Email of the day on China funds and high yield (received on the 4th)

I am currently long ASHR (yay!!), which is looking mighty parabolic and amazingly extended...

But, what are the best US-traded ETFs for investing in China with some diversification across sectors, based on your (extensive) knowledge of China?

<change of subject>

I noted that HYG and JNK are moving down, which is a bit of a non-confirmation of the recent S&P performance (though, if I may say so, breadth still sucks). Any thoughts?

Hope you're staying dry. We call this "winter" in CA. :)

Thank you for the well wishes. The torrential downpours last week and more due this week certainly make a change from the endless sunshine of the last year. It also made the drive to Arizona last week particularly picturesque as the desert began to bloom.

![]()

The Deutsche X-Trackers Harvest CSI 300 China A-Shares ETF (ASHR) is a useful instrument and offers direct exposure to China’s most liquid Index.

Today’s downside key day reversal on the Shanghai A-Shares Index has checked the powerful breakout for at least the short term and some consolidation of recent gains is the most likely scenario. Considering how far the Index rallied in the last month, there is ample room for ranging.

The Morgan Stanley China A-Share Closed End Fund (CAF) has similar performance but trades at a discount to NAV of 15%.

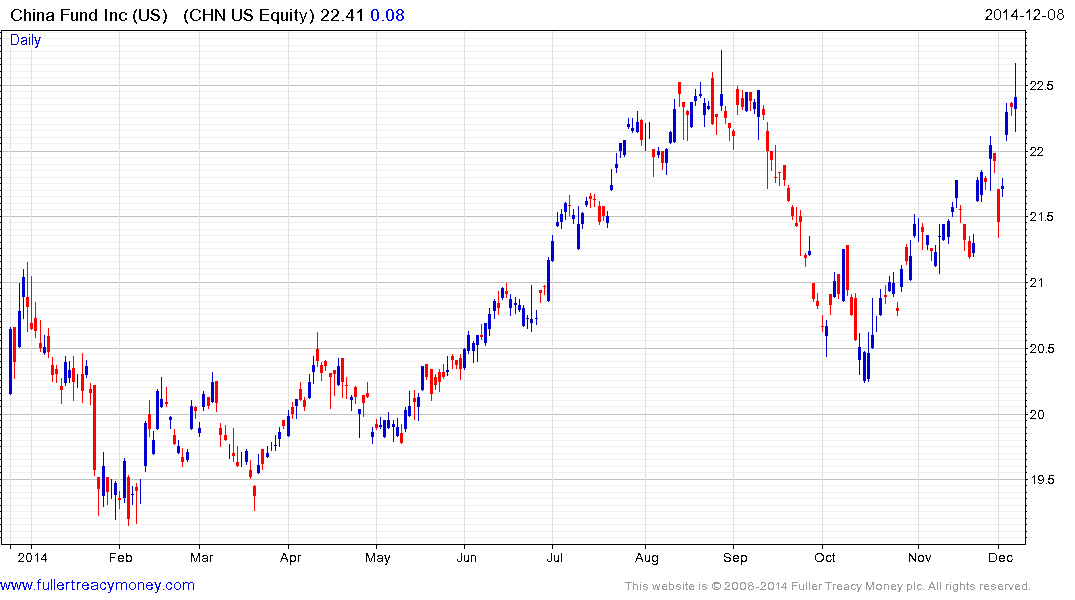

In terms of diversification the China Fund Inc. (CHN) trades at a discount of 10% and has paid a long-term capital gain of approximately 10% on each of the last four years and some are anticipating that the payout will be larger this year. The Fund’s holdings are evenly spread between China, Hong Kong and Taiwan. It has been ranging in the region of the 2011 high since June and a sustained above $23 will be required to reassert the medium-term uptrend.

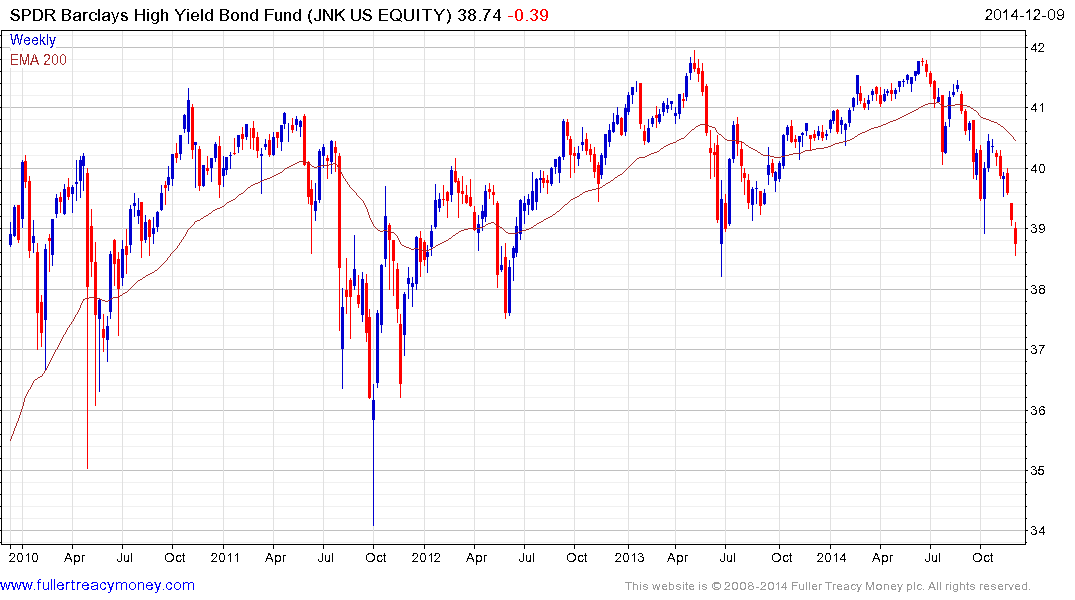

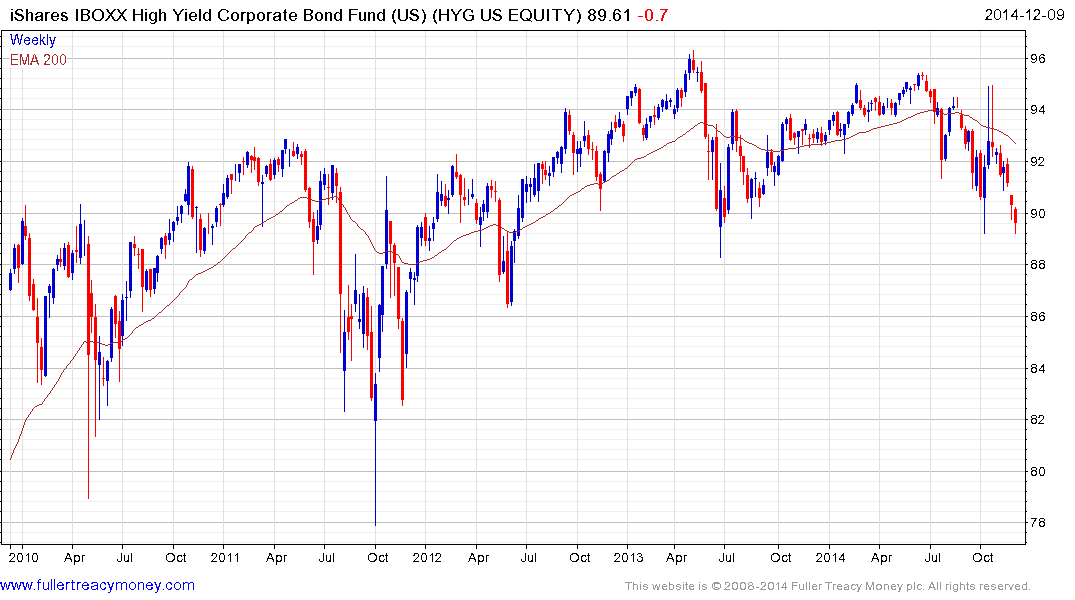

Turning to high yield, I agree the charts of HYG and JNK have bearish characteristics but both are in the region of previous lows which may increase potential for a bounce.

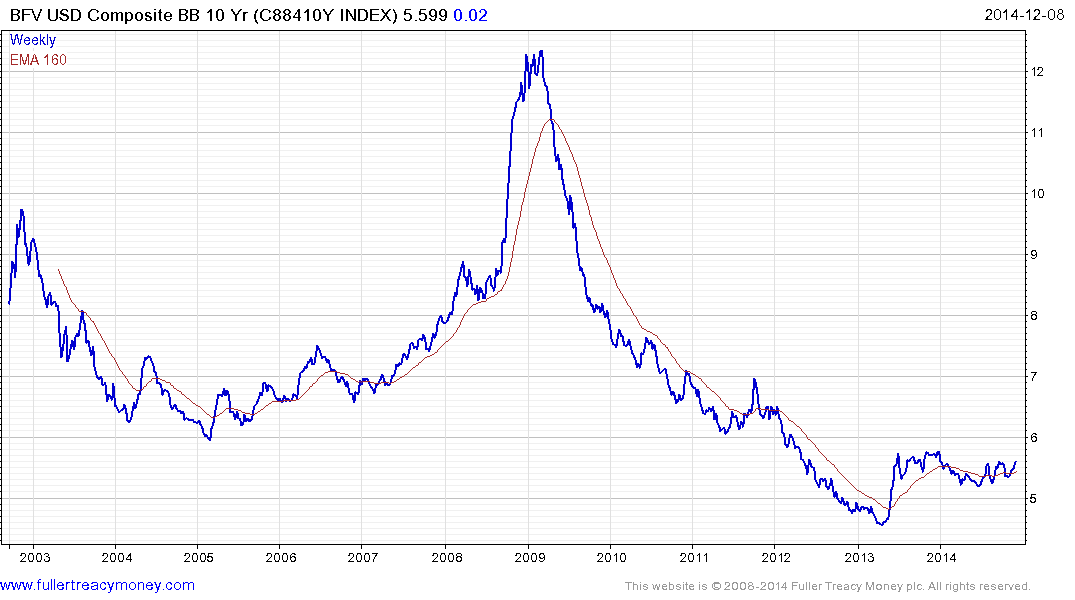

BB yields are still below where they bottomed in 2005 but last year’s rally broke the more than four-year downtrend, suggesting the lengthy period of yield compression is over.

Spreads over US Treasuries are also trending higher form historically tight levels.

.png)

Considering how much leverage is in the system and how exposed junk bond issuers are to interest rates, the market appears to be pricing in the fact that the environment has been about as good as is possible and will not get better from an issuer’s perspective.

It has been a contention of mine for some time that the eventual choking off of liquidity to the bond market will represent a drag on the stock market to the extent that it affects share buybacks.

Back to top