Email of the day on divergence in performance between Hong Kong and mainland China:

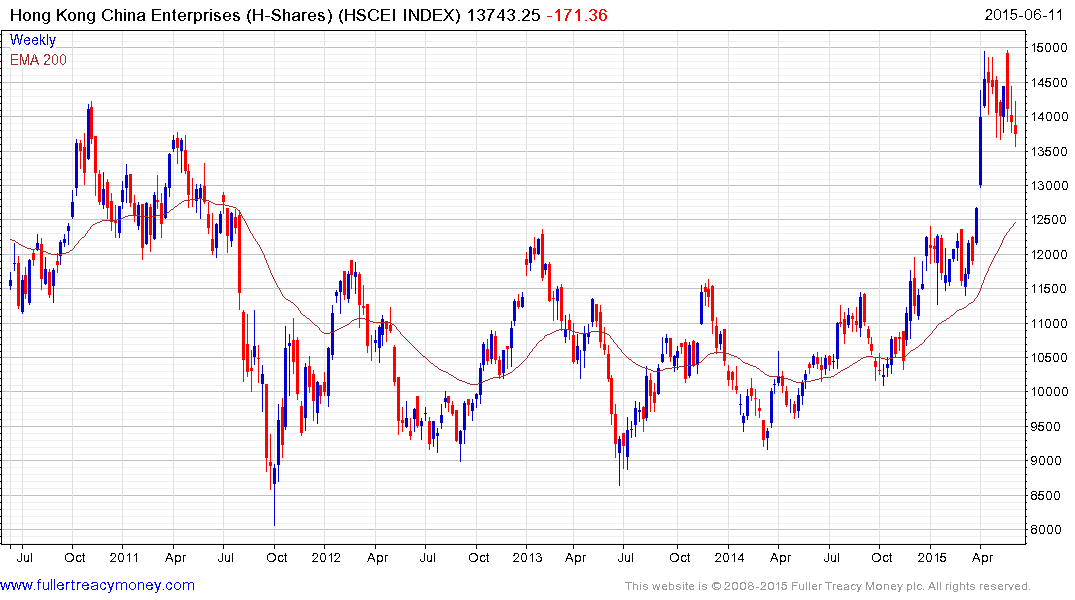

The rally in A-shares has been impressive, while the H-shares have been lagging behind in a big way. What is your view on this? I also attach a chart showing relative performance. I have lightened my position in the HSCEI but wonder if I should be looking to increase it again.

Thank you for this topical question. The Hong Kong Dollar is pegged to the US Dollar so zero interest rates have propelled property prices on the island to dizzying heights. There is a fear that when interest rates start to rise, Hong Kong will experience some pain. This is at least part of the reason the Hang Seng has underperformed but is less of an issue for the Chinese Enterprises Index (H-Shares).

The H-Shares are affected more by foreign flows than the mainland which is dominated by domestic investors. With MSCI’s decision to delay admittance of A-Shares into their Emerging Markets Index Hong Kong listed shares of all hues pulled back and the main indices remain in processes of mean reversion.

.png)

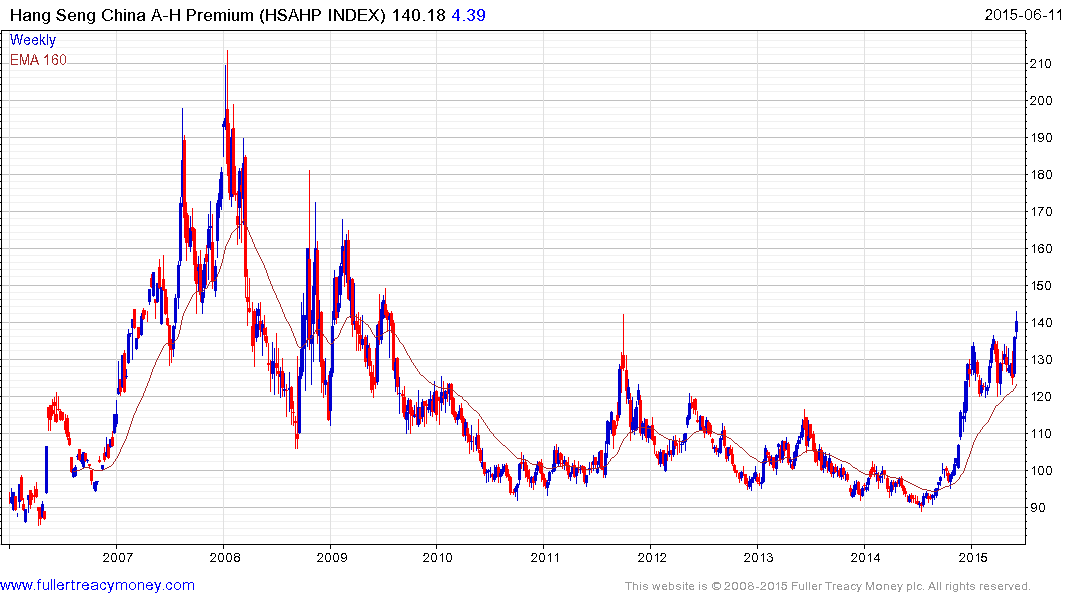

At some stage investors in mainland equities will realise that the increasing discount represented by Hong Kong listings is something they need to take advantage of but the A-H Share Premium shows no sign yet of reversing. In fact it looks like the premium will continue to widen.

The below chart is in equilibrium at 100 so it indicates the A-Shares are currently trading at a premium of approximately 40%.