Email of the day on Friday's big picture long-term video and audio

Thank you for Friday’s weekly summary, especially the long excursus on technology

It is good from time to time to digress on the long term trends that are likely to influence markets in the future

The short term price action is important but your reflections on the technology developments are very much appreciated

Good work in the New Year!

And

Thank you so much for another nice long term audio last Friday. But you did not comment on precious metals, and gold mining companies. Could you kindly comment on these as well as the oil companies i.e. shell/Exxon etc. at your convenience. Tks again. And best wishes for the New Year to you and David.

Thank you both for your well wishes and I look forward to covering both the outlook for technology and precious metals in depth this year. Last Friday I intentionally decided to expound upon the case for technological innovation representing a powerfully bullish factor for both the global economy and the stock market over the coming decades.

To summarise there is the world of difference between innovation that creates convenience in discretionary expenditure versus necessary expenditure. The disintermediation associated with the evolution of the internet wiped out bookstores, record stores, travel agents and many resellers. Social media is a further iteration of the incursion of the digital economy into our lives. No one would argue that we have had a major boost in productivity resulting from being able to do business online but that is already largely priced in.

Change in the healthcare and energy sectors can have profound consequences because they represent necessary spending. Our entire economy is based on ready access to abundant energy at a reasonable cost. Every one of us has a vested interest in living as long and healthy a life as possible and as a result healthcare is not a discretionary expenditure either. Anything that reduces the price of either energy or healthcare frees up capital for spending and boosts economic growth.

Over the next decades we can expect profound change in both. Energy storage innovation might be slow but it is inexorable and every improvement has a multiplier effect for the rest of the energy sector. Solar is increasingly competitive with coal in sunny climates and is likely to represent an ever larger proportion of the energy mix; aided by industrial batteries. Electric cars are obvious beneficiaries of advances in battery technology.

Genetic editing and understanding is blossoming and this is going to have profound implications for the healthcare sector. The cost of developing new blockbuster drugs has ballooned while the relative cost of creating individualised genetically based solutions is trending exponentially lower. It is reasonable to expect that at some point in the next decade the industry will reach a tipping point where it will simply be cheaper to create individual solutions than broad based ones. None of that will be possible without big data and artificial intelligence. It is the concurrent growth of both these sectors that is fuelling evolution in healthcare.

It couldn’t be happening at a better time because as a society we need lower healthcare costs. We need everyone working at their best for as long as possible if the pension obligations and debt overhangs are ever going to be met and even then a good deal of inflation will be required.

Gold does best when inflation is rising faster than interest rates. That hasn’t been the case recently and it has knocked prices bank quite significantly. This time last year gold was depressed after an almost five-year downtrend and it staged an impressive rebound before hitting a medium-term peak near $1400. The decline since early December has seen prices accelerate lower, giving up much of last year’s advance in the process, and a short-term oversold condition is now evident.

Potential for a reversionary rally has increased and trading action last week suggests that might now be underway.

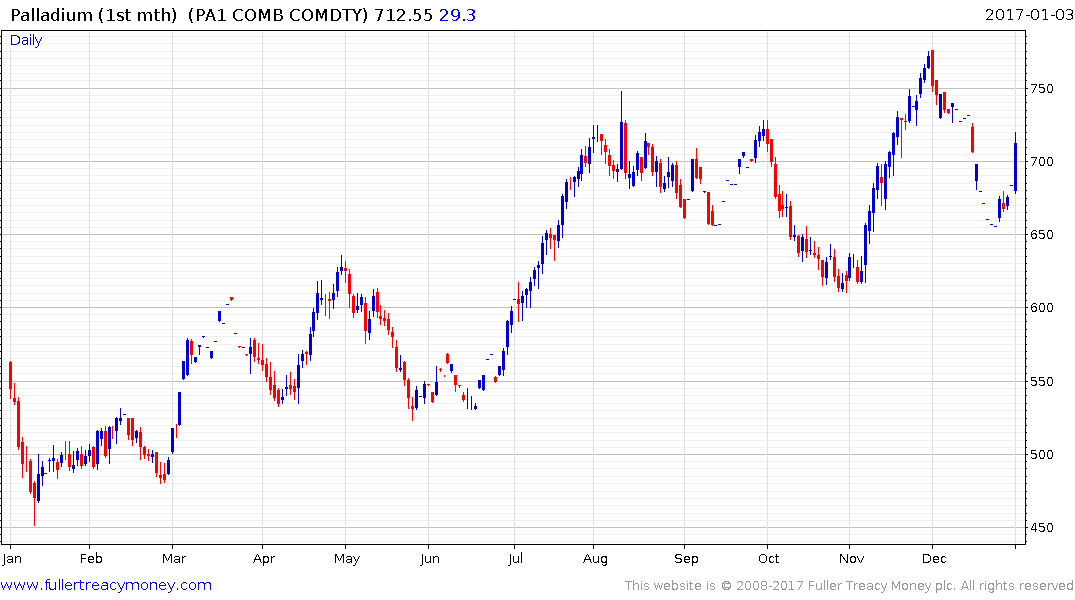

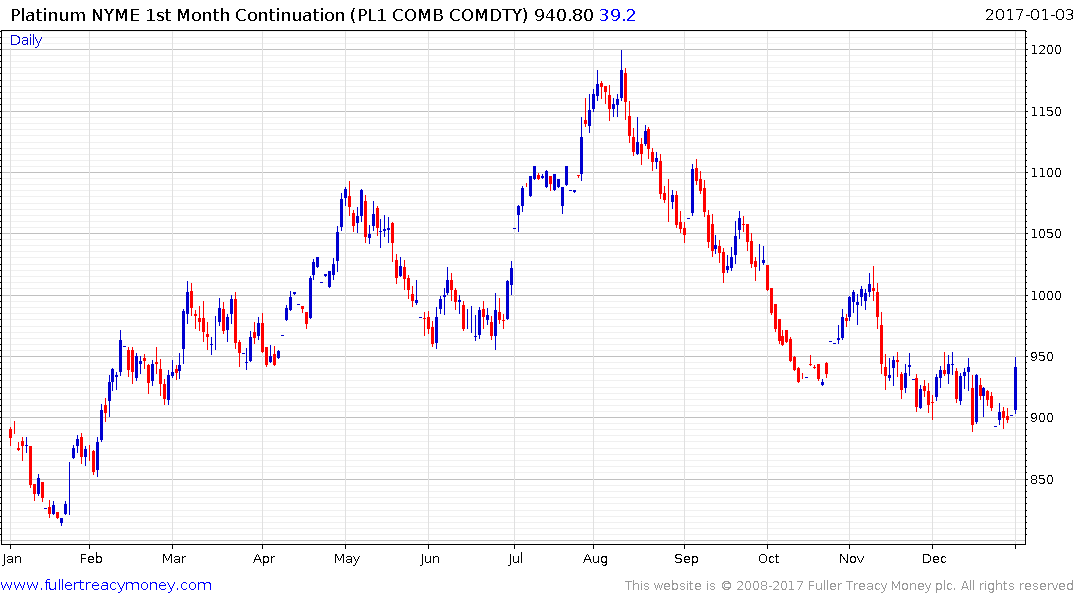

Upward dynamics today on platinum, palladium and silver support the view a reversionary rally is beginning.

Gold shares, represented by the NYSE Arca Gold Bugs Index, have now broken the five-month progression of lower really highs and a sustained move below 175 would be required to question potential for an additional rally.

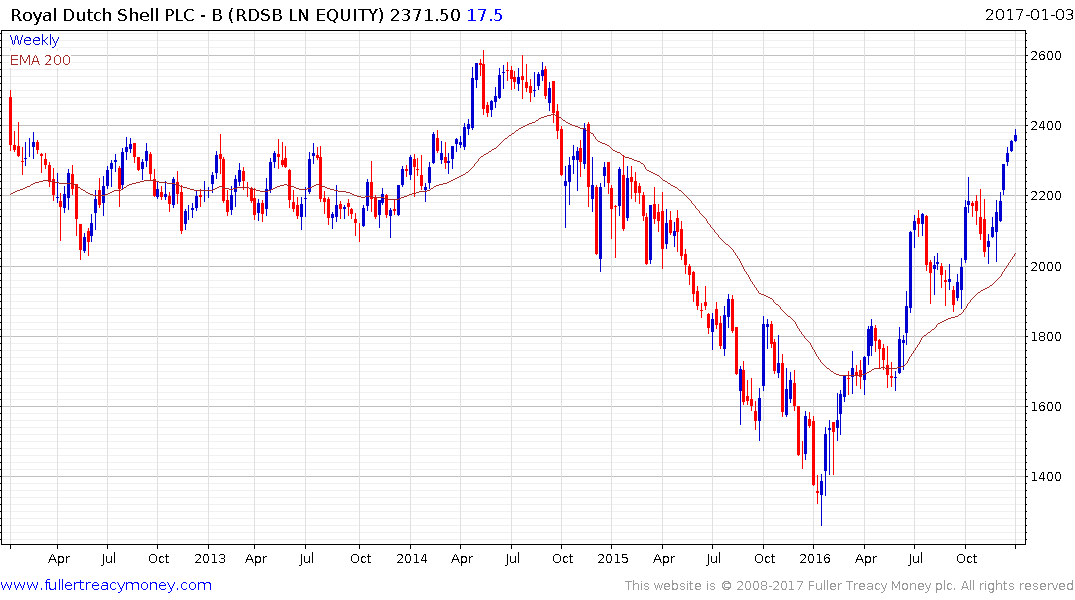

Meanwhile the downside key day reversal on oil today suggests the risk a reaction and consolidation of recent gains is an increasing possibility for related shares such as Royal Dutch Shell and Exxon Mobil.