Email of the day on European banks

Hope you are enjoying a well-earned Christmas break with lots of gourmet eating!

I have a very simple question. What happens to the Euro banking index if Deutsche Bank gets nationalised?

Thank you for the well wishes. We enjoyed an eclectic mix of fare on Christmas Day foregoing a bird in favour of a 5lb lobster cooked Cantonese Style and complimented with a honey glazed ham. We washed it all down with Fortnum and Mason’s English Mint Tea which I can’t recommend highly enough. This was a landmark year for the family since my ten-year old has finally developed a taste for Mahjong so we had the requisite four to play for hours after dinner to much shouting, laughter and banter.

It hasn’t exactly been festive for Deutsche Bank investors as the share continues to deteriorate. I believe it’s likely Deutsche Bank will be nationalised however it now represents only 3% of the Euro STOXX Banks Index’s market cap. The move will undoubtedly be deleterious for sentiment but will also remove one of the sector’s weakest members.

The nature of market cap weighted indices, however, means the lower the price of a major constituent goes the less impact it has on the Index’s price. The much bigger issue is how Deutsche Banks massive derivative position would be handled in the event of a nationalisation.

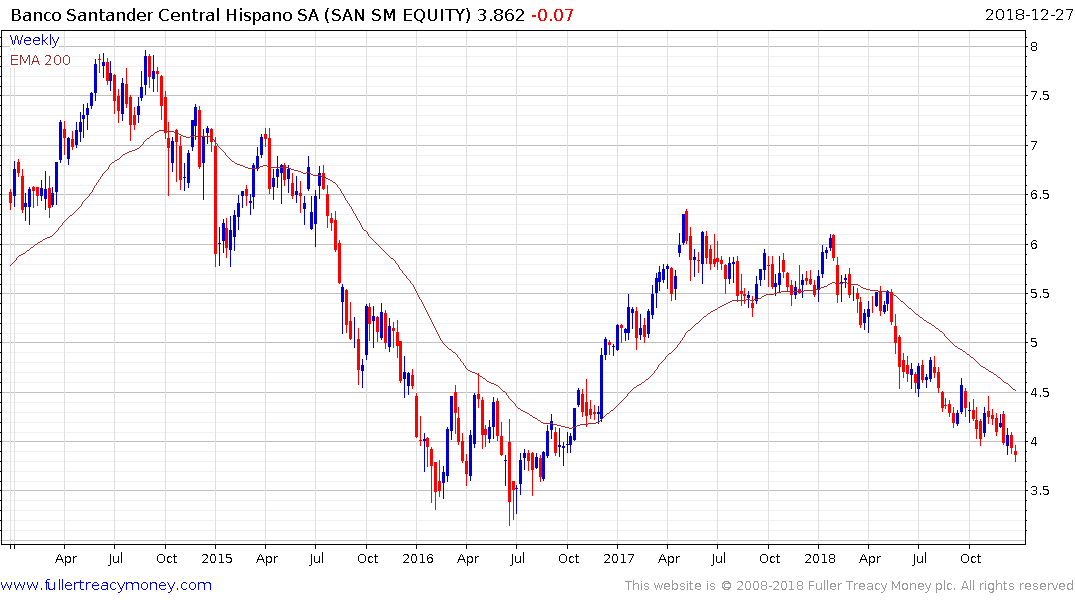

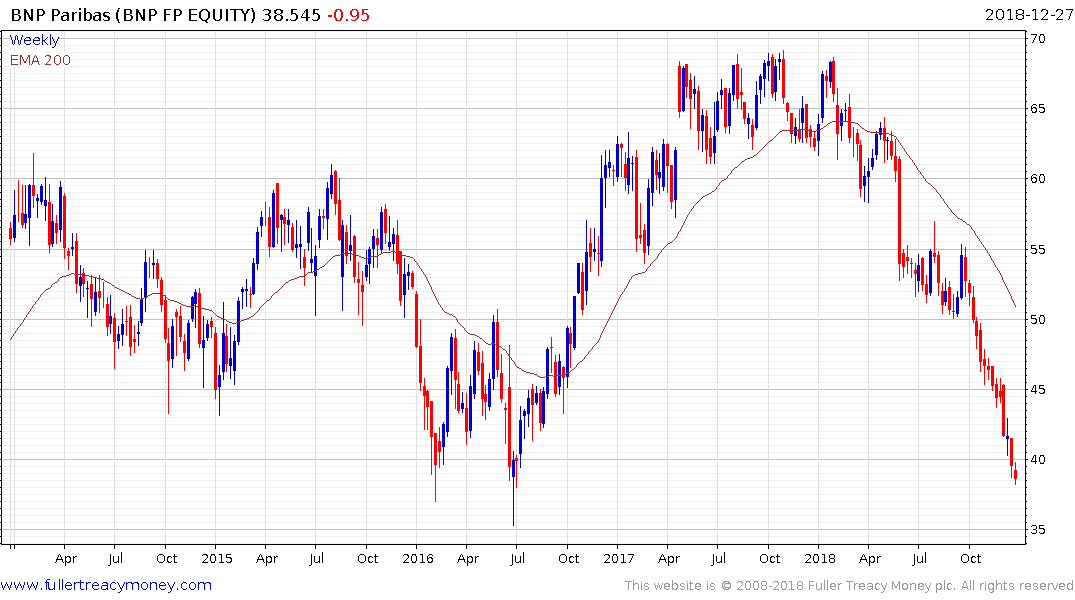

Banco Santander and BNP Paribas are the two largest weightings in the Index and both are accelerating lower. The commonality both within Europe and globally in the underperformance of banks is a clear sign of removal of liquidity is resulting in tightening credit which is a particular problem for banks.