Email of the day on electricity costs over the next two years

I enjoy reading and listening to Mr. Treacy commentary which helps me in a number of facets of my financial decisions (I live in the UK).

Mr. Treacy has recently been commenting on commodity pricing easing as one of the by-products of early onset recession.

I have been wrestling whether to fix my electric and gas rate with current provider for 2 years (which is 52% higher than current price). Whilst pundits are predicting 65%+ rate rises Mr. Treacy’s comments suggest otherwise (commodities easing).

I would be interested in Mr. Treacy view on this matter.

Thank you for this question. It is a sign of the times that the savings from successfully deciding on what electricity plan to sign up for could pay for a subscription to this service.

I had an opportunity to fix my electricity rate at last year’s level for two years at the end of March. I took it. The alternative was for the price to jump 50% percent and the company was only offering two or three-year contracts. Most of the other providers were doing the same.

The UK has North Sea gas, pipeline access to Europe and three LNG import facilities. However, the UK only has capacity to store 1% of annual consumption. That’s heavy exposure to just in time inventory management. There are discussions underway about temporarily reopening the Rough facility, which has capacity to store about a week’s worth of demand. However, even that is a stop gap measure.

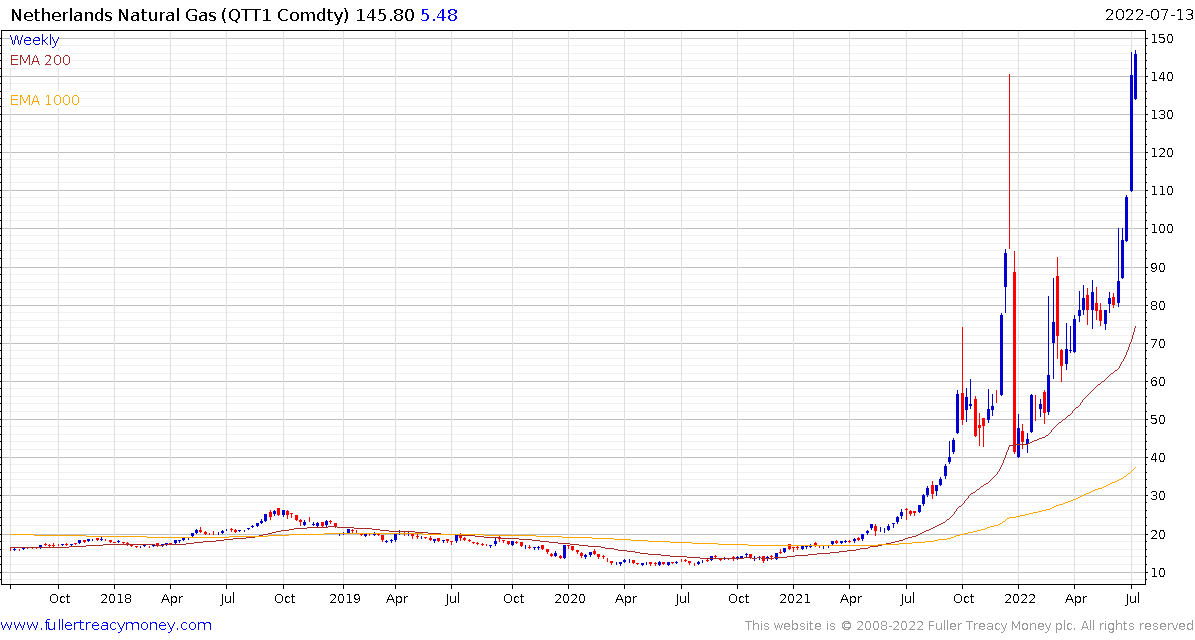

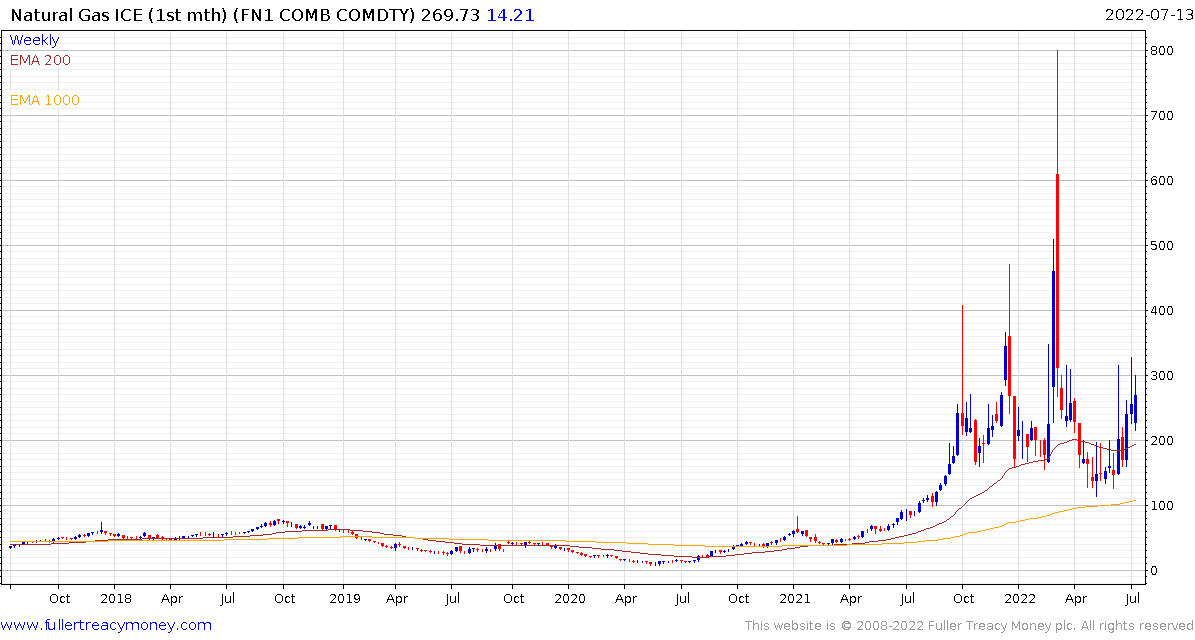

The UK regulator raises the maximum price level every six months. It went up over 50% in April. That implies the next ceiling adjustment will be October. For UK consumers the big question is the trajectory of the war in Ukraine and the potential for normalization of relations with Russia.

I believe it is in Russia’s interests to keep the Nord Stream 1 pipeline closed just as it has done with the Turk Stream pipeline. The EU has very publicly broadcast they intend to stop buying in December. Russia has nothing to gain by facilitating that plan. Meanwhile they appear to be using old armaments as fodder for the modern armaments Ukraine has received from NATO countries. That suggests they are waiting for Ukraine to run out before pushing a more aggressive offensive.

Moreover, Russia needs a high energy price to fund its war effort and to support the currency. They also generate much more money from oil than gas, even if gas is more strategic.

Most energy analysts think of supply as variable and demand as constant. That’s only true in the abstract. At major market turns, like recessions, demand falls and makes supply uncompetitive. Crude paused at the psychological $100 again today as the Dollar's advance paused. There is clear scope for a further decline, at least towards the $80 area, potentially more. That’s a major problem for Russia and suggests scope for mischief making will remain high.

Crude oil, metals and agricultural products are internationally traded and are all rolling over. Gas is more international than ever before but is still dominated by local factors. European gas prices are at very high levels and there is no way to refill storage without Russian gas because import facilities are already at maximum capacity. That implies shortages, rationing and high prices. The case for lower prices implies much lower industrial demand and high unemployment, which is seriously problematic from an economic perspective.

Russia’s logic is dastardly but that’s doesn’t mean it is wrong. They don’t believe European consumers have the gumption to endure personal hardship in service to supporting Ukraine. NATO banded together following Russia’s invasion or Ukraine. Holding resolve is going to be much more difficult.

The short answer to your question is, I’d wait to see what happens with the Nord Stream 1 pipeline and make a decision after that.

Back to top