Email of the day on getting the bad news out on a Friday

Collapses of Large Banks on Fridays:

- Friday, Mar. 14, 2008: Bear Stearns hit by liquidity crisis

- Friday, Sept. 12, 2008: Last trading day before Lehman Brothers declares bankruptcy

- Friday, Sept. 26, 2008: Washington Mutual seized by regulators marking largest bank collapse in US history

- Friday, Mar. 10, 2023: SVB seized by regulators, marking 2nd biggest bank failure in US history

- Friday, Mar. 10, 2023: Signature Bank sees $10 billion in withdrawals, seized by regulators 2 days later

- Friday, Mar. 17, 2023: UBS bids for Credit Suisse, $CS, to avoid its collapse

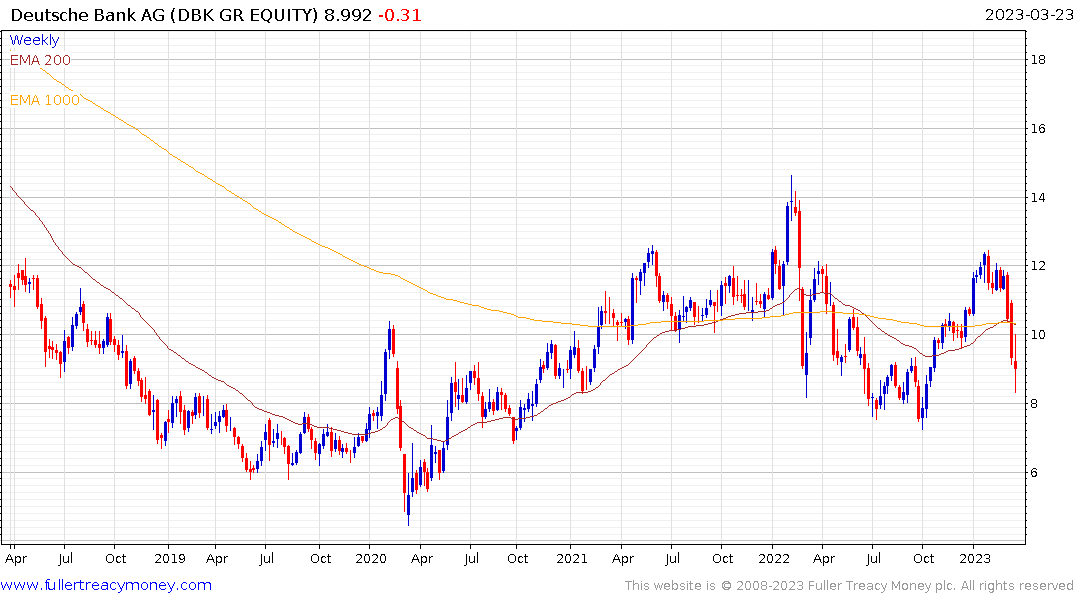

- Friday, Mar. 24, 2023: Deutsche Bank, $DB, credit default swaps hit 4-year high on contagion fears

Just about every large bank failure in recent history has occurred on a Friday.

This can't be a coincidence.

Giving regulators time to make an announcement over the weekend helps to avert market panic. That’s as good a reason as any to announce bad news as close to the market close as possible on a Friday.

Deutsche Bank is already partly nationalized. If this crisis proves too onerous it will be delisted by the German government. There is no reason to own the share and shorting is unlikely to be productive because of the possibility contracts will be voided.

Deutsche Bank is already partly nationalized. If this crisis proves too onerous it will be delisted by the German government. There is no reason to own the share and shorting is unlikely to be productive because of the possibility contracts will be voided.

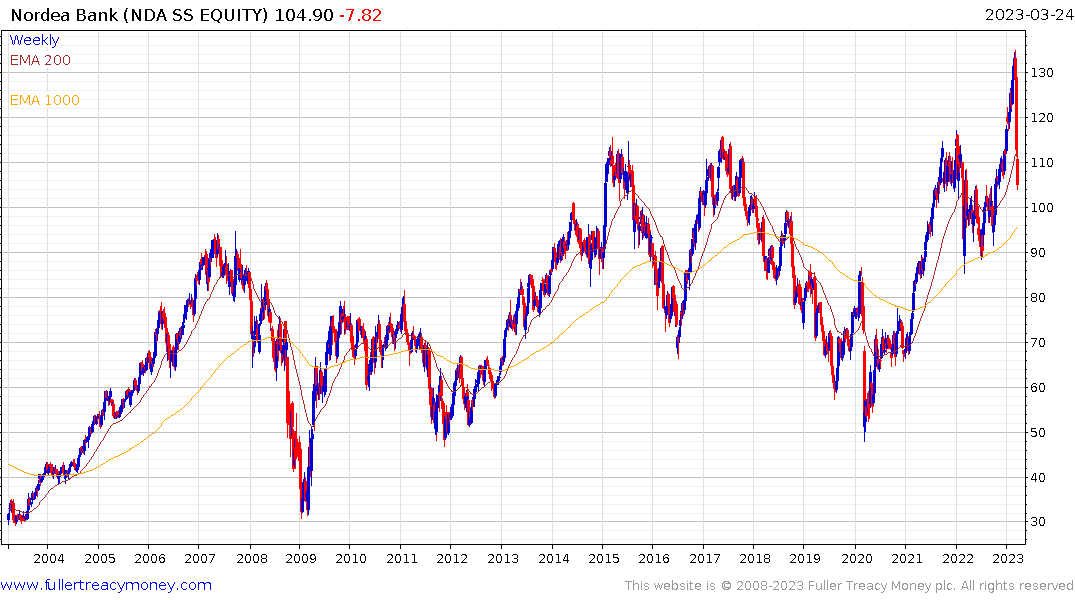

Nordea was at a new all-time high as recently as 3 weeks ago. The downside key reversal has followed through on the downside with a massive reaction against the prevailing trend. That’s a very large failed upside break and suggests the downside potential is a retest of the SEK70 area.

Nordea was at a new all-time high as recently as 3 weeks ago. The downside key reversal has followed through on the downside with a massive reaction against the prevailing trend. That’s a very large failed upside break and suggests the downside potential is a retest of the SEK70 area.

The move from negative yields to sharply positive yields is a drastic change of circumstances for European banks and insurance companies. As with the US banks, this is not an issue that will easily be solved.

Back to top