUI:

A big advantage GDX has over the HUI is its component list is actively managed by expert analysts. So while HUI component changes are rare to nonexistent, GDX's are constantly being shuffled around. I see this on a quarterly basis as I analyze the top GDX component stocks' quarterly operating results. There's no doubt GDX is a more-accurate ongoing reflection of this dynamic sector than the static HUI.

But GDX has other disadvantages in addition to extreme over-diversification. By virtue of including so many stocks in such a small sector, GDX also has to include plenty of primary silver miners. While their stocks generally mirror gold-stock action, the substantial silver weighting among GDX's top components makes it more of a precious-metals-stock benchmark than the pure gold-stock one it is often advertised as.

For many contrarian investors gold stocks and silver stocks are synonymous and interchangeable, they own both. While gold price action overwhelmingly drives silver, occasionally silver disconnects from gold and its miners' stocks follow. Such divergences weaken GDX's gold-stock tracking, and I've heard from plenty of investors not happy their "gold-stock ETF" also includes most of the major silver miners as well.

The HUI on the other hand is a pure gold-stock benchmark, including no silver miners that dilute its core mission. Ideally gold-stock benchmarks should only include primary gold miners since that's what they are supposed to track. Silver stocks can go into other silver-stock ETFs. This separation helps investors more easily tailor their specific gold and silver exposure via their respective miners exactly how they want it.

The fact that despite their differences the Gold BUGS Index and the Market Vectors Gold Miners ETF have very similar performances highlights how much commonality there has been in the gold mining sector. Almost every share has done well which is a testament to how much rationalisation went on within the sector ahead of precious metals bottoming.

The Market Vectors Gold Miners ETF has held a progression of higher reaction lows since January and moved to a new recovery high yesterday to reassert the seven-month uptrend. A sustained move below $28 would now be required to question uptrend consistency.

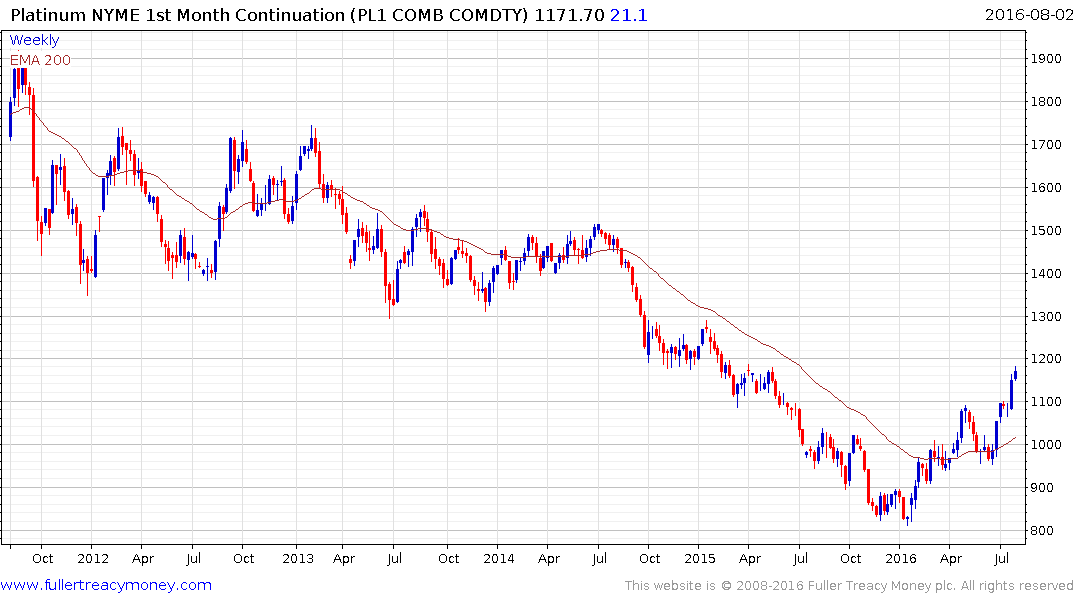

Platinum broke out to new highs last week and gold is rallying towards the upper side of its short-term range. There is a high probability that gold shares and platinum are leading the gold price higher.