Email of the day on clothing companies and Autonomy membership

I was wondering why Abercrombie doesn't qualify as an autonomy? The graph is basing out it seems, and in Milan while the other stores are empty (except the Ferrari store); you have to practically line up to get in and to pay at Abercrombie. / Hollister. It is the one of the favorite brands among teenagers here along with Bershka. Also, I hope you plan to alternate the audio comments between Mr. Fuller and Mr. Treacy because even though the research and conclusions are the same, the styles are different and I like to listen to both of you regularly

Thank you for this question and I’m glad you enjoy the audio commentaries. I agree that Abercrombie and Hollister are very popular brands among teenagers but Bershka, as an offshoot of Inditex, has greater Autonomy characteristics.

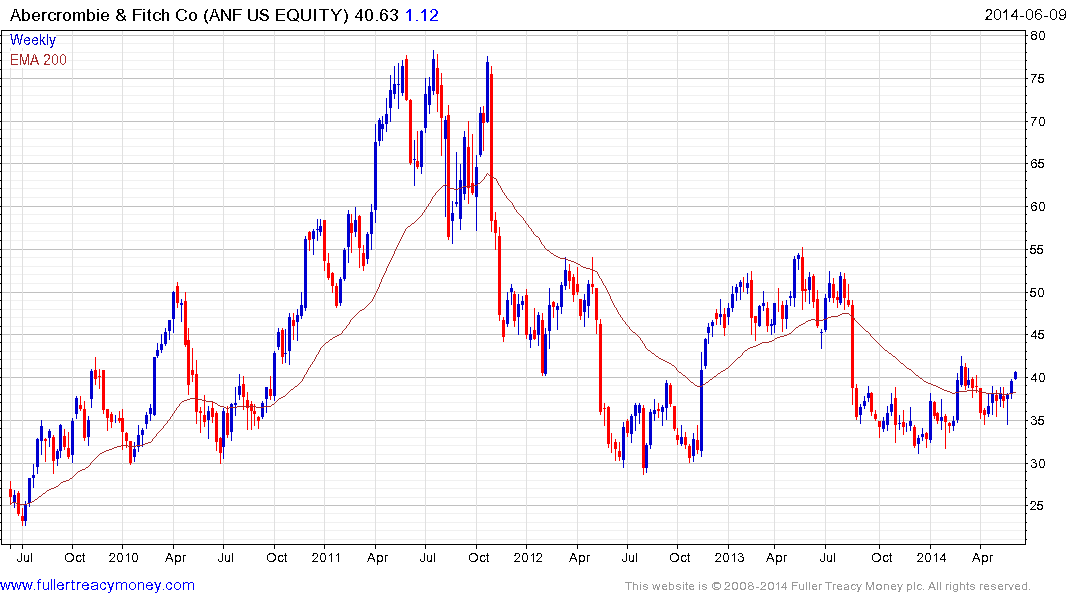

Abercrombie (Est P/E 17.22, DY 1.98%) derived64% of revenue from the USA and 27% from Europe last year. The company’s investments in international expansion, in a drive to become a truly globally recognised brand, have weighed on share performance. I agree the price chart has base formation characteristics and is currently firming from the lower side.

Inditex (Est P/E 26.51, DY 1.77%) has a more even spread with 56.7% of revenue from the EU, 17.7% from the OECD and 25.7% from the Rest of the World. The company has a portfolio of brands that appeal to more than the teenage demographic. The share has lost momentum over the last year as valuations increased but continues to hold its progression of higher reaction lows.

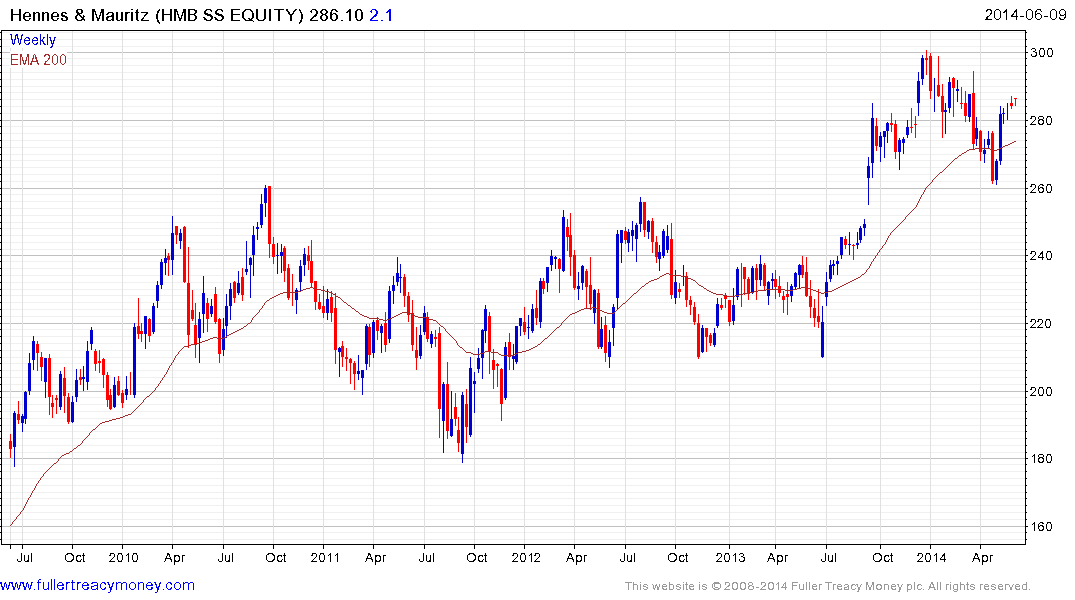

H&M (Est P/E 24.47, DY 3.33%) also has a global spread to revenues. The share completed an almost four-year range in September and continues to find support above the psychological SEK250 area.