Email of the day on coffee:

I am fine and I hope you are in good condition also.

In order to give you some feedback about Arabica I make the following comments.

Arabica seems to be bottoming out with recently a strong reaction to the upside.

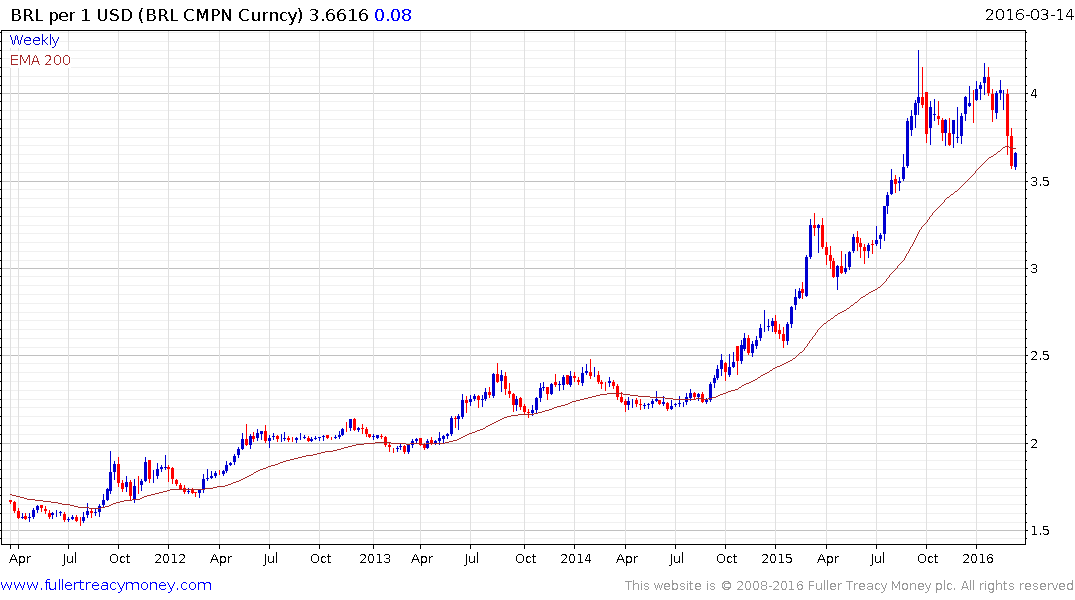

120 cents per pound has always been an at least an intermediate floor under the market, dating from the minimum price of 120 cents of the International Coffee Agreement in the seventies.The present reaction is also linked to the prices of oil and of the Real, the Brazilian currency. I suggest you have a look at the charts of these, where you can observe a reversion to the mean of oil.

Also other commodities, minerals and metals, produced by Brazil became more expensive. The consequence is that the Real became stronger after a descent from 0,65 USD to 0,25 USD. When the Real becomes suddenly more expensive the mechanical consequence is that more dollar cents have to be paid for a pound of Arabica, of which Brazil is the largest producer in the world.

That being said a large crop is being expected for the 2016/2017 season, as well in Brazil, as in Colombia and in Vietnam, the three main coffee producers. So for the moment there are no fundamental reasons for the present breakout of Arabica to lead to sky high prices. However, as you very well know, charts give always a clear independent view and seem to indicate that a balance between supply and demand has been found. It could be that bears will be taking profits for a while, leading to higher prices in the short and medium term. Physical balance is one thing and terminal market positions are another thing.

With kind regards and always available for further comments.

Thanks to this highly experienced subscriber who generously contributed this email in response to a request I sent asking for information. It is safe to say he has forgotten more about the coffee market than I ever hope to know.

The US Dollar has unwound its overbought condition relative to the Brazilian Real and found at least near-term support yesterday, in the region of the trend mean. Some additional steadying in this area is to be expected. The bullish case for the Real rests on both the outlook for oil and the prospect of Dilma Rousseff being impeached. A sustained move below this week’s low would be required to question medium-term Dollar dominance.

Both Arabica and soybeans were a little softer today on the Real’s weakness while the iBovespa Index continues to pull back from the psychological 50,000 level following last week’s surge.