Email of the day on gold and overextensions relative to the trend mean

While trying to figure out if silver and gold have finished their current decline I decided to assess the size of the drawdown relative to 200-day SMA. Silver has a consistent pattern, in the last three years the difference between the price at the trough during the largest drawdowns and the reading of MA the same day was about $2. The current one even has a bit larger difference of $2.1 with the low of $14.33 and MA of $16.43.

Gold's pattern is less consistent, from $105 (in late 2015) to $153 (in late 2016) in the last four years, with the latest drawdown of $133: the price of $1140 at the trough with 200-day MA at about $1293 the same day.

In your opinion, do these calculations have any relevance? I just thought they can show the "size" of patience (or impatience) of investors before they begin to leave the market (sellers), enter it (buyers) or reverse their short positions into longs.

Your thoughts will be very much appreciated.

I received this email from a subscriber on the 17th which was very prescient but it turned up in my junk folder so I’m afraid I missed it. However, I believe it is well worth publishing now nonetheless.

When there is consistency in the overextension relative to the trend mean present in a price series, yes, I believe it is important to pay attention to because as you say it gives us a window into how the ebb and flow of supply and demand is evolving.

Gold has bounced over the last week and is now testing the first area of resistance, represented by the four-month progression of lower rally highs. It needs to hold the move above $1200 if a further reversion towards the mean is to be given the benefit of the doubt.

.png)

Silver’s rally has so far been limited to an equal sized bounce compared to other ranges within the downtrend since June. It needs to sustain a move above $15 to break that sequence of ranges one below another.

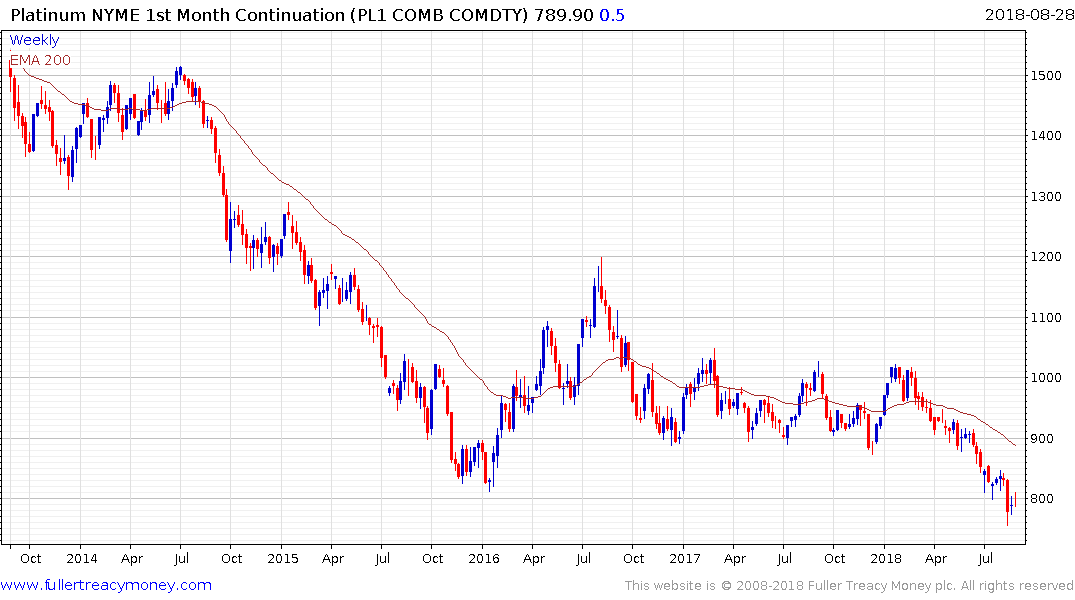

Platinum is back testing the $800, representing the lower side of the overhead trading range. It needs to sustain a move above that level to signal a failed downside break and to pressure shorts.

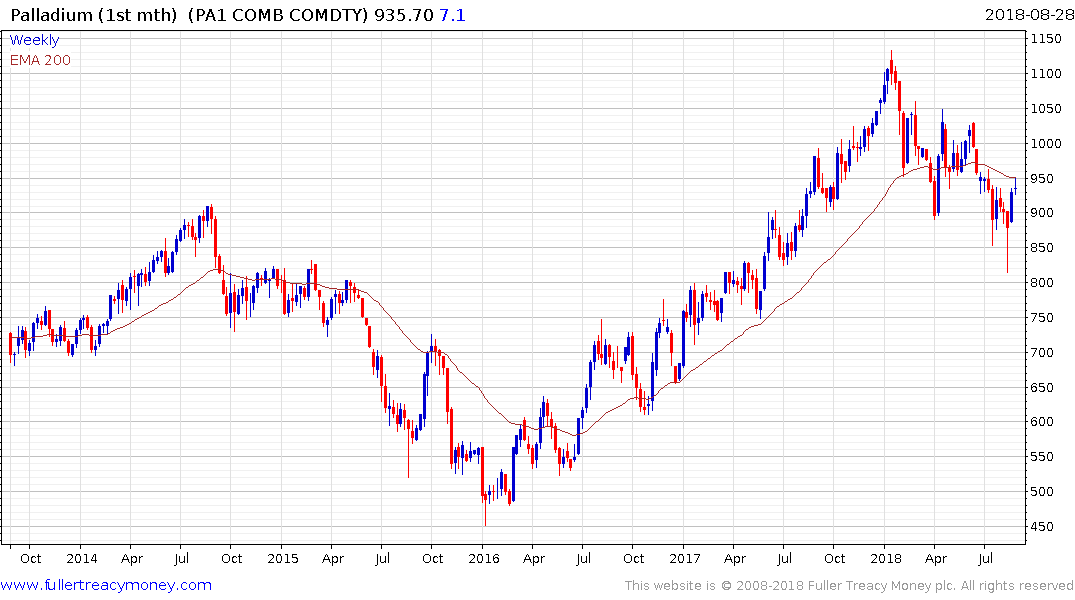

Palladium remains the clear outperformer within the precious metals sector and has now rallied to close its overextension relative to the trend mean. A short-term oversold condition has been replaced by a short-term overbought condition and it will need to hold the mid-August low to confirm a return to more than short-term demand dominance.