Email of the day on commodity market correlations

As an occasional medium term commodity investor (Long or short) and hopefully aware of the importance of risk management in regard to correlation between commodity markets do you have any advice or data as to historical correlation between individual commodity sectors i.e. corn to wheat to soybeans (especially the grains) also correlation between the major country stock indices? I appreciate that at times we may read too much into this and often (apparent) correlation may be just random coincidence but in some cases the correlation is obviously relatively recurring and a useful guide in balancing risk and positioning sizes.

Back to my question; Do you have any reference data and/or views on market correlation?

Thank you for this question and the Collective may have additional feedback. We do not have any specific data sets on inter market commodity correlations but I found this report on commodity market correlations which may be of interest.

Here are some additional thoughts:

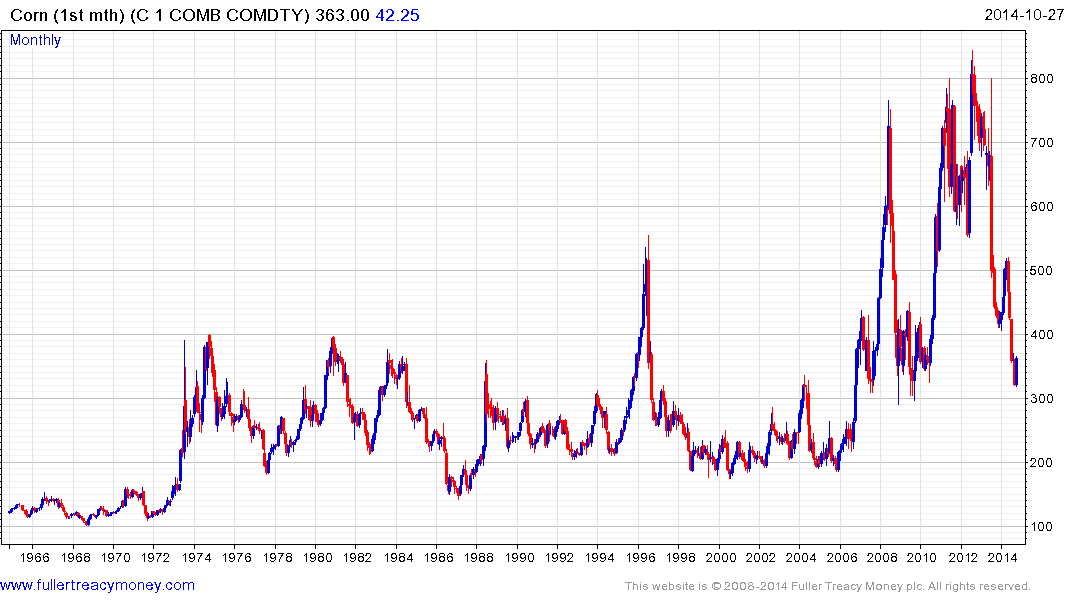

The Kondratiev cycles were first observed in the pricing of agricultural commodities at a time when agriculture represented a major component of the wider economy. The role of crops in today’s major economies is considerably less important. As a tool for diversification, commodities pose challenges for long-term holders which we have previously written about but contango, interest rates, roll and other costs are non-trivial considerations.

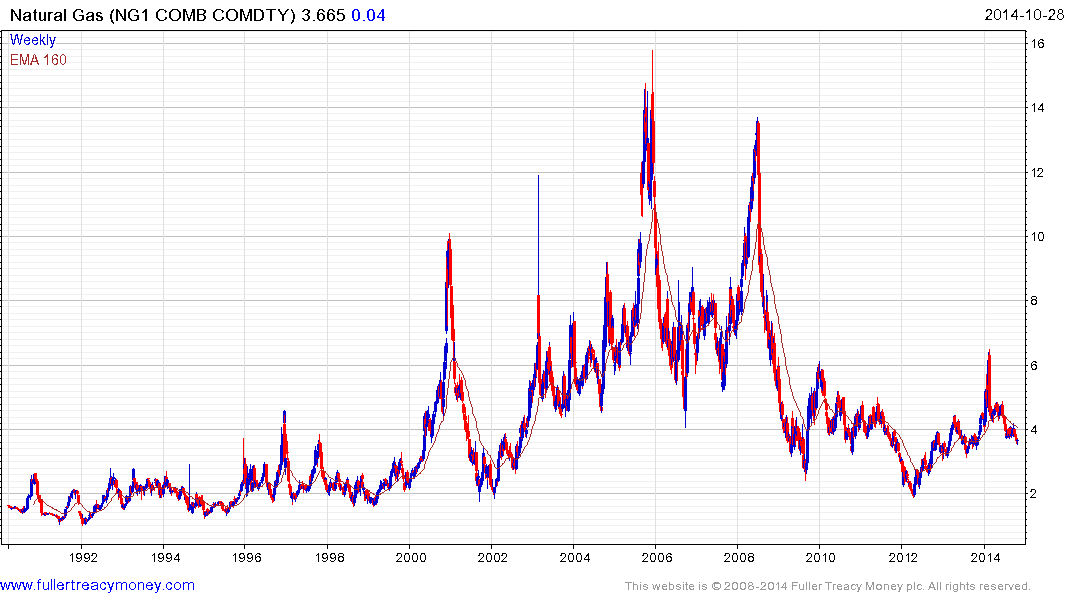

We have long defined the bull market in commodities in terms of the rising cost of marginal production. Looking at long-term charts, the higher production costs experienced over the last decade represent a step up for average pricing relative to previous decades. Despite the compression in pricing, not even natural gas has returned to the levels that prevailed before 2003.

The marginal cost of production has increased which potentially represents a meaningful medium to long-term floor for prices that are above where the previous historical mean traded. However, it would be rash to conclude that the consecutive years of positive advances posted by a wide basket of commodities is about to be reasserted. The more likely scenario is that the characteristic volatility of the sector will be reasserted with individual markets trading on their own merits.