Email of the day on Chinese liquidity measures

In recent years, changes in liquidity in China have caused considerable upset. How significant is the following reported change?

In recent years, changes in liquidity in China have caused considerable upset. How significant is the following reported change?

Thank you for this useful graphic as well as the link to the associated article. Here is a section:

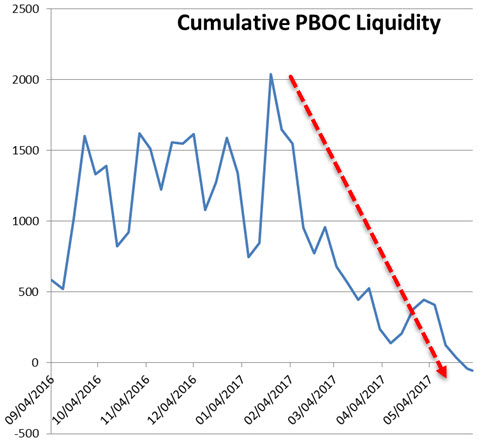

Mark Orsley and I have been working on a “Chinese Liquidity Monitor” which tracks the PBoC’s various measures (repos, reverse repos, OMOs, SLFs, MLFs, Pledged Supplementary programs)—see below. The key point here: it’s not just the sharp decline in the ‘rate of change’ of PBoC ‘lending’ / ‘financing’ / ‘credit creation’….it’s that liquidity is being outright REMOVED.

.png)

The trend of Chinese liquidity is contracting. I think that is a reasonably well known fact. The problem with the chart included in this article is that there is no legend to tell us what the numbers mean and the decline has been going on since the beginning of the year. The danger with looking at short-term charts like this, particularly of macroeconomic data, is that we have no sense of context.

The sharp decline in iron-ore prices has also been pointed to as an indicator of a slowdown in Chinese demand for industrial resources. While the majority of related miners steadied in the region of their trend means on Friday they will need to continue to hold those lows if medium-term uptrends are to be reasserted in the near term.

Bitcoin has surged since finding support in the region of the trend mean in March and briefly posted another new high today. Despite the uncertainty of when a hard fork in the cryptocurrency will occur (which will create two competing currencies, one with limited supply, the other with limitless supply) it remains a favoured method for Chinese to take their money out of the country.

The price is 60% overextended relative to the trend mean right now so there is potential for another one of the swingeing pullbacks that have punctuated the advance since late 2015.

The Renminbi’s downtrend has paused since early this year following the PBoC’s last intervention to support it. Nevertheless, the Dollar’s progression of higher reaction lows has remained intact and a sustained move below the trend mean would be required to question the consistency of the trend.

The FTSE/Xinhua A600 Banks Index has broken its progression of higher major reaction lows. It steadied from the 12,500 level today but will need to sustain a move back above 12,850 to signal more than short-term steadying.

Meanwhile the Shanghai Property Index has steadied in the region of the trend mean.

The size of China’s reserves appears to be a hotly contested figure and I have seen some very wide estimates for what the true figure is. The IMF’s and Bloomberg’s figures of a fall from $4 to $3 trillion were last updated at the end of March and would appear to be the most credible. The most important point is that the trend of reserve accumulation ended in 2014 and there is no sign the dissipation has ended.

On aggregate, there is certainly some evidence of a change in the dynamics of the Chinese market and the potential for additional currency devaluation and even stronger capital controls remain more likely than not.