Email of the day on emerging market potential

Hello Eoin, In today's Financial Times it is stated that the IMF is concerned about the risks of debt defaults by emerging market companies and states. How does this bring into question the flow of stock market investments in these countries in recent months?

Thank you for this question which is certainly topical. Countries like Ghana, Egypt, Pakistan, Lebanon, and Turkey experienced significant stress in their respective debt markets over the last 12 months. The unfolding drama with Adani group in India is an additional sign that global liquidity conditions are tightening. I think it reasonable to assume the flow of money into “emerging markets” is either bargain hunting or avoiding some of these destinations.

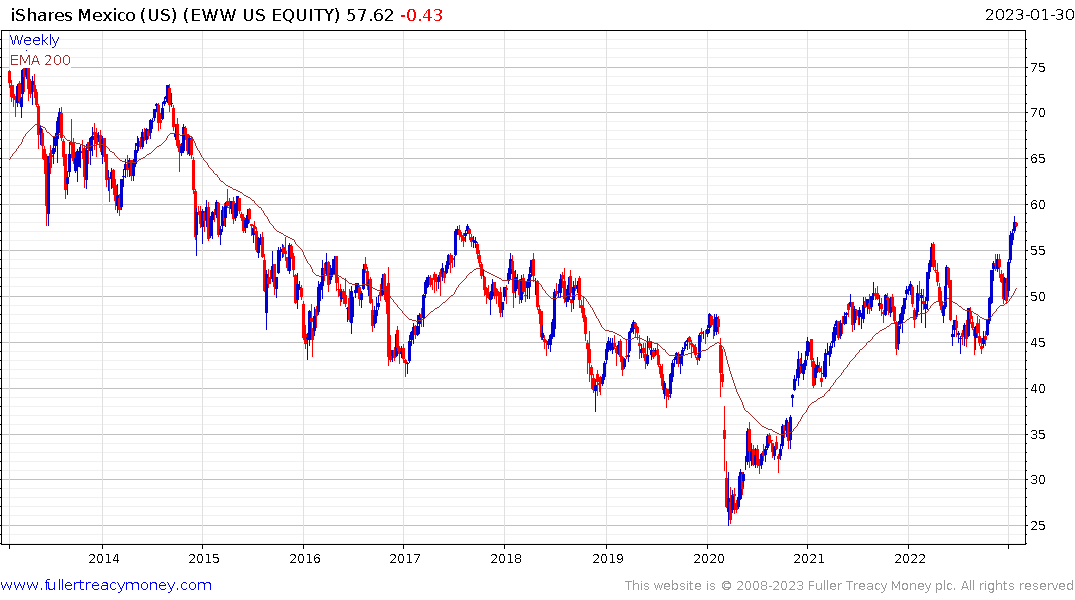

The iShares MSCI Mexico ETF broke out to new seven-year highs last week. It’s a little overbought in the short-term but that is significant relative strength.

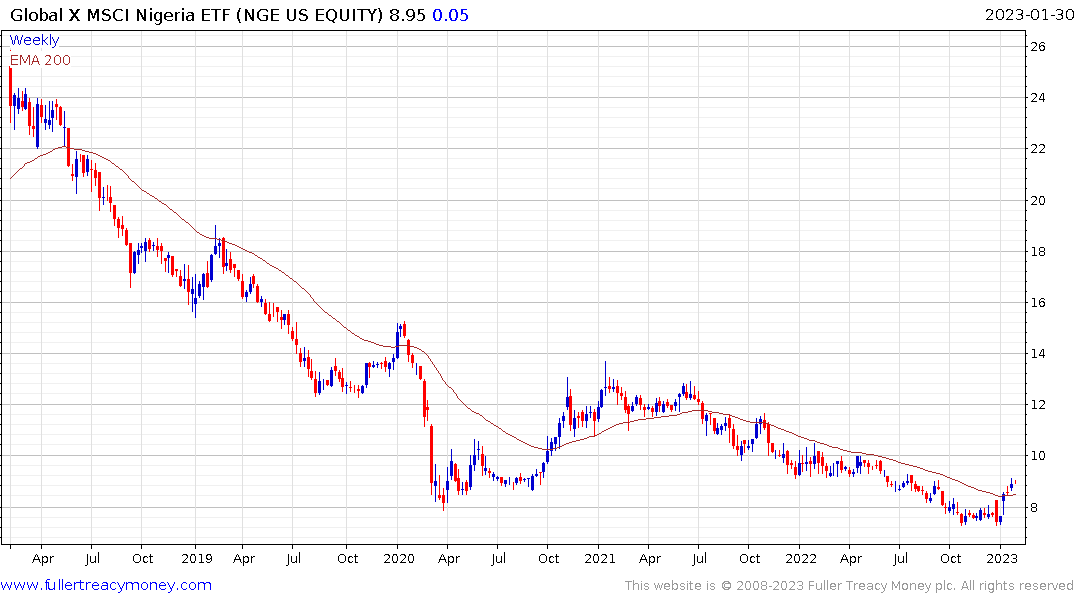

The Global X MSCI Nigeria ETF rallied from the beginning of January to break a two-year downtrend. Some consolidation also looks likely here but that is a significant rebound from a depressed level.

The Global X MSCI Nigeria ETF rallied from the beginning of January to break a two-year downtrend. Some consolidation also looks likely here but that is a significant rebound from a depressed level.

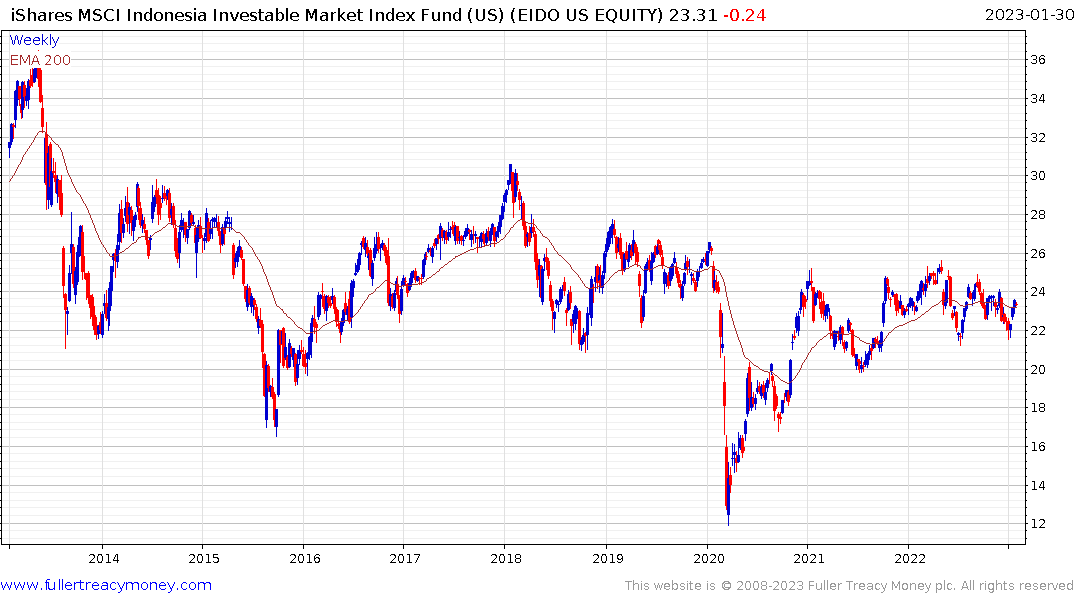

The iShares MSCI Indonesia ETF continues to range below the psychological $25 area. A sustained move above that level would confirm a return to medium-term demand dominance.

The Aberdeen New India Trust has not been immune from the angst over Adani Group’s debt and is back testing the region of the 1000-day MA.

The Aberdeen New India Trust has not been immune from the angst over Adani Group’s debt and is back testing the region of the 1000-day MA.

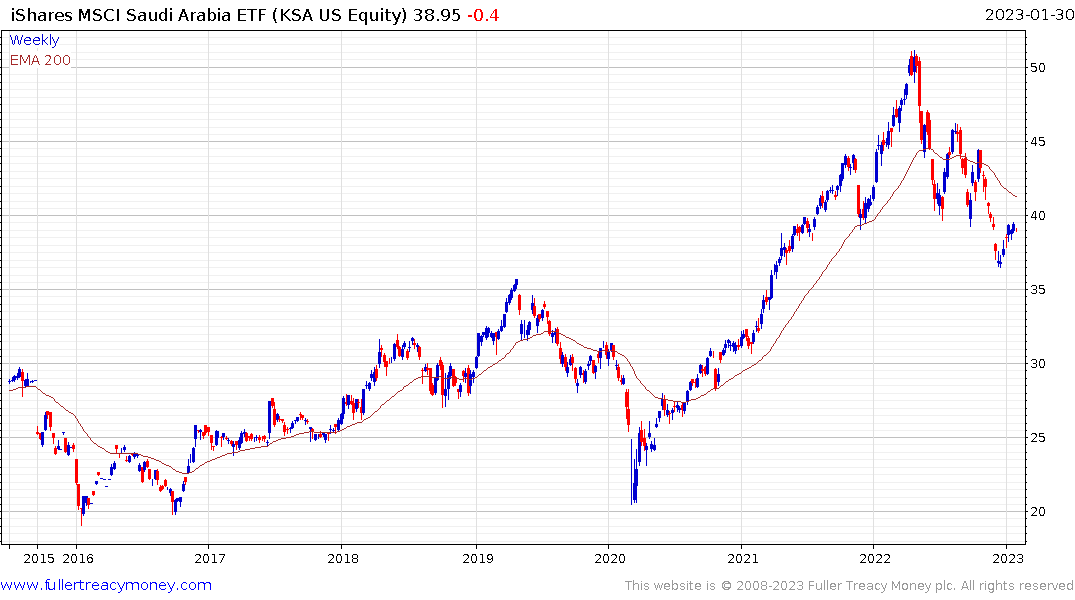

The iShares Saudi Arabia ETF continues to steady in the region of the 1000-day MA.

The iShares Saudi Arabia ETF continues to steady in the region of the 1000-day MA.

The China Fund Inc has rebounded emphatically to break a two-year downtrend but is short-term overbought at present.

The China Fund Inc has rebounded emphatically to break a two-year downtrend but is short-term overbought at present.

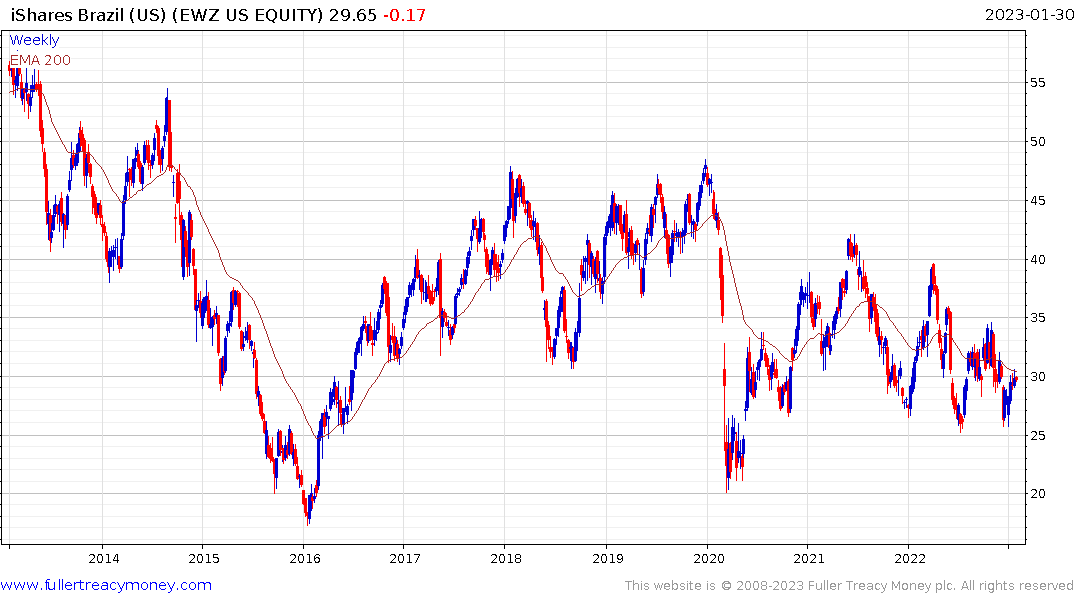

The iShares MSCI Brazil ETF continues to rebound from the lower side of a yearlong range.

Dollar weakness is a much more important consideration for emerging markets than current debt issues in my view.

Dollar weakness is a much more important consideration for emerging markets than current debt issues in my view.