Email of the day on competitive devaluation

Sweden cuts rates below zero as global currency wars spread

Now if the US Congress (always the opposite of Progress) acts to punish China, all those voters who shop at Walmart will be pretty pissed off...

Hope all is well - grats on the new fund deal. Will US investors be able to invest in the new Autonomies Fund?

Thank you for your well wishes. The Global Corporate Autonomies Fund will be available in the UK. It is also UCITS registered for investment within the EU. Investors from Australia, South Africa and elsewhere will be able to invest by sending a Sterling denominated cheque to the transfer agent and by signing a money laundering waiver. Chris Moore [email protected] Unfortunately, the fund will not be available to US investors from launch but this is something we aim to rectify later in the year.

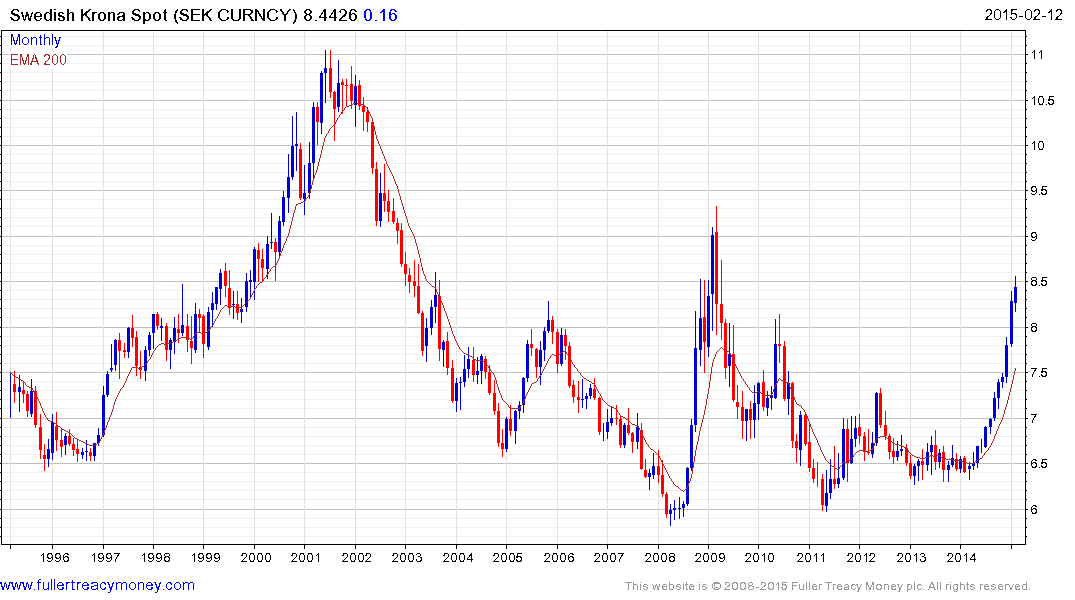

The decision by the Riksbank to introduce a negative interest rate suggests a panicky response to the disinflationary effect of lower commodity prices on the country’s stock of outstanding debt. Ultralow borrowing costs, a disincentive to save, a weak currency and money printing are combining to boost asset prices, at least in nominal terms.

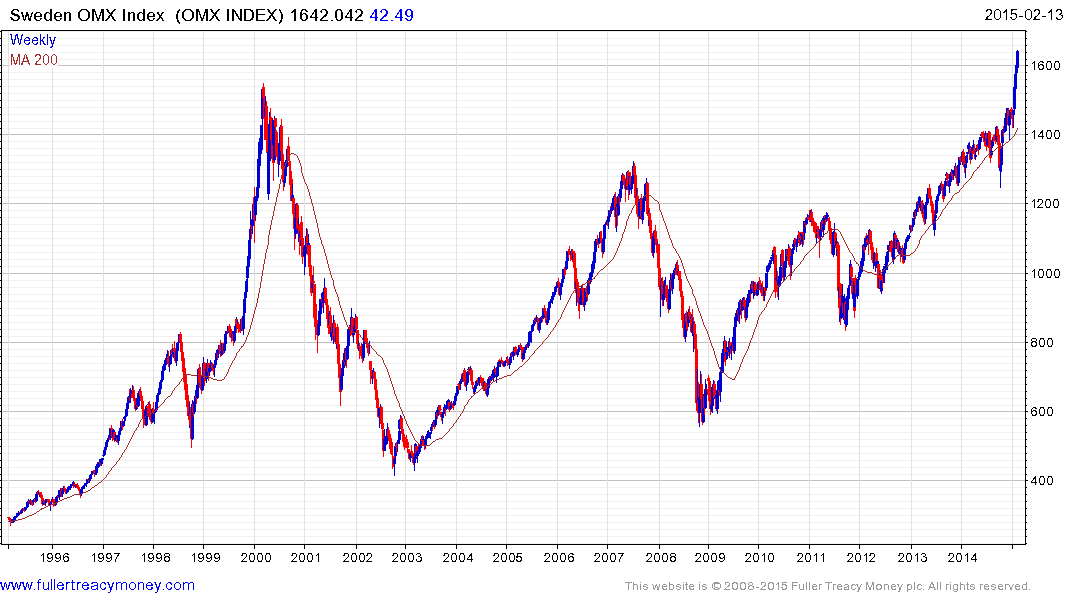

The OMX Index broke out to new all-time highs two weeks ago and while increasingly overbought in the short-term, a clear downward dynamic would be required to suggest mean reversion.

Lower commodity prices and generally subpar economic performance are allowing central banks to ramp up policy easing. I agree that China has had enough of currency strength and will be less willing to acquiesce to demands to allow the Renminbi to appreciate versus the Dollar, especially when just about all of its neighbours are engaged in devaluation. So far the USA has been relatively sanguine about the strength of the Dollar. This will not always be the case, not least if it threatens the recovery.

With regard to the above article, this section concerning the Danish Euro peg may be of interest:

Jens Nordvig from Nomura said the Danish central bank has spent €32bn so far this year intervening in the exchange markets to defend its euro peg in the Exchange Rate Mechanism, almost 10pc of GDP. “This is the fastest pace of reserve accumulation by the Danish National Bank in its history. There is no doubt that the pressure on the krone is very significant, and that the fight for the peg will be tough,” he said.

Steen Jakobsen from Saxo Bank said a rupture of Denmark’s euro-peg would be dangerous since the country’s private pension system is heavily invested in EMU bonds and assets, yet its liabilities are in Danish krona.

“There is a currency mismatch which could leave some of these pension funds technically insolvent. I wager that if push comes to shove, Denmark would rather join the euro than allow a 10pc revaluation. It could happen very fast if things come unhinged in Greece,” he said.

As central banks progressively adopt extraordinary self-preservation measures, the potential for nominal asset prices to appreciate remains the most likely scenario.

Back to top