Email of the day on Crowd Money, late cycle moves and credit

As you have repeatedly mentioned in recent audios, we are at a very interesting time in markets. The coming weeks may potentially offer us a guide as to whether markets are pricing in a recession in late 2019/2020 or whether this maybe further delayed by the Fed and the US administration setting a looser policy tone sooner rather than later.

As David has always urged “don’t fight the Fed”.

Being away from my desk enjoying the delights of the Caribbean, I have taken the time to re-read your most illuminating book Crowd Money which you published back in 2013 and I read back in 2014 (again in the Sunny Caribbean).

I have to mention that a good many of your observations have come to pass and my holdings in a number of Autonomies who are also Dividend Aristocrats have been a core holding of my balanced personal portfolio. I have noted with interest the recent late cycle outperformance of these holdings compared to previously sexy growth stocks.

I would recommend to the collective to take the opportunity to read or re-read Crowd Money at a time when market strategy is in flux.

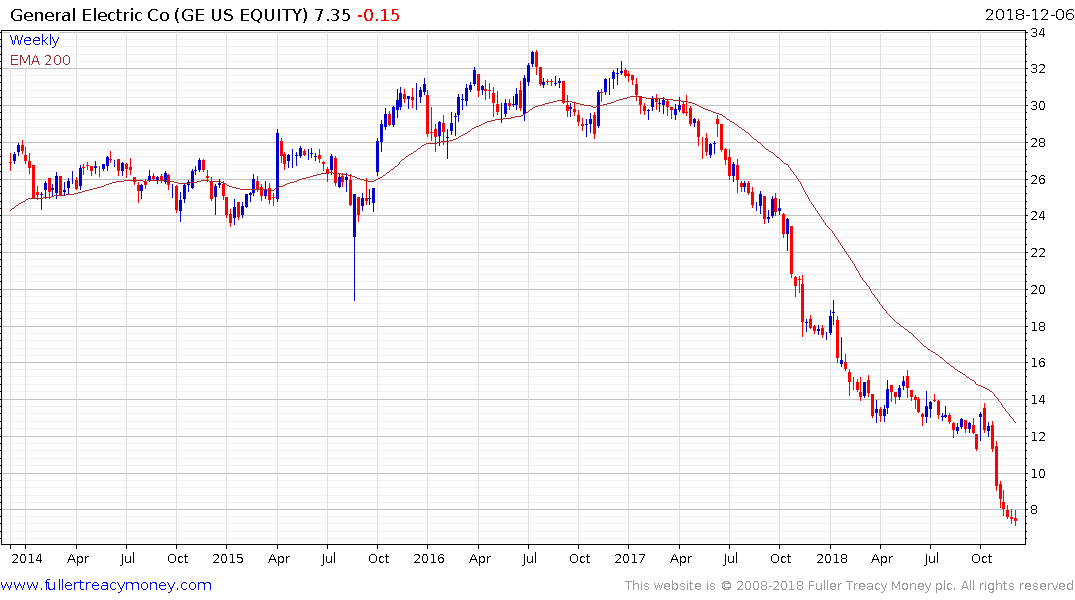

You have also made reference to the possibility of GE corporate debt being downgraded to junk. I attach a link to the UK Investment Manager M&G ‘Bond Vigilantes’ website and their comments relating to the US corporate debt market and with specific reference to GE’s strategy to deleverage and preserve their IG status.

Hope this is of interest.

Thanks for the link your kind words and I agree there is nothing quite like a good dose of sun in December. It is enormously gratifying that you are enjoying Crowd Money. I’m working on another book to try and put the emerging state of flux in context but it’s a hard slog. I’m reviewing late cycle phenomena in the following piece so I would like to focus on the credit market.

Here is a section from the article:

The Fallen Angel figure, of course, could balloon if one of these Angels happens to be a company with a large capital structure. One of the businesses that has lost its public single-A rating lately is US industrial giant General Electric – the 87th biggest company within the S&P 500 index, holding c. $50bn of notional debt – the majority of which could enter the HY market if multiple notches of downgrades occur. How immediate is this risk for investors?

GE downgrade fears are still speculative. The company is trying to shore up its cashflow and balance sheet, and may well retain its IG badge after all. Since liquidity, usually investors’ No. 1 concern, seems ample, the company is now focusing on improving its free cash flow and balance sheet structure. Companies at the lower end of the IG spectrum are indeed strongly incentivized to retain their credit ratings as a cut in long-term ratings from BBB- to BB+ materially lifts borrowing costs as some investors are prevented from holding Non-Investment Grade companies.

GE, however, still holds a BBB+ rating with stable outlooks from all three major credit rating agencies, leaving this flagship industrial group still a long way from junk. What will matter over the coming quarters is GE’s new CEO delivering on a promise of accelerated deleveraging, alongside turning around the structurally challenged power division. All of this amidst a backdrop of ongoing Department of Justice and SEC investigations, as well as some shareholder litigation.

GE is being priced as if it is about to be downgraded not least because the sale of assets to shore up its balance sheet is not occurring quick enough to placate the bears. The big issue for the credit markets is that the downgrade risk is predicated on the rosy environment that has predominated over the last decade persisting. Quantitative tightening raises big questions on that front.

From an investor’s perspective, and particularly for an unconstrained investor, the question is not whether bonds are going to be downgraded but rather whether they will default. That is a wholly different subject because investment grade funds never get the opportunity to bargain hunt among fallen angels that do not in fact default.

GE 5% subordinately perpetuals are being priced as if the company is going to default. However, that is quite unlikely given the maturity profile of the debt and the assets the company has available and it is not every day we get to see close to 20% yields. Of course, I might be wrong eventually but you don’t 20% yield compounding doubles one’s investment in less than four years.

Deutsche Bank on the other really could go bust, considering the size of its derivatives book, and the significant quantity of CoCo (contingent convertible) bonds sitting on its books look like particularly bad value for investors. The 4.5% 2025 bullet bond yield broke out to new highs today to close just shy of 7.5%.