Email of the day on gold and fighting the Fed

Thursday's article, “Gold Plunges the most in Four Weeks…” is greatly appreciated. Despite all the uncertainties and volatility of the past two months you report that you have retained your gold investments and are looking forward to “increase [your] position”. You express even more confidence in silver.

The attached St Louis Fed Chart showing an accelerating measure of inflation provides good evidence to support your position, long term, but long-term charts, both weekly and monthly show gold is still over-extended.

If “fighting The Fed” is to be avoided, a bullish gold position may be a courageous act when the world’s central banks will be united in their determination to frustrate gold investors. There may have been some evidence of that last year. Also, since silver prices are more easily manipulated, that market seems to be more vulnerable to a combined central bank manoeuvre?

Common sense says that the present world-wide, money creation will end in disaster. In that situation, precious metals are a safe haven but, in the short term, and even the medium term, risks in those markets appear to be very high. A prudent plan to cover both outcomes seems desirable. That plan should, perhaps, also incorporate different allocations to gold and silver. Further guidance by you would be invaluable.

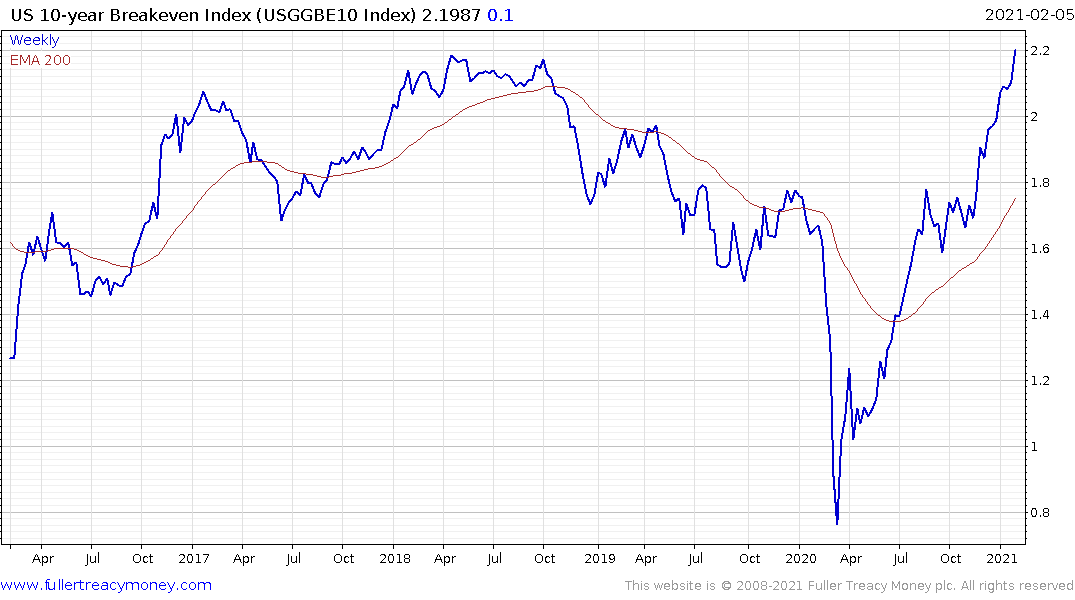

Thank you for this email. Fighting the Fed would be holding a gold position in a positive real interest rate environment where one can easily anticipate a positive return from other asset classes. That is not at all what we have at present. We could be looking at a negative real yield for years to come as central banks attempt to loot savings to pay off massive unfunded debts.

The primary challenge for gold investors is commodities tend to do best when stock markets are in secular bear markets and range more than trend. We are not there yet. The excess debt created, particularly in the USA over the last few years will make growth harder over the medium term. In the short-term, there is the prospect of full opening up as vaccines are rolled out. That could deliver a significant boost to consumption and spending over the next 12 months.

Gold is no longer overextended since it is now trading in the region of the trend mean, represented by the 200-day MA. However, it will need to break the six-month sequence of lower rally highs to confirm a return to demand dominance.

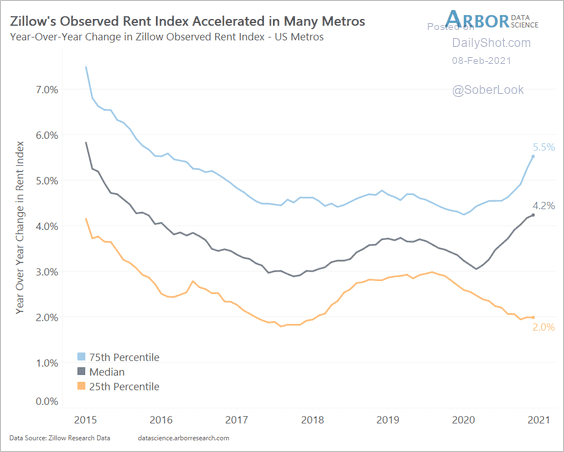

The Fed’s breakeven rate can be defined as the bond yield required to compensate you for inflationary pressures. Since rent is the biggest component of how the Fed measures inflation it is likely to continue to experience upward pressure.