Email of the day on cloud computing

At the risk of representing a bottom, my hat's off to you Eoin for your call on the cloud. A year ago I remember being in a Covid tent with an investor and you had just laid out the case for the cloud glut. Roll tape on all these guys with buys a year ago including Cramer.

Thank you for this kind email. Back when I put the list of Autonomies together in 2012, the one share people asked me about more than any other was Salesforce. It did not have the big global sales footprint of the other companies. I included it anyway because I thought it would, and wanted to have some forward-looking constituents. Cloud computing subsequently went on to prosper beyond most people’s expectations.

The pandemic pulled forward cloud sales from the future into the present. This was a rerun of what the Y2K fears did for the tech sector in the 1990s. Salesforce’s revenue doubled during the pandemic. That growth is totally unsustainable. Now that the share has halved the big question is how sustainable current revenue is.

The big drawdown in 2022 was about valuation contraction, the impact of higher interest rates, and tighter liquidity. 2023 will focus much more on cost-cutting and the sustainability of margins. We are in for a much more differentiated market. Revenue growth is likely to be rewarded but misses will be punished.

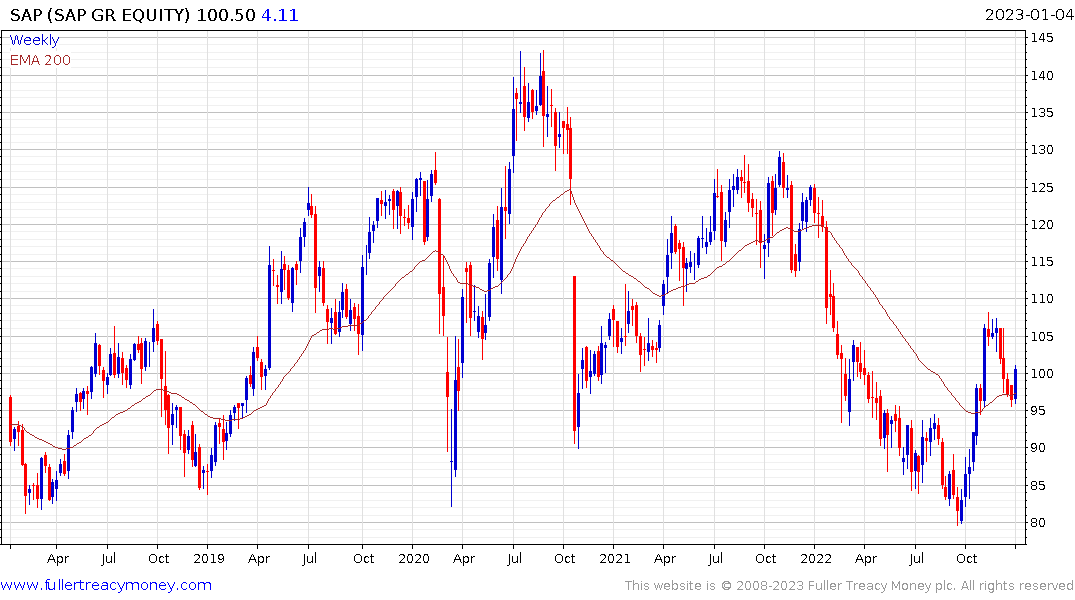

Companies like Oracle and SAP with established businesses are exhibiting clear relative strength.

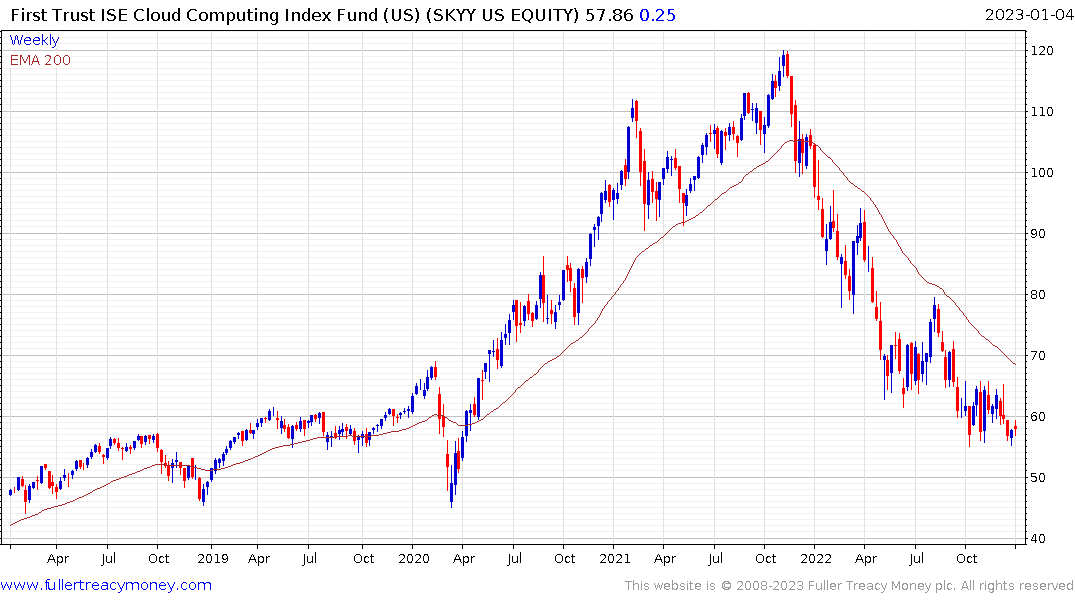

Meanwhile, the Frist Trust Cloud ETF remains in a consistent downtrend.

Meanwhile, the Frist Trust Cloud ETF remains in a consistent downtrend.

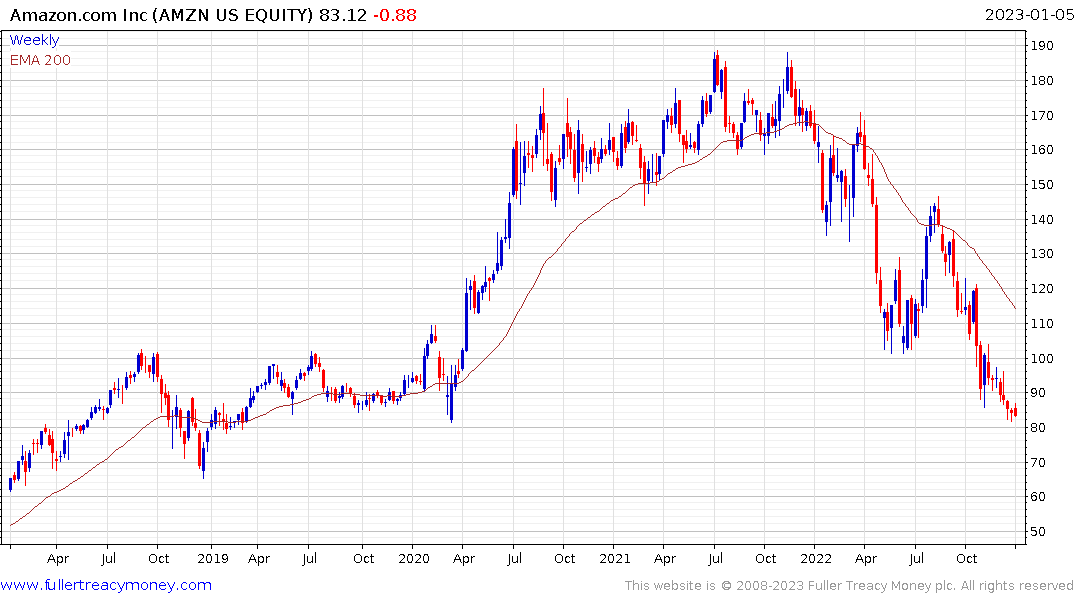

Cloud can be broken down into three different sections. The big data warehouses are Amazon, Microsoft, and Google. Then you have hardware/software integration companies. Lastly there are app developers that provide frontend user experiences.

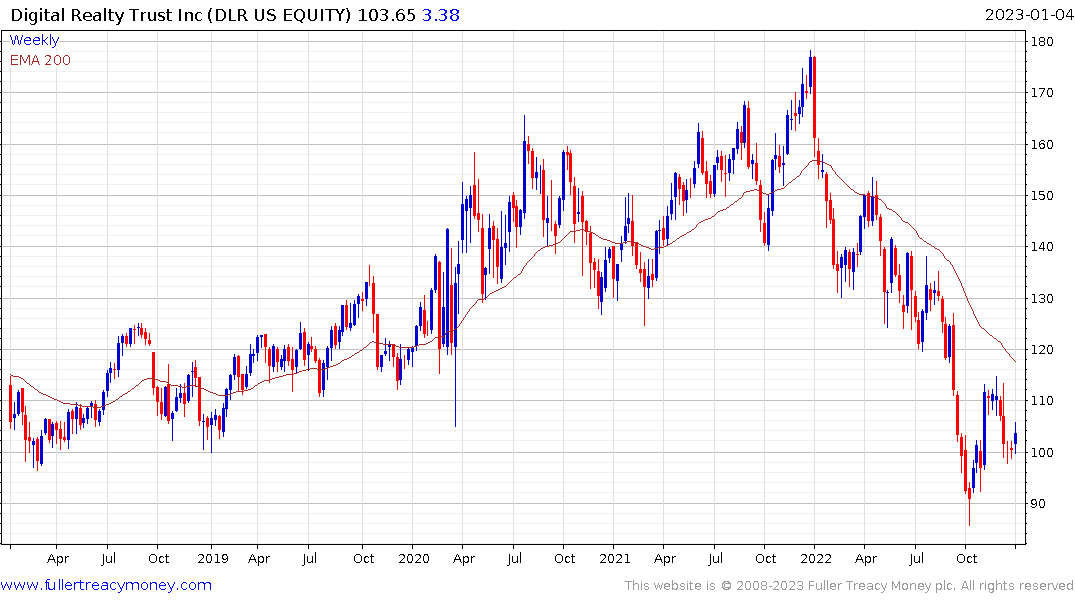

As growth rates wane and even reverse, demand for data warehousing will also fall. That’s terrible news for industrial REITs focusing on the sector. Equinix and Digital Realty are both susceptible to additional weakness.

There is clear scope for that one-stop shops will take over. All of those single-use companies that provide a niche service in the back end will be folded into a complete product offering of cloud in a box. That’s what Dell is trying to provide. The share has not broken the downtrend but it is exhibiting relative strength.

The Southwest Airlines debacle with thousands of flights cancelled because of failing technology and tense union negotiations is an example of how cloud services or at least modernization could deliver results. It helps to highlight there are still big sales avenues for the cloud sector but the go-go days of the pandemic are over.

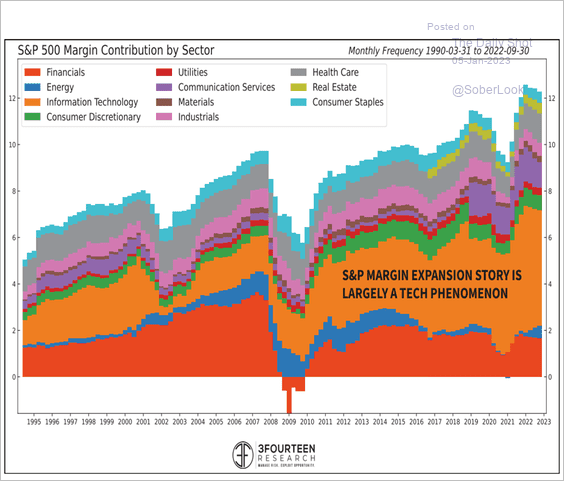

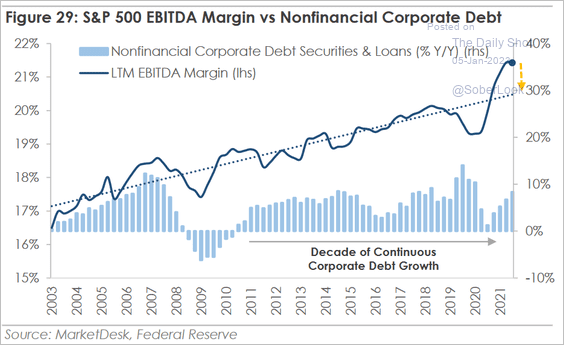

These two graphics illustrate first how much margins increased during the pandemic and how technology companies were responsible for most of that growth. That suggests technology is the sector with the most room for retrenchment in earnings.