Email of the day on Credit Suisse

As always thanks for your excellent service. I appreciate your comments on Volkswagon today, and am considering buying some, as I don't see how the German government would let VW go under. Can you also please comment on Credit Suisse. Do you think there is a serious risk that Credit Suisse will not survive. Thanks in advance.

Thank you for this question which may be of interest to the Collective. Credit Suisse employs over 50,000 people so I imagine the Swiss government has an interest in ensuring it remains a going concern.

The biggest challenge for all Swiss banks is they lost all their US clients when they were forced to share account details in 2012. That sharing was greatly expanded in 2017 and today Switzerland shares details with almost 100 countries. Swiss banks have struggled to tap into new markets like China and India.

In that regard Singaporean banks have done much better. DBS for example remains in a consistent medium-term uptrend.

In that regard Singaporean banks have done much better. DBS for example remains in a consistent medium-term uptrend.

Competing on the quality of asset management rather than secrecy is a big challenge which has led Credit Suisse to take risks out of character with its history. Very few of those bets have paid off. We are still very early in the restructuring so it is premature to draw a confident conclusion on success. At a minimum the bank will need to rely on the largesse of investors which suggests scope for further dilution of shareholders in future.

Competing on the quality of asset management rather than secrecy is a big challenge which has led Credit Suisse to take risks out of character with its history. Very few of those bets have paid off. We are still very early in the restructuring so it is premature to draw a confident conclusion on success. At a minimum the bank will need to rely on the largesse of investors which suggests scope for further dilution of shareholders in future.

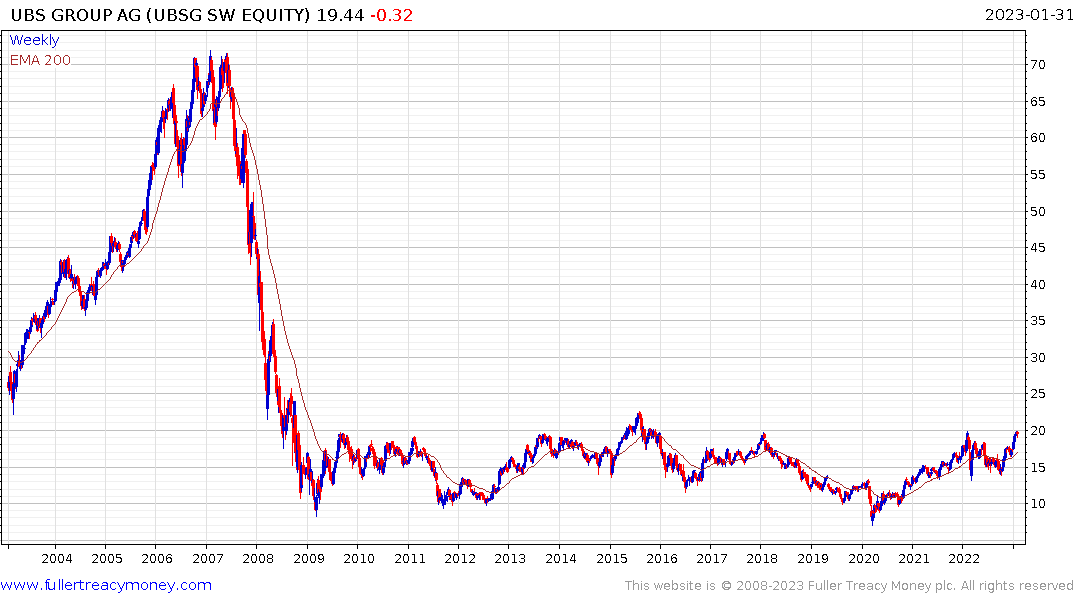

At the other end of the spectrum UBS is on the cusp of completing a 15-year base formation.