Email of the day on global property prices

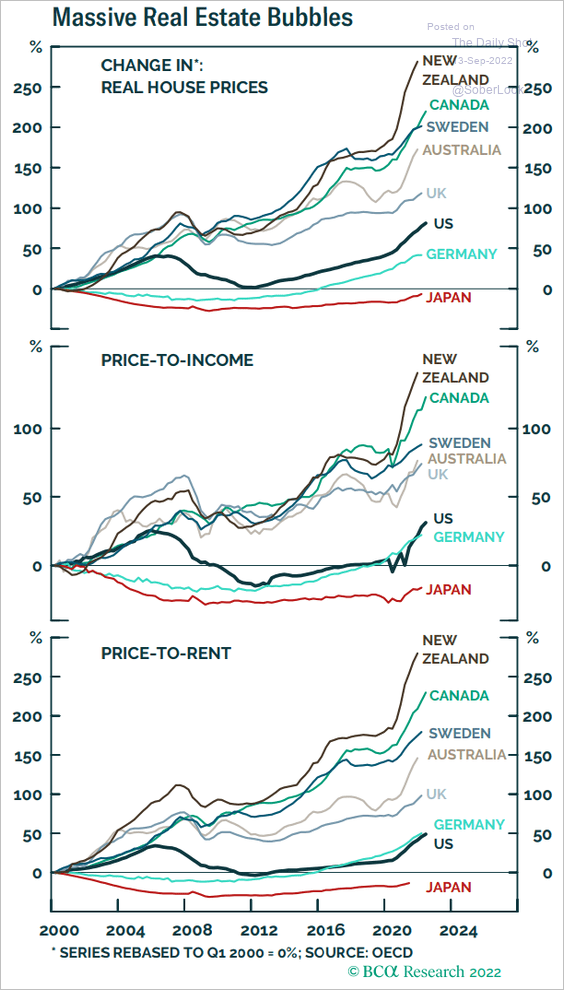

In the Big Picture Roundup, you shared this wonderful chart.

The problem is that the way that you shared it, means that we could not see the date axis.

It would be great if you could share a better version of this chart e.g., on Comment of the Day

Thank you in advance

Thank you for pointing this out. The aspect ratio between my monitor and the recording software is not always one to one. Here is the chart you were asking about.

What I like about this chart is it starts in 2000. It graphically illustrates that some property markets completely sidestepped the housing crash associated with the global financial crisis in 2008. These same markets, notably Australia, Canada, New Zealand and Sweden are expensive on a price/income and price/rent basis.

What I like about this chart is it starts in 2000. It graphically illustrates that some property markets completely sidestepped the housing crash associated with the global financial crisis in 2008. These same markets, notably Australia, Canada, New Zealand and Sweden are expensive on a price/income and price/rent basis.

These are about the only objective measures of affordability. When they are elevated, it suggests acute sensitivity to interest rates, liquidity and government support. Bond yields are rising in all of these markets so that is raising mortgage rates and putting pressure on prices.

Zillow was sending me push notifications on my phone for most of the last year telling me how much my house had appreciated in value. Now that the algorithm is going in the opposite direction (apparently my house lost $83,000 in value last month), I’m not getting that feel good factor anymore and the push notifications have stopped.

Zillow was sending me push notifications on my phone for most of the last year telling me how much my house had appreciated in value. Now that the algorithm is going in the opposite direction (apparently my house lost $83,000 in value last month), I’m not getting that feel good factor anymore and the push notifications have stopped.

Two issues immediately come to mind. The first is the central bank problem with the highest inflation in decades. Only the Bank of England has said they expect a recession. However, that’s because they are reduced to talking down inflation because of the potentially disastrous consequences of raising rates for adjustable-rate mortgages. Nevertheless, the threat is the same for all overleveraged markets and that includes much of the USA following the acceleration during the pandemic.

The second issue is commodities. Australia, New Zealand and Canada are major commodity exporters and Chinese demand softened the blow from the global financial crisis. Today, China’s demand is in question so it may be less of a support during a recession.

Adjusted for the weakness of their domestic currencies the S&P/NZX 50FG is trading lower in a consistent manner. The S&P/ASX 200 is testing its lows but is clearly trending downwards. The S&P/TSX is exhibiting relative strength but has a lot of work to do to repair the trend.