Email of the day on filtering the FTSE-100

Is the chart filter working? if so, how do I use it? I recall a long time ago using it and (focusing on FTSE 100 shares), getting a variety of tables, comparing 1 week to 1 month performance. or 1 month to 3 month performance, and so on. I no longer know how to use it.

Thank you for this question and here is link to the tutorial I created when we relaunched the filter system in May.

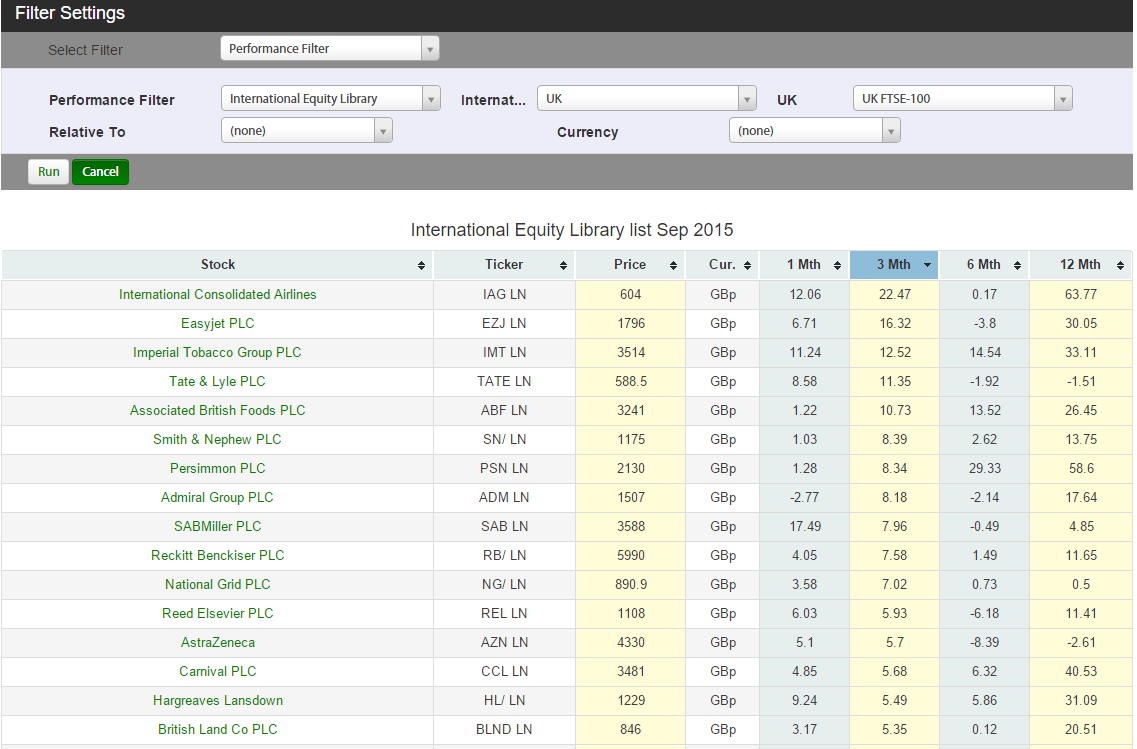

The Filter system is processional so that once you make a selection additional relevant options become available. Here is a set of steps to complete a Performance Filter of the FTSE-100.

Click on the Filter button, located to the right of the Search button in the black bar towards the top of the page.

Select “International Equity Library” from the Performance Filter drop down menu.

Select “UK” from the next menu that appears

Select FTSE-100 from the next menu.

Click on Run.

Your results should look like this:

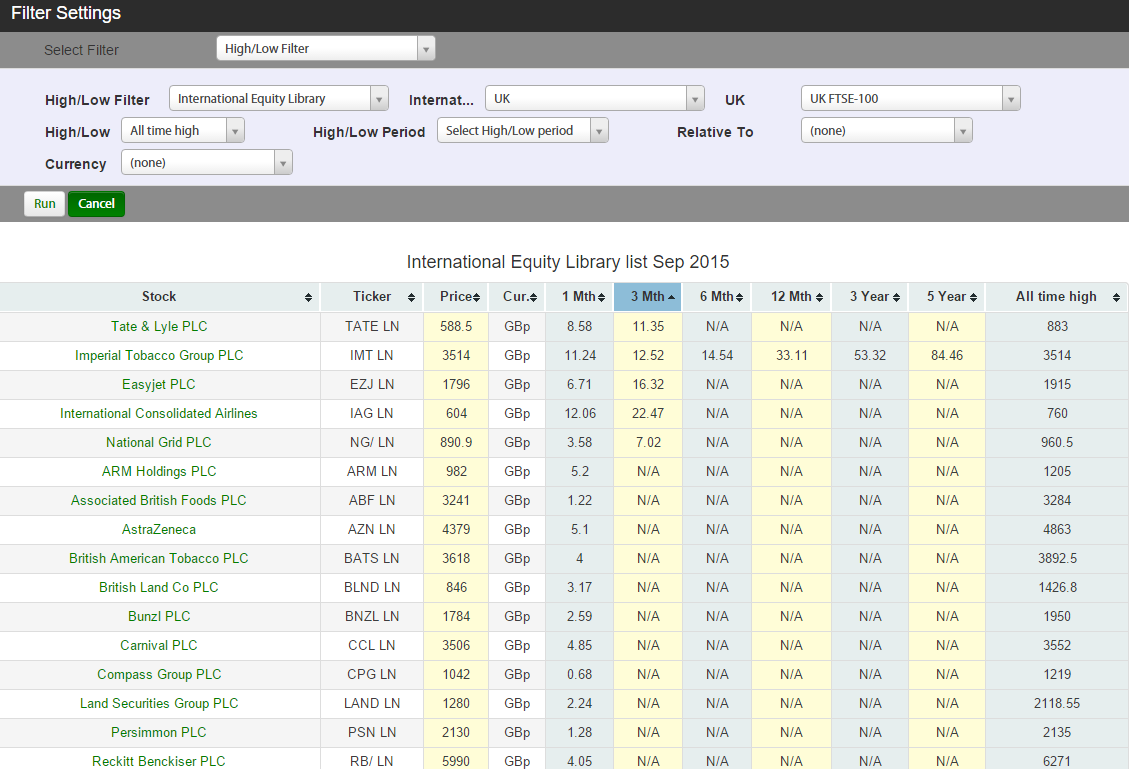

You can follow the exact same set of steps to complete a High/Low Filter. Here is what your results would look like.

You can follow the exact same set of steps to complete a High/Low Filter. Here is what your results would look like.

Since both lists are quite similar we can conclude that not only are a relatively small number of companies making new three-month highs but they have also been among the best performers over the last three months.

Since both lists are quite similar we can conclude that not only are a relatively small number of companies making new three-month highs but they have also been among the best performers over the last three months.

This is a further sign of the narrowing of market breadth that has been in evidence for the last few months.

International Consolidated Airlines and Easyjet remain in reasonably consistent medium-term uptrends and continue to benefit from the relatively low cost of energy.

Tate&Lyle has been trending lower for more than two years. It has rallied over the last month to test the region of the 200-day MA and the medium-term progression of lower rally highs. However it will need to sustain a move above 800p to begin to suggest a return to demand dominance beyond a mean reversionary rally.

While Tate & Lyle sold out of its sugar operations a number of years ago, I was prompted to look at German listed Suedzucker which shares the commodity’s medium-term progression of lower rally highs. Sugar has a good day on Friday and a sustained move above the MA would signal a return to demand dominance beyond short-term steadying.

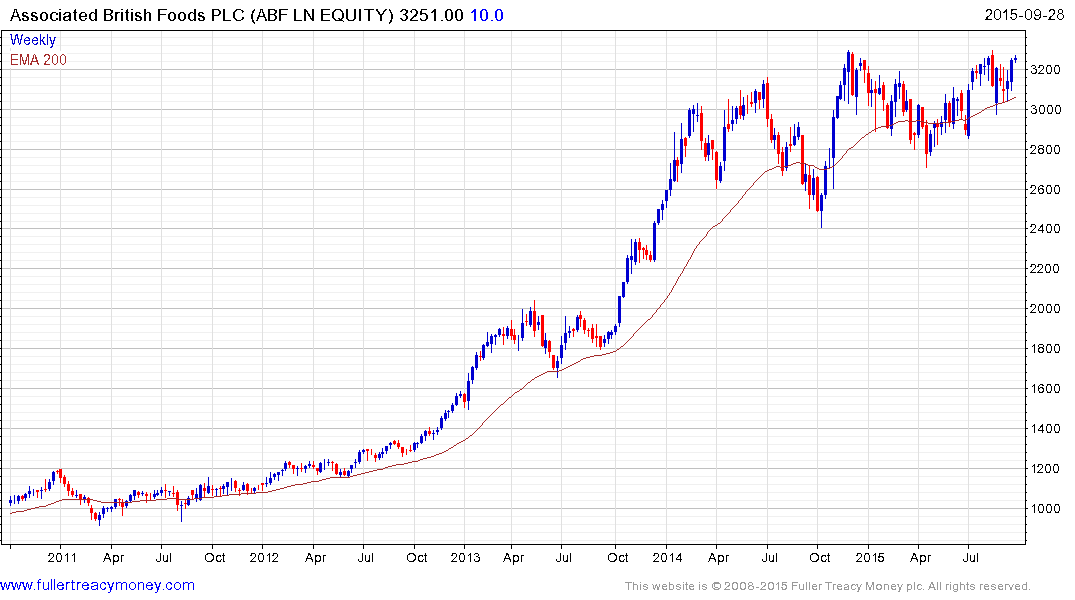

Associated British Foods is still trading on an estimated P/E of 33 and is testing the upper side of a yearlong range. A sustained move below the trend mean would be required to question medium-term upside potential.